Key Takeaways

- Increasing frequency and severity of natural catastrophes could raise claim costs, hurt net margins, and negatively impact profitability.

- Integration of Validus offers strategic benefits but could strain resources, affecting operating income and requiring careful management.

- RenaissanceRe Holdings' strategic financial management and strong earnings foundation enhance shareholder value and bolster share price stability or growth prospects.

Catalysts

About RenaissanceRe Holdings- Provides reinsurance and insurance products in the United States and internationally.

- Natural catastrophe losses, such as the recent California wildfires, are becoming more frequent and severe, driven by both climate change and human factors like dense building practices. This could increase the cost of claims and negatively impact net margins by leading to higher loss ratios.

- The company recognizes that its general liability lines are underperforming due to elevated loss trends. Despite proactive management and engagement with customers to address rate and trend, ongoing loss inflation pressures could compress underwriting margins and affect overall earnings.

- The integration of Validus has led to capital efficiencies and strategic benefits, but maintaining and growing this combined platform successfully requires careful execution and could strain resources, potentially impacting operating income growth.

- Industry-wide pressure from significant catastrophe losses over recent quarters is likely to increase demand for reinsurance. However, if property catastrophe rates don't remain firm or increase, it could impact the top-line premium growth, keeping it flat or reducing profitability.

- The introduction of a 15% corporate income tax in Bermuda starting in 2025 could reduce net income and ROE as the company begins accruing for this tax, thus affecting earnings projections.

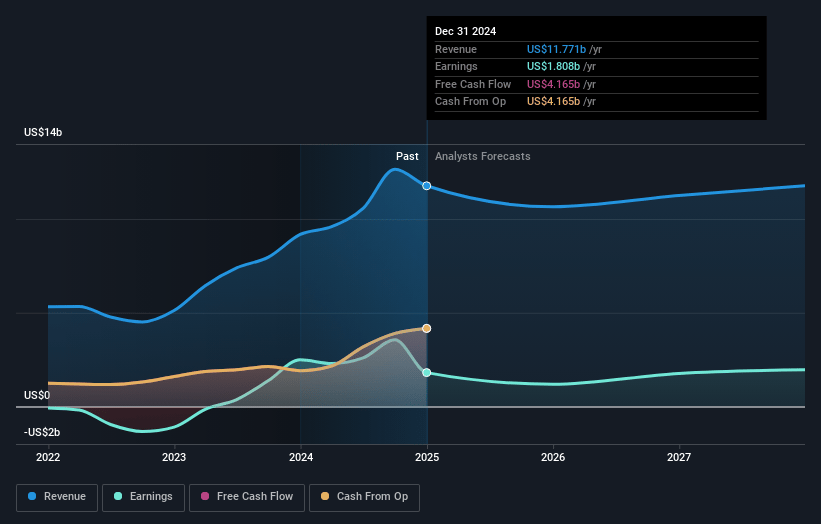

RenaissanceRe Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on RenaissanceRe Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming RenaissanceRe Holdings's revenue will decrease by 2.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.4% today to 16.0% in 3 years time.

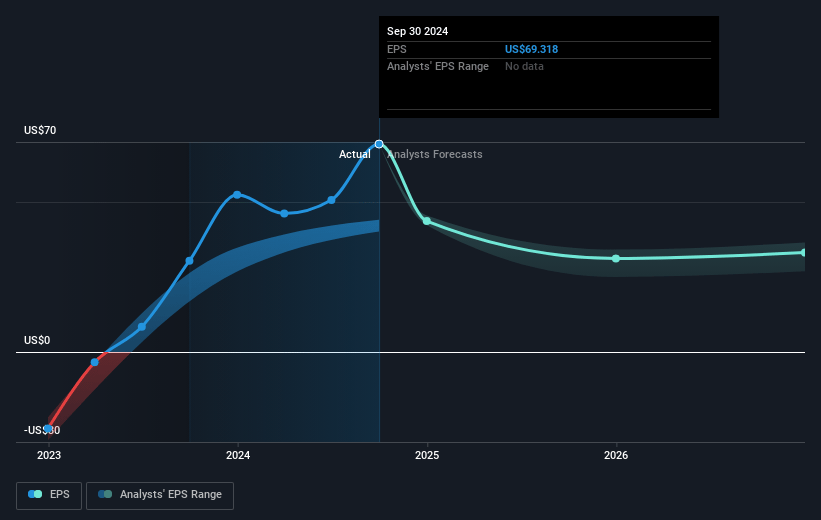

- The bearish analysts expect earnings to remain at the same level they are now, that being $1.8 billion (with an earnings per share of $42.04). The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.2x on those 2028 earnings, down from 6.4x today. This future PE is lower than the current PE for the US Insurance industry at 13.2x.

- Analysts expect the number of shares outstanding to decline by 6.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

RenaissanceRe Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant growth in tangible book value plus accumulated dividends by 26% suggests strong underlying financial health, which could positively impact shareholder equity and lead to stable or even increasing share prices in the future.

- Operating income exceeding 2.2 billion dollars, along with robust performance across all major profit drivers such as underwriting income of 1.6 billion dollars, indicates a solid earnings foundation, which could support share price stability or growth.

- With a well-received integration of Validus and efficient capital management strategies including over 800 million dollars of share buybacks, RenaissanceRe Holdings is optimizing shareholder value, which can lead to favorable earnings per share metrics and support share prices.

- The company's approach to proactive risk management, exemplified by maintaining a diversified and resilient underwriting portfolio despite a challenging environment, may safeguard net margins, thus sustaining or improving its share value.

- Strong investment income of over 1.1 billion dollars due to a low-duration investment portfolio benefits from rising treasury yields, enhancing earnings and potentially leading to a favorable outlook on the company's stock performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for RenaissanceRe Holdings is $231.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of RenaissanceRe Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $435.0, and the most bearish reporting a price target of just $231.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $10.9 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 6.2x, assuming you use a discount rate of 6.2%.

- Given the current share price of $234.82, the bearish analyst price target of $231.0 is 1.7% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:RNR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.