Last Update 18 Dec 25

Fair value Decreased 0.34%MMC: Future Earnings Will Stay Resilient Despite Softer Property And Casualty Cycle

Analysts have nudged their fair value estimate for Marsh & McLennan Companies slightly lower to approximately $211.62 from $212.35. This reflects broadly reduced Street price targets around $200 to $215 as they factor in softer near term organic growth, a moderating P&C pricing cycle, and a less compelling valuation backdrop.

Analyst Commentary

Recent Street research underscores a more balanced stance on Marsh & McLennan Companies, with target prices converging around the low to mid 200 dollar range and a mix of neutral to moderately positive ratings. Analysts are weighing the companys solid return profile and resilient earnings against softer organic growth trends and a less supportive pricing environment in property and casualty markets.

Bullish Takeaways

- Bullish analysts highlight the companys strong and durable return on equity profile and consistent book value per share growth, supporting a premium multiple relative to insurance peers.

- Expectations for low to mid single digit organic revenue expansion and mid single digit total revenue growth in 2026 and 2027 reinforce the view that Marsh & McLennan can still deliver steady top line progress despite a softer cycle.

- Some bullish analysts point to a relatively benign recent catastrophe loss backdrop and lighter claims experience, which support higher earnings estimates and help cushion valuation risk.

- Target price increases at the upper end of the range, toward the mid 240s to mid 250s, reflect confidence that the companys scale, diversified platform, and capital discipline can sustain long term value creation.

Bearish Takeaways

- Bearish analysts emphasize that underlying revenue growth, including roughly 4 percent in the latest quarter, has lagged more robust historical levels, raising concerns about execution and long term growth momentum.

- The combination of a softening property and casualty pricing cycle, increased capacity in reinsurance, and a slow hurricane season is expected to pressure renewals and compress returns, limiting upside to earnings and valuation.

- Several target cuts into the 200 dollar area reflect a view that the shares are potentially not inexpensive given the current macro environment and the companys recent organic growth underperformance.

- Cautious analysts argue that the stock is unlikely to outperform without clearer communication around an improved growth profile or a shift in market conditions that re rates the sectors earnings power.

What's in the News

- The Board of Directors authorized a new share repurchase plan on November 20, 2025, indicating continued commitment to returning capital to shareholders (Key Developments).

- The company announced a major share buyback program of up to 6 billion dollars, which may provide support for earnings per share and the stock price (Key Developments).

- The company reported completion of 1.96 million share repurchases for 400 million dollars in the third quarter of 2025, bringing total buybacks under the long-running 2010 authorization to 148.76 million shares, or 28.41 percent of shares outstanding (Key Developments).

- The company reaffirmed its active pursuit of acquisitions, with leadership emphasizing a preference for smaller to midsized, culturally aligned deals that are intended to enhance growth in underpenetrated markets (Key Developments).

- The company entered a strategic knowledge partnership with Bloomberg Media to support marquee global events and develop thought leadership on systemic risk and resilience, debuting the new Marsh brand at these forums (Key Developments).

Valuation Changes

- Fair Value Estimate has edged down slightly to approximately $211.62 from $212.35, reflecting modestly softer assumptions in the model.

- Discount Rate is effectively unchanged at about 6.96 percent, indicating a stable risk and return framework for projecting future cash flows.

- Revenue Growth has risen slightly to roughly 5.35 percent from 5.35 percent previously, implying a marginally more constructive outlook on top line expansion.

- Net Profit Margin has ticked down fractionally to about 17.61 percent from 17.61 percent, suggesting essentially stable long term profitability expectations.

- Future P/E multiple has eased slightly to around 23.1x from 23.2x, contributing to the small reduction in the overall fair value estimate.

Key Takeaways

- Growing risk complexity and regulatory demands are fueling long-term global demand for the company's advisory, insurance, and consulting services.

- Strategic digital investments and acquisitions are driving operational efficiency, service breadth, and market expansion, supporting sustained earnings growth.

- Ongoing pricing declines, consulting demand uncertainty, acquisition challenges, liability cost pressures, and tech disruption risk threaten long-term revenue stability and profit growth.

Catalysts

About Marsh & McLennan Companies- A professional services company, provides advisory services and insurance solutions to clients in the areas of risk, strategy, and people worldwide.

- Rising global risk complexity-including increased litigation, extreme weather, catastrophic events, cyber threats, and evolving AI risks-is expected to drive higher demand for Marsh & McLennan's specialized risk advisory and brokerage services, supporting long-term fee revenue and new client growth.

- Expansion of the global middle class, particularly in emerging markets like Latin America, Asia, and EMEA, is fueling robust demand for insurance and risk management solutions, as reflected in continued high single-digit international revenue growth, which should expand the company's addressable market and underpin top-line growth.

- Ongoing regulatory tightening and evolving compliance requirements worldwide are increasing the need for consulting, actuarial, and risk management advisory expertise, creating resilient demand and supporting stable revenues for the firm's consulting divisions.

- Strategic investments in digital transformation, advanced analytics, and AI (e.g., proprietary data tools for risk modeling, agentic interfaces) are expected to enhance operational efficiency and improve product/service offerings, enabling margin expansion and net earnings growth through improved client retention and lower cost to serve.

- Acquisition-driven growth, demonstrated by recent transactions like McGriff and successful integration of wealth management businesses, is broadening Marsh & McLennan's service portfolio and geographic footprint, enabling scale advantages and contributing to higher consolidated earnings over time.

Marsh & McLennan Companies Future Earnings and Revenue Growth

Assumptions

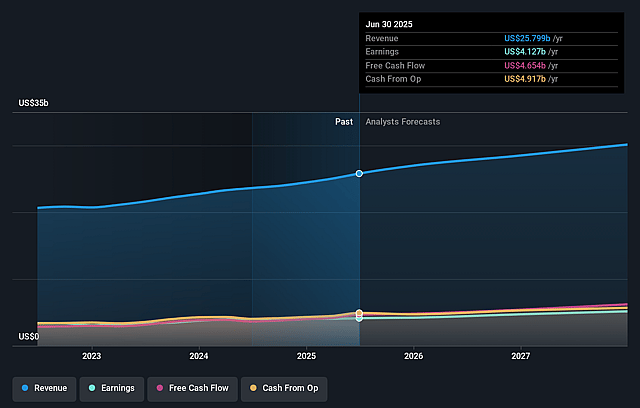

How have these above catalysts been quantified?- Analysts are assuming Marsh & McLennan Companies's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.0% today to 17.4% in 3 years time.

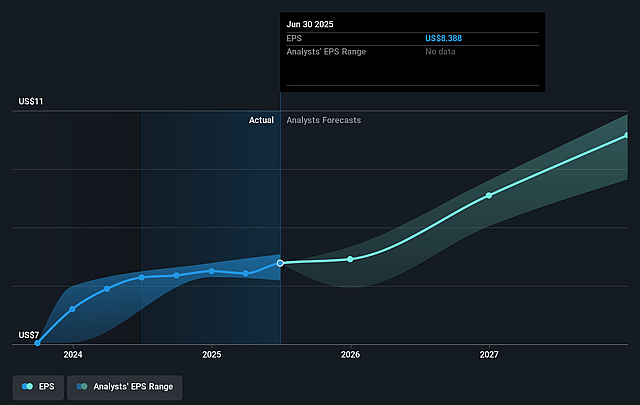

- Analysts expect earnings to reach $5.3 billion (and earnings per share of $11.3) by about September 2028, up from $4.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $4.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.1x on those 2028 earnings, up from 24.0x today. This future PE is greater than the current PE for the GB Insurance industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Marsh & McLennan Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent decline in property and reinsurance pricing, as highlighted by several consecutive quarters of price decreases and ongoing soft market conditions, threatens Marsh & McLennan's revenue growth and commission income, which may impact both top-line revenue and profitability over the long term.

- Structural decline and slowing demand in discretionary and project-based consulting services (notably in Mercer's Career segment and in project-based pension consulting) expose the company to greater revenue volatility and earnings risk, especially during periods of economic or labor market uncertainty that shrink client spend.

- The company faces elevated operational risk and margin pressure from integrating large acquisitions such as McGriff, further exacerbated by increased debt levels and significant acquisition-related charges, which could hinder net margin expansion and earnings growth if synergies fail to materialize as planned.

- Growing exposure to litigation-driven increases in U.S. liability insurance costs and the prevalence of "nuclear verdicts" create client hesitancy, higher insurance costs, and potential reductions in insurance demand, which may dampen both revenue and client retention rates in key U.S. markets.

- Rapid adoption of advanced analytics, AI, and insurtech across the industry poses a long-term risk of traditional service disintermediation; if Marsh & McLennan fails to keep pace with faster, more nimble digital-first competitors, its margins and fee-based revenues could be eroded by shrinking pricing power and client migration to tech-enabled alternatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $232.421 for Marsh & McLennan Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $258.0, and the most bearish reporting a price target of just $197.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $30.7 billion, earnings will come to $5.3 billion, and it would be trading on a PE ratio of 26.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $201.88, the analyst price target of $232.42 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Marsh & McLennan Companies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.