Key Takeaways

- Expansion in underinsured markets and digital investments are fueling higher policy sales, revenue growth, and net margins.

- Adoption of advanced technologies and disciplined capital management are driving stronger operating earnings and shareholder value.

- Demographic pressures, outdated distribution, margin-threatening claims, market saturation, and regulatory scrutiny threaten Globe Life’s long-term revenue growth and earnings sustainability.

Catalysts

About Globe Life- Through its subsidiaries, provides various life and supplemental health insurance products, and annuities to lower middle- and middle-income families in the United States.

- Globe Life is positioned to benefit from the growing number of underinsured Americans and the expanding gig economy, which are set to drive self-purchased life and supplemental health insurance demand, resulting in accelerated premium and revenue growth in 2025 and beyond.

- Ongoing investment in digital direct-to-consumer distribution and data-driven marketing is improving customer acquisition efficiency and reducing costs, supporting both top-line growth from increased policy sales and higher long-term net margins.

- The demographic shift toward a larger middle-class population with rising income levels underpins robust agent recruitment and persistency, leading to sustained double-digit increases in producing agent counts and, by extension, higher policy sales and organic revenue growth across key business units.

- The company’s disciplined capital management, including around $600 million to $650 million in annual share repurchases and efficient capital utilization, is expected to continue boosting earnings per share and enhancing shareholder value over time.

- Increased adoption of advanced underwriting technologies and robust data analytics is resulting in favorable mortality experience and lower-than-expected policy obligations, driving meaningfully higher life underwriting margins, which is set to lift operating earnings growth well above historical rates.

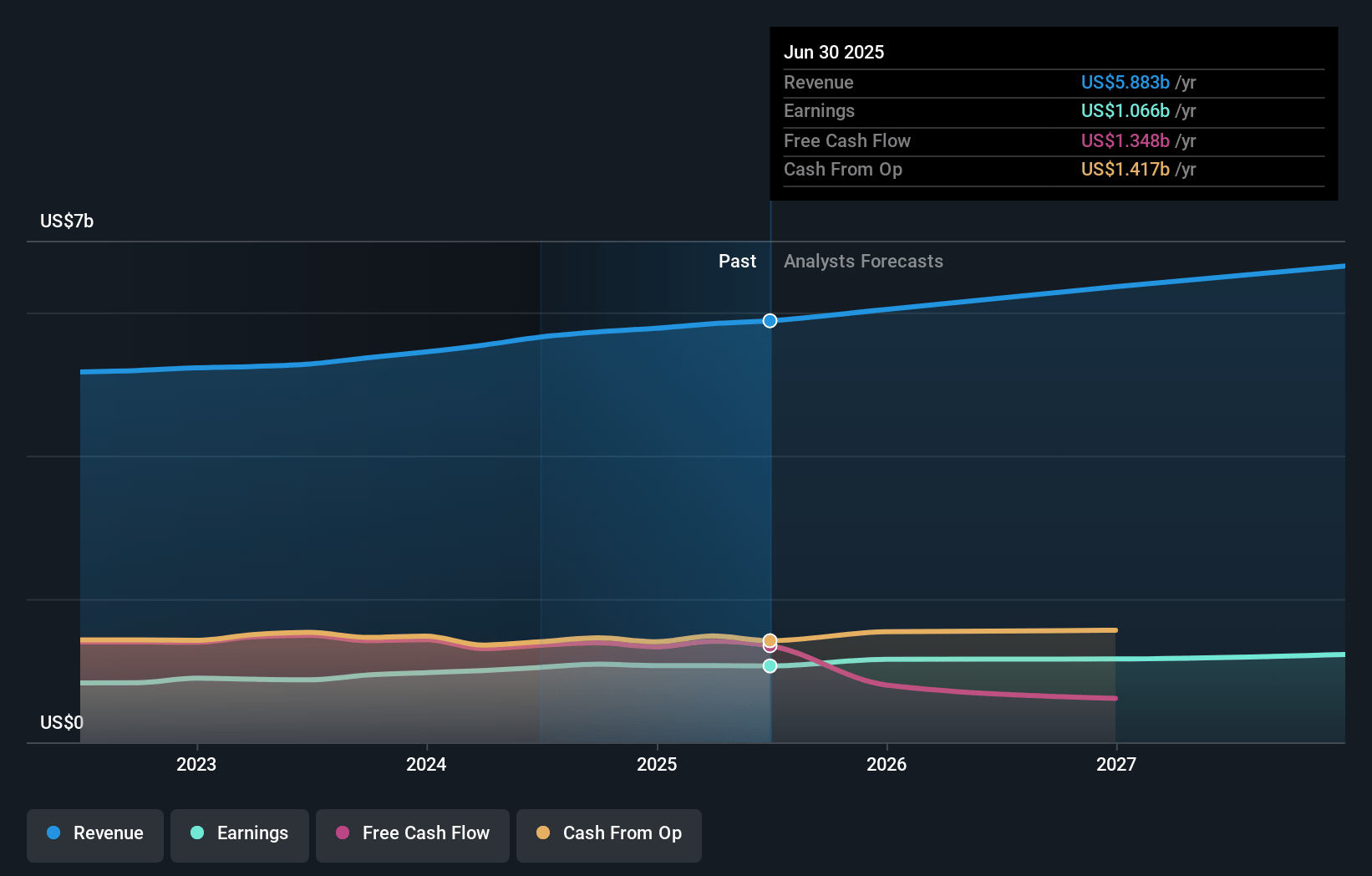

Globe Life Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Globe Life compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Globe Life's revenue will grow by 5.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 18.5% today to 18.7% in 3 years time.

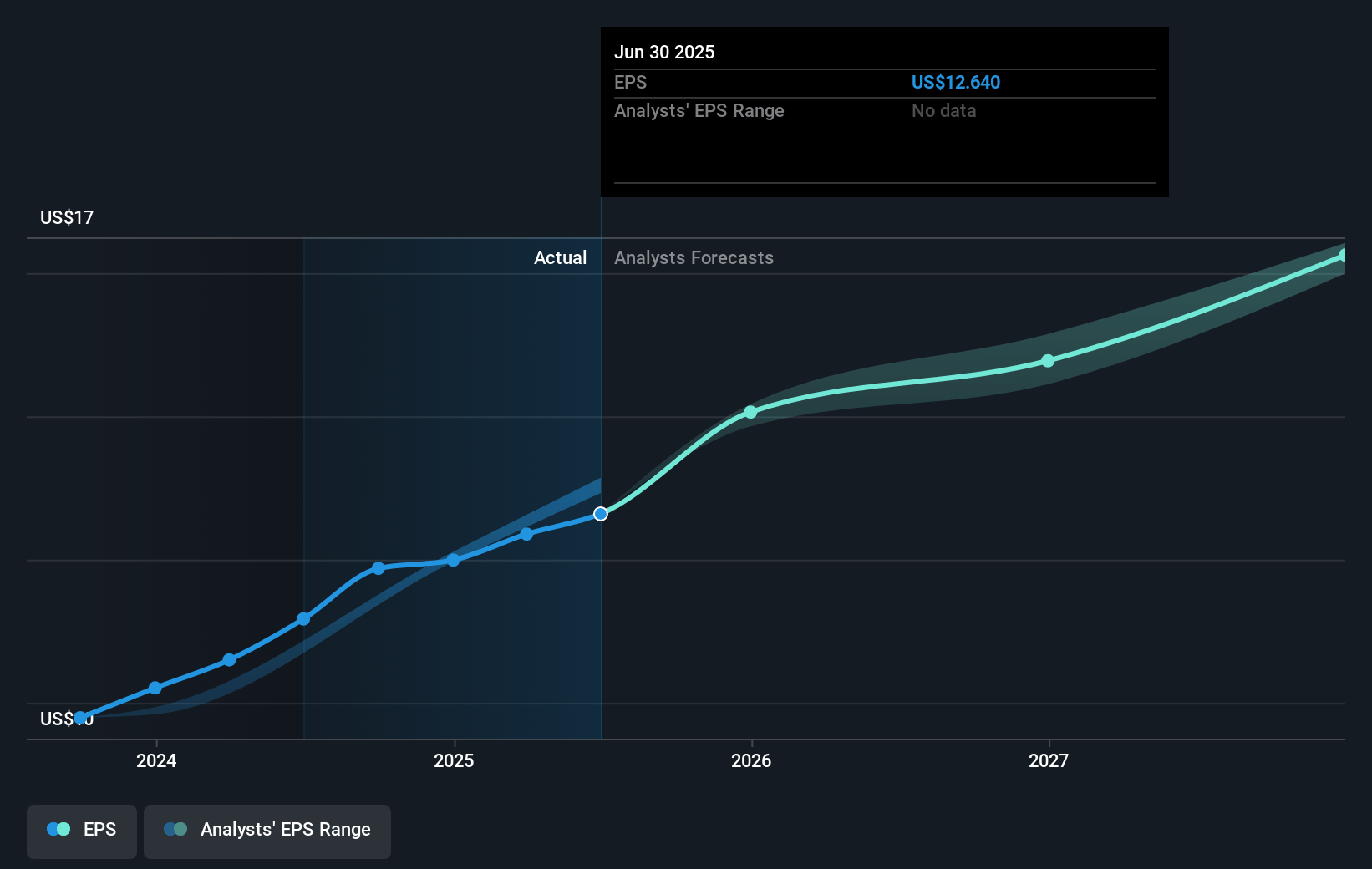

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $16.65) by about April 2028, up from $1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, up from 9.5x today. This future PE is lower than the current PE for the GB Insurance industry at 13.3x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Globe Life Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Demographic headwinds such as an aging population and declining birth rates in the U.S. may gradually shrink Globe Life’s addressable market for new policies, reducing the company’s ability to drive long-term premium revenue growth.

- Globe Life’s reliance on captive agents and traditional distribution methods, highlighted by rising agent counts and recruitment expenses, risks higher acquisition costs and lower operating margins as digital-first insurtech competitors continue to capture market share with lower-cost models.

- Increased health insurance claims utilization, which the company expects to outpace approved premium rate increases in 2025, may further erode health underwriting margin and compress overall earnings if these trends persist and are not fully addressed by future rate filings.

- The company’s heavy concentration of sales in mature, slow-growing southern U.S. markets could limit topline revenue growth potential over time as market saturation is reached and opportunities for expansion diminish.

- Regulatory scrutiny, including ongoing DOJ and SEC inquiries and increasing legal expenses, could result in additional compliance costs or potential fines, thereby reducing net margins and creating uncertainty around the sustainability of earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Globe Life is $185.09, which represents two standard deviations above the consensus price target of $141.18. This valuation is based on what can be assumed as the expectations of Globe Life's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $188.0, and the most bearish reporting a price target of just $111.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.7 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $121.68, the bullish analyst price target of $185.09 is 34.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:GL. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.