Key Takeaways

- Expansion in international markets and specialized insurance, along with digital innovation, is driving strong, diversified revenue and earnings growth.

- A disciplined underwriting strategy, robust capital deployment, and strong cash flow support sustained profitability and flexible shareholder returns.

- Rising competition, loss costs, catastrophe exposure, and regulatory pressures threaten Chubb's profitability and create significant uncertainty for future revenue growth and margins.

Catalysts

About Chubb- Provides insurance and reinsurance products worldwide.

- Strong premium growth in international markets (especially Asia and Latin America), fueled by rising asset ownership, growing middle classes, and increasing insurance penetration, is likely to support durable multi-year revenue expansion and geographic diversification.

- Continued acceleration in digital distribution channels and advanced analytics is enabling more precise risk segmentation and underwriting, especially in consumer and small commercial lines, enhancing both revenue growth and net margin over the long term.

- Chubb's disciplined approach to risk selection and underwriting (walking away from underpriced business, reshaping portfolios) in both U.S. and global markets is preserving industry-leading combined ratios and underpinning sustained net margin performance.

- Capital deployment through ongoing share repurchases (new $5B authorization), growing dividends, and selective M&A is creating upward pressure on earnings per share (EPS), while robust cash flow and capital position provide flexibility for further shareholder returns.

- Growth in specialized insurance demand-such as cyber and high-net-worth personal lines-driven by macro trends (digitalization, greater risk exposures, climate-driven catastrophes), positions Chubb to leverage expertise and scale for above-industry-average topline and earnings growth.

Chubb Future Earnings and Revenue Growth

Assumptions

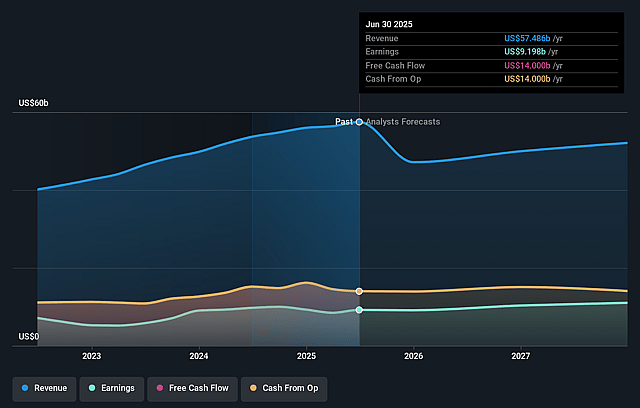

How have these above catalysts been quantified?- Analysts are assuming Chubb's revenue will decrease by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.0% today to 20.0% in 3 years time.

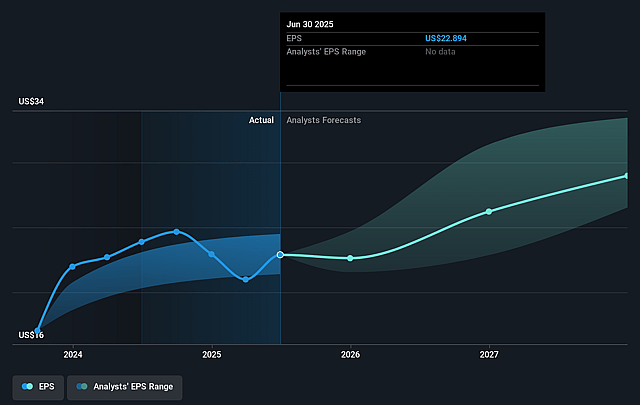

- Analysts expect earnings to reach $9.8 billion (and earnings per share of $27.04) by about August 2028, up from $9.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, up from 11.7x today. This future PE is about the same as the current PE for the US Insurance industry at 14.1x.

- Analysts expect the number of shares outstanding to decline by 1.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.45%, as per the Simply Wall St company report.

Chubb Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Chubb is facing increasing competition and price softness in large account and property insurance, with rates for large accounts down significantly (e.g., property pricing down 12% in large account business), which could pressure premium revenue growth and net margins if the trend continues or intensifies.

- The persistent and rising costs associated with social inflation and litigation, particularly in casualty and commercial auto lines, are driving loss cost trends well above general inflation (7-9% vs national average), increasing claims expenses and potentially eroding underwriting profitability over time.

- The company is exposed to volatility and execution risk in high-growth emerging markets like Latin America and Asia; while these present growth opportunities, they also carry economic and geopolitical risks that could lead to unpredictable earnings variability and integration challenges impacting long-term revenue and margins.

- Elevated catastrophe losses ($630 million pretax in the quarter) and ongoing exposure to severe weather and natural disaster risk (especially in property lines and high-net-worth personal lines) could increasingly pressure net margins and earnings, particularly as climate trends intensify and reinsurance pricing remains volatile.

- Heightened regulatory scrutiny, litigation developments, and changing liability laws (varying state-by-state in the U.S., with ongoing need for tort reform) increase operational complexity and compliance costs, threatening efficiency and putting long-term pressure on Chubb's expense ratios and net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $300.421 for Chubb based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $340.0, and the most bearish reporting a price target of just $267.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $49.2 billion, earnings will come to $9.8 billion, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 6.4%.

- Given the current share price of $269.63, the analyst price target of $300.42 is 10.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.