Narratives are currently in beta

Key Takeaways

- Geographic expansion in Commercial Lines and disciplined underwriting are key strategies to drive revenue growth and profitability.

- Strategic realignments and technology leverage enhance market adaptability, operational efficiency, and shareholder value.

- Elevated catastrophe losses and social inflation are impacting profitability, while strategic pricing and geographic expansion could pose growth and execution challenges.

Catalysts

About Selective Insurance Group- Provides insurance products and services in the United States.

- Selective Insurance Group has entered new states and is expanding its geographic footprint in Standard Commercial Lines, which could drive revenue growth as they diversify their property book and tap into new markets.

- The company is implementing a disciplined underwriting process and achieving significant price increases in Commercial Lines, suggesting an improvement in net margins and profitability moving forward.

- A focus on rate adequacy and shifting towards a mass affluent segment in Personal Lines is anticipated to enhance revenue and improve net margins over time.

- Selective Insurance Group is leveraging technology to quickly adapt to market changes in underwriting and pricing, which may lead to more efficient operations and enhanced earnings.

- The ongoing executive leadership and strategic realignment, including the hiring of a new CFO with significant insurance experience, aim to provide clear capital allocation and investment strategies that enhance shareholder value and future earnings.

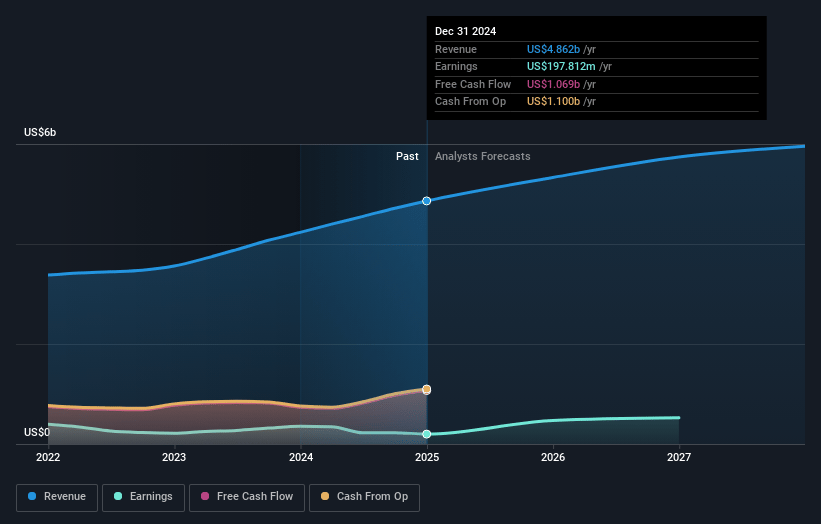

Selective Insurance Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Selective Insurance Group's revenue will grow by 9.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.8% today to 11.8% in 3 years time.

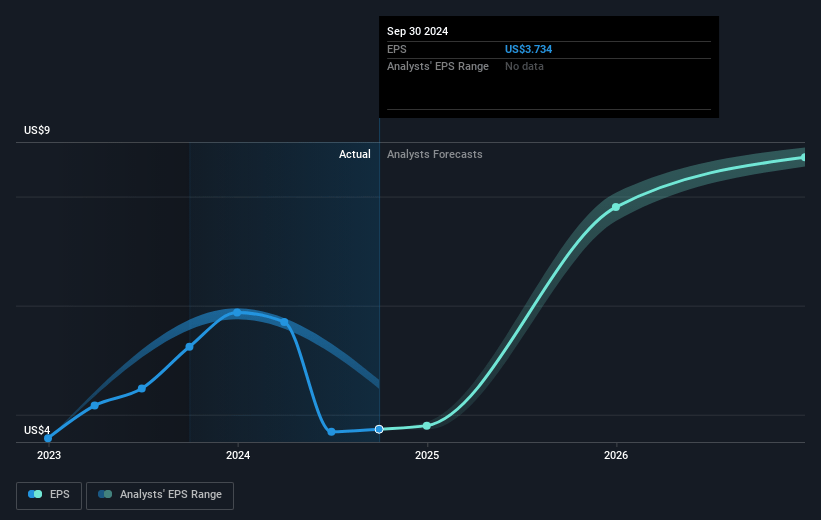

- Analysts expect earnings to reach $731.9 million (and earnings per share of $11.89) by about November 2027, up from $227.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.0x on those 2027 earnings, down from 26.0x today. This future PE is lower than the current PE for the US Insurance industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 0.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Selective Insurance Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated catastrophe losses, like those from Hurricane Helene, have significantly impacted the company's combined ratio and earnings, potentially indicating volatility and risks in net margins.

- The persistent issue of social inflation leads to increased severity trends and higher reserve requirements, affecting profitability and operating margins.

- Significant pricing actions in Standard Commercial Lines may hinder growth by prioritizing profitability over expansion, potentially impacting revenue growth.

- Elevated loss trends in commercial auto and adjustments to reserves due to unforeseen severity could lead to additional financial strain, impacting earnings consistency.

- Continued geographic expansion in commercial lines may introduce execution risks and competitive pressures, which could affect the company's revenue and market position.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $101.33 for Selective Insurance Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $6.2 billion, earnings will come to $731.9 million, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 6.0%.

- Given the current share price of $97.09, the analyst's price target of $101.33 is 4.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives