Last Update 17 Nov 25

Fair value Increased 4.35%PLMR: Pricing Improvements In Commercial Lines Should Drive Improved Outlook

Narrative Update on Palomar Holdings

Analysts have revised Palomar Holdings' price target downward from $153.33 to $160.00, citing a combination of slightly higher projected revenue growth, lower profit margin estimates, and noting that, while Q3 fundamentals remain solid, broader sector underperformance has tempered near-term optimism.

Analyst Commentary

Recent analyst assessments provide a nuanced outlook for Palomar Holdings, highlighting both supportive trends and areas of caution as pricing targets and sector forecasts are updated.

Bullish Takeaways- Bullish analysts cite a "solid quarter" in the third quarter, suggesting Palomar continues to demonstrate strong execution despite broader sector weakness.

- The general lighter mix of property renewals is expected to support improved pricing in select commercial lines, which could help maintain or boost revenue growth rates.

- Ongoing updates and recalibrations of price targets across the insurance sector reflect a dynamic environment. Palomar's fundamentals appear resilient compared to several peers.

- Bearish analysts have lowered their target valuations for Palomar, signaling concern over sustained sector underperformance and mixed stock price momentum.

- Profitability pressures and weaker profit margin estimates are limiting near-term optimism, even as top-line growth holds steady.

- The sector's overall performance compared to the equal weight S&P continues to trail. This raises questions about industry-wide valuation headwinds impacting Palomar's shares as well.

Valuation Changes

- The consensus analyst price target has been increased moderately from $153.33 to $160.00.

- The discount rate has risen slightly from 6.78% to 6.96%.

- The revenue growth estimate has edged up from 23.71% to 24.24%.

- The net profit margin projection has decreased from 20.92% to 18.88%.

- The future P/E (price-to-earnings) ratio estimate has declined from 18.65x to 17.37x.

Key Takeaways

- Expanding specialty insurance lines and advanced technology support earnings growth, risk diversification, and competitive cost advantages.

- Strong capital position, favorable reinsurance terms, and proactive risk management drive ongoing profitability and financial stability.

- Heavy exposure to catastrophe risks and rising competition threaten profitability, while dependence on reinsurance and expansion efforts heighten margin pressure and operational vulnerability.

Catalysts

About Palomar Holdings- A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

- Climate change and population migration to catastrophe-prone regions are expanding demand for specialty insurance, positioning Palomar for sustained premium and revenue growth as evidenced by the strong performance and high single-digit growth expected in residential earthquake, inland marine, and newly expanded flood insurance via the Neptune partnership-all likely to drive higher top-line growth.

- Ongoing investment in proprietary technology, data analytics, and advanced underwriting disciplines is improving risk assessment and pricing accuracy-already reflected in strong combined ratios and low loss ratios-which should continue to enhance underwriting profitability and expand net margins over time.

- Diversification into new specialty lines such as crop, casualty, and surety, backed by experienced new hires and recent acquisitions (e.g., Advanced AgProtection), reduces concentration risk and opens new avenues for earnings growth, as highlighted by 119% YoY casualty premium growth and the rapid scaling of the crop portfolio-supporting long-term earnings stability and growth.

- Digital distribution and adoption of automated underwriting/claims technology are creating structural cost advantages, lowering operational expenses and potentially improving net margins, especially in lower competition or higher barrier-to-entry admitted markets like residential earthquake, Hawaii hurricane, and builders risk.

- Improved reinsurance terms, proactive risk management, and capital strength (including a $150M buyback program) enable Palomar to maintain conservative retentions while locking in favorable reinsurance economics through 2026, underpinning future earnings stability and supporting continued growth in book value and return on equity.

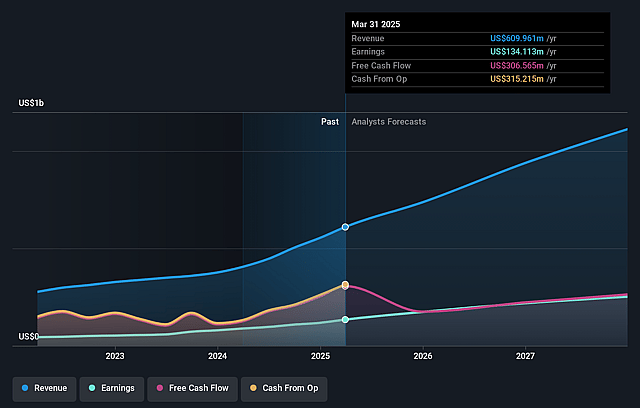

Palomar Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Palomar Holdings's revenue will grow by 23.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.7% today to 21.1% in 3 years time.

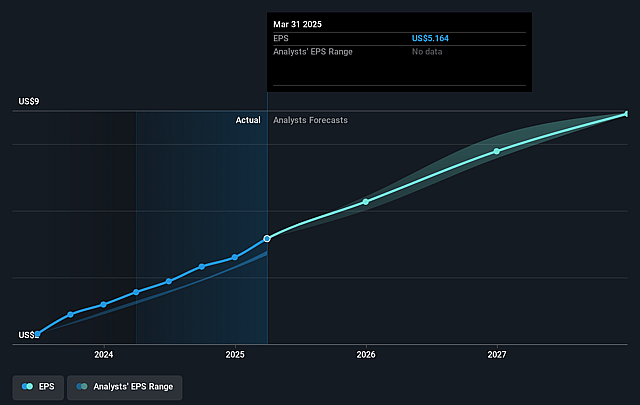

- Analysts expect earnings to reach $268.3 million (and earnings per share of $8.8) by about September 2028, up from $154.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.3x on those 2028 earnings, down from 20.9x today. This future PE is greater than the current PE for the US Insurance industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Palomar Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition and significant rate decreases in the large commercial earthquake and commercial property markets may pressure premium growth and pricing power, potentially leading to slower revenue growth and lower net margins if conditions persist or worsen.

- The company's high reliance on catastrophe-exposed property lines (earthquake, hurricane, builders risk) leaves earnings vulnerable to spikes in claims and reinsurance costs from more frequent or severe natural disasters, which could negatively impact net income and earnings stability over the long term.

- Continued dependence on reinsurance and the need to secure favorable treaty terms exposes Palomar to potential future increases in reinsurance costs and/or reduced coverage availability, which could erode margins and restrict profitable premium growth if industry-wide "hard" market conditions return.

- Investments in scaling new lines (Crop, Casualty, Surety) and geographic expansion increase operating expenses and execution risk; if these new segments face unexpected losses, unfavorable market cycles, or operational missteps, this could hamper earnings quality and slow margin improvement.

- Industry-wide trends toward greater regulatory scrutiny and the adoption of advanced InsurTech platforms by competitors could increase compliance costs and competitive pressure, ultimately squeezing margins and reducing long-term profitability if Palomar fails to keep pace or if new entrants disrupt current business models.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $165.333 for Palomar Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $268.3 million, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $121.03, the analyst price target of $165.33 is 26.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.