Key Takeaways

- Strong top-line growth and increased in-force policy count indicate potential for sustained revenue growth as AMERISAFE maintains its positive trajectory.

- Effective capital management and solid profitability, marked by low combined ratio and high ROE, suggest improved future margins and appeal to income-focused investors.

- Decreased investment income and unrealized portfolio losses, alongside rising expenses, could pressure AMERISAFE's future net margins and financial stability.

Catalysts

About AMERISAFE- An insurance holding company, underwrites workers’ compensation insurance in the United States.

- AMERISAFE demonstrated strong top-line growth with a 3.9% increase in gross premiums written for the fourth quarter and 3.1% for the full year 2024, driven by a 9.6% increase in in-force policy count, indicating potential for future revenue growth as they capitalize on maintaining this trajectory.

- The company achieved a combined ratio of 88.7% and an ROE of 20.2%, reflecting strong profitability that can potentially lead to improved net margins if sustained or enhanced in the future through a disciplined approach to underwriting.

- With the Board of Directors approving a 5.4% increase in the regular dividend, there is potential for higher earnings per share if AMERISAFE continues managing capital effectively, attracting long-term investors looking for income growth.

- Favorable development from prior accident years totaled $34.9 million in 2024, suggesting that better-than-expected claims outcomes may lead to lower future loss ratios and thus support bottom-line growth moving forward.

- The investment portfolio's yield on new investments increased, driving tax equivalent book yield higher, which can contribute positively to net investment income, potentially offsetting some effects of lower unrealized gains on equity securities and supporting overall earnings growth.

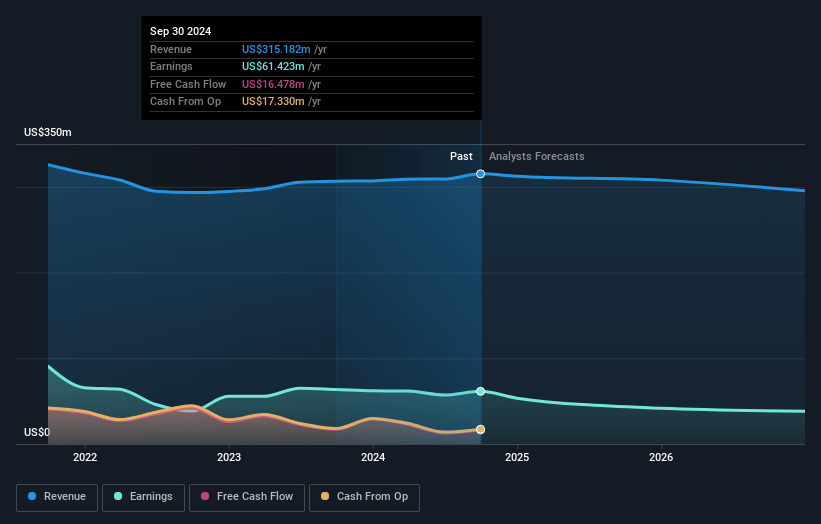

AMERISAFE Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AMERISAFE's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.9% today to 10.1% in 3 years time.

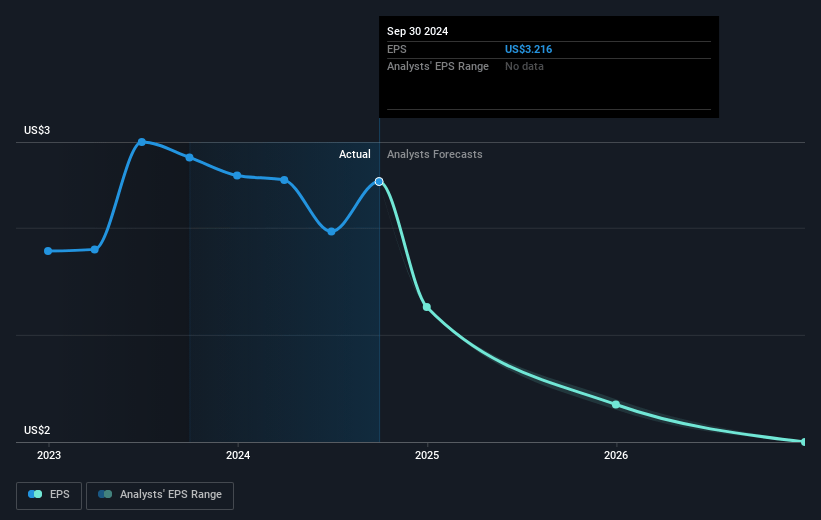

- Analysts expect earnings to reach $33.8 million (and earnings per share of $1.75) by about March 2028, down from $55.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.0x on those 2028 earnings, up from 17.1x today. This future PE is greater than the current PE for the US Insurance industry at 12.8x.

- Analysts expect the number of shares outstanding to decline by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

AMERISAFE Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in net income compared to the previous year due to lower net unrealized gains on equity securities suggests potential risks in investment income that could impact future earnings.

- The slight decline in average policy size, despite policy count growth, may indicate challenges in maintaining or increasing premium revenue.

- A 14.4% decrease in net investment income for the quarter, partly due to a decrease in investable assets following the payment of a special dividend, could impact future net margins and earnings.

- An increased expense ratio in the fourth quarter due to operating expenses may pressure net margins if not managed effectively as the company grows.

- Unrealized losses of $13.3 million in the investment portfolio due to a rise in interest rates highlight a potential risk to book value and long-term financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $56.333 for AMERISAFE based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $335.5 million, earnings will come to $33.8 million, and it would be trading on a PE ratio of 36.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of $49.79, the analyst price target of $56.33 is 11.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives