Narratives are currently in beta

Key Takeaways

- Accelerating product development and strategic launches in multiple markets could boost revenue and enhance competitiveness.

- Restructuring for efficiency and strategic promotional activities may improve margins and drive customer engagement.

- The challenging operating environment and execution risks may pressure revenue growth through declining margins and increased costs, particularly in the Chinese market.

Catalysts

About USANA Health Sciences- Develops, manufactures, and sells science-based nutritional, personal care, and skincare products in the Asia Pacific, the Americas, and Europe.

- USANA's focus on engaging with associate sales leaders and receiving positive feedback from recent conventions could lead to increased sales momentum and customer acquisition, potentially boosting future revenue.

- The company's strategy to accelerate new product development, with product launches planned in multiple markets, may bolster revenue growth as the new products capture consumer interest.

- Plans to introduce significant upgrades and additions to the existing product lineup indicate potential future revenue growth as these offerings enhance competitiveness and stimulate consumer demand across markets.

- The restructuring of the product development process to enhance cross-functional team collaboration can lead to increased operational efficiency and potentially improve net margins as a result of faster time-to-market for products.

- Anticipated increased promotional activity and strategic realignment of advertising expenses are likely to drive customer engagement and sales, positively impacting future revenue and potentially improving earnings.

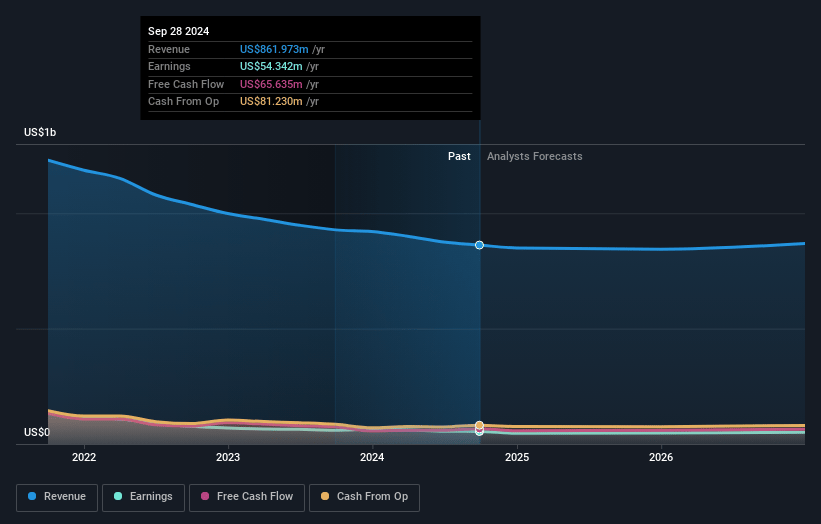

USANA Health Sciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming USANA Health Sciences's revenue will decrease by 0.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.3% today to 5.8% in 3 years time.

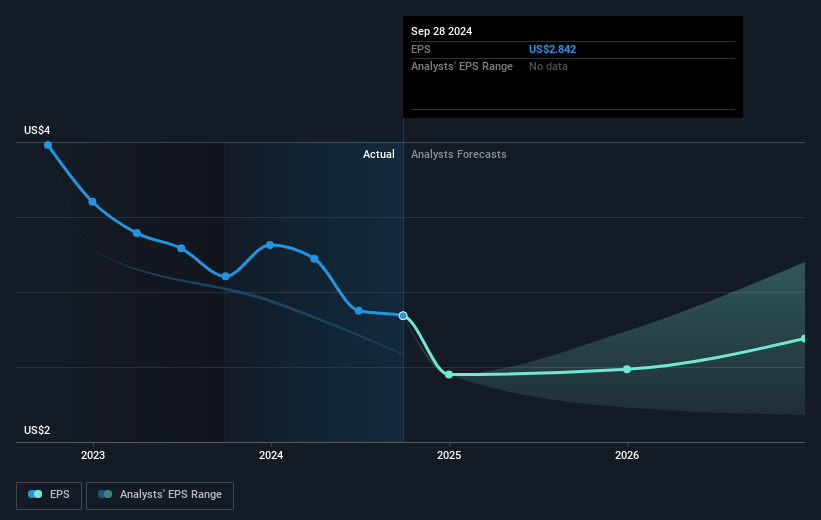

- Analysts expect earnings to reach $50.0 million (and earnings per share of $2.62) by about November 2027, down from $54.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $61.5 million in earnings, and the most bearish expecting $41.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.5x on those 2027 earnings, up from 14.3x today. This future PE is lower than the current PE for the US Personal Products industry at 28.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.68%, as per the Simply Wall St company report.

USANA Health Sciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenging operating environment in key markets, particularly in China, is causing a decline in net sales, indicating potential pressure on revenue growth.

- Reduced average spend in the Chinese market despite an increase in active customer counts may lead to decreasing margins and could indicate issues in converting customer engagement to higher revenues.

- Modest performance relative to internal expectations suggests potential execution risks in strategy implementation, which may impact earnings if not addressed effectively.

- Increased promotional activity and restructuring efforts could drive up short-term costs and expenses, affecting net margins if not compensated by a proportional increase in sales.

- The need to adapt to evolving regulatory environments, as indicated by the different commercialization timelines for new products in different markets, may pose additional risks to revenue due to delays or logistical complications.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $46.5 for USANA Health Sciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $58.0, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $865.9 million, earnings will come to $50.0 million, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 6.7%.

- Given the current share price of $40.91, the analyst's price target of $46.5 is 12.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives