Key Takeaways

- Innovations in premium product forms and market expansion are expected to drive revenue growth and enhance net margins through increased operational efficiencies.

- Strategic international brand expansion and a digital-focused marketing strategy are likely to boost earnings and sustain competitive advantages long-term.

- Lack of innovation and market challenges could suppress growth, as Gummy Vitamins drag performance and promotional pressures risk revenue and margin compression.

Catalysts

About Church & Dwight- Develops, manufactures, and markets household, personal care, and specialty products.

- Church & Dwight's innovation in their core categories, especially with their new ARM & HAMMER Deep Clean and POWER SHEETS products, is expected to drive revenue growth, particularly by capturing consumer interest in premium products and introducing new product forms like laundry sheets.

- The company is focusing on expanding market share through effective marketing, retaining consumers gained during competitor shortages, and leveraging new product launches, which is likely to support improvements in their net margins by driving volume-led growth and operational efficiencies.

- The international expansion of key brands like THERABREATH and HERO is projected to contribute significantly to revenue, as both brands have been performing well domestically and are now being registered in more international markets, which is expected to further boost earnings.

- Church & Dwight's focus on digital marketing, which constitutes 85% of their advertising spend, allows for more cost-effective and targeted marketing strategies, contributing to a favorable mix that could enhance net margins while supporting top-line growth.

- Strategic reinvestments in R&D and marketing to support ongoing innovation cycles and maintain category leadership are anticipated to drive top-line growth while sustaining competitive advantages and underpinning robust earnings in the long term.

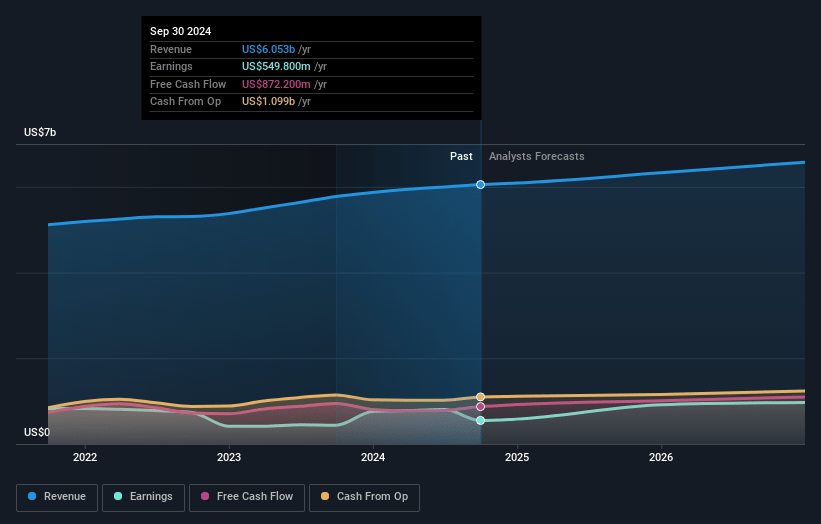

Church & Dwight Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Church & Dwight compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Church & Dwight's revenue will grow by 3.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.6% today to 15.6% in 3 years time.

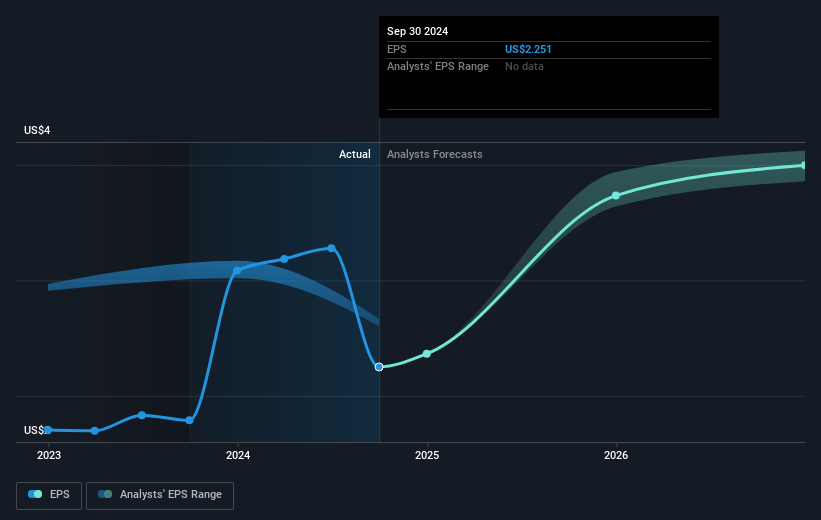

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $4.32) by about April 2028, up from $585.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 34.0x on those 2028 earnings, down from 44.2x today. This future PE is greater than the current PE for the US Household Products industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 0.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Church & Dwight Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Gummy Vitamins business is a significant drag on organic growth, and the lack of meaningful innovation in recent years has led to a $357 million write-down, negatively impacting future profits and the overall financial outlook.

- Increased promotional activity in the Litter segment driven by competitors, with deals reaching 40%, indicates a potential price war that could pressure revenue and margins in that category.

- Although ARM & HAMMER has achieved some market share gains, the overall liquid laundry detergent category was flat in Q3, which might limit growth prospects and affect revenue generation in the future.

- Uncertain consumer behavior in the U.S. with a deceleration in consumption growth indicates caution for future category growth rates, potentially impacting overall sales and revenue.

- Rising manufacturing costs being only partially offset by productivity and volume gains could compress gross margins, diminishing earnings despite sales growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Church & Dwight is $121.0, which represents one standard deviation above the consensus price target of $107.05. This valuation is based on what can be assumed as the expectations of Church & Dwight's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $126.0, and the most bearish reporting a price target of just $72.12.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.8 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 34.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of $105.07, the bullish analyst price target of $121.0 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:CHD. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives