Key Takeaways

- Expansion in distribution and enhanced product availability aim to sustain revenue growth and improve margins by optimizing cost structures.

- Strategic advertising and supply chain improvements are expected to increase consumer engagement, leading to revenue growth and improved earnings.

- Rising input costs, particularly in protein, and domestic challenges with Dymatize could pressure margins, while international growth remains crucial for revenue stability.

Catalysts

About BellRing Brands- Provides various nutrition products in the United States.

- The company predicts a strong future demand for their products, as they have initiated national advertising campaigns for the first time since 2021, which is expected to fuel top-line revenue growth by increasing brand visibility and consumer awareness.

- BellRing Brands anticipates expansion in market share through ongoing distribution gains and increased product availability, which are critical for sustaining revenue growth and enhancing operating margins by optimizing cost structures.

- The innovation pipeline, including new product launches such as the indulgent line of shakes and forthcoming packaging redesign, is expected to attract new consumers and drive incremental sales, positively impacting both revenue and earnings.

- The company's strategic investments in advertising and promotion, particularly through television and social media, are expected to bolster consumer engagement and brand penetration, which should improve revenue growth and potentially widen net margins through increased economies of scale.

- With improved supply chain capabilities and a scalable infrastructure, BellRing Brands expects to efficiently support projected sales increases, suggesting potential improvements in earnings and operating margins due to better asset utilization and reduced cost pressures.

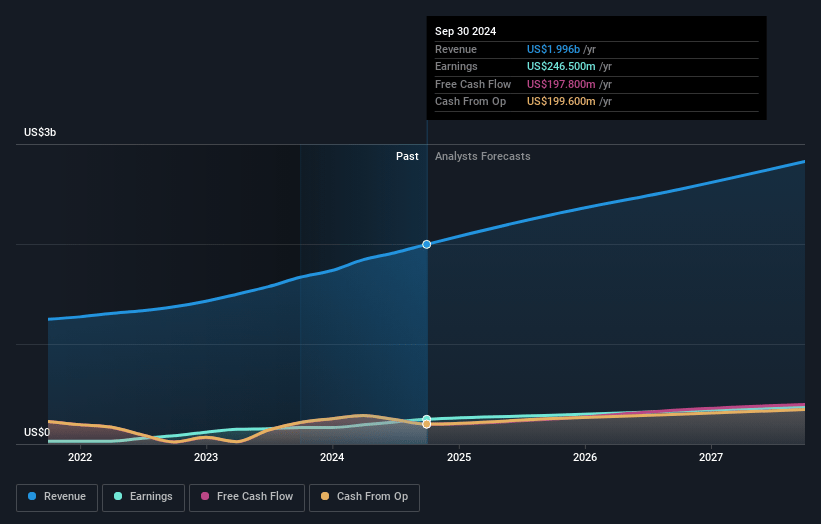

BellRing Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BellRing Brands's revenue will grow by 11.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.3% today to 13.7% in 3 years time.

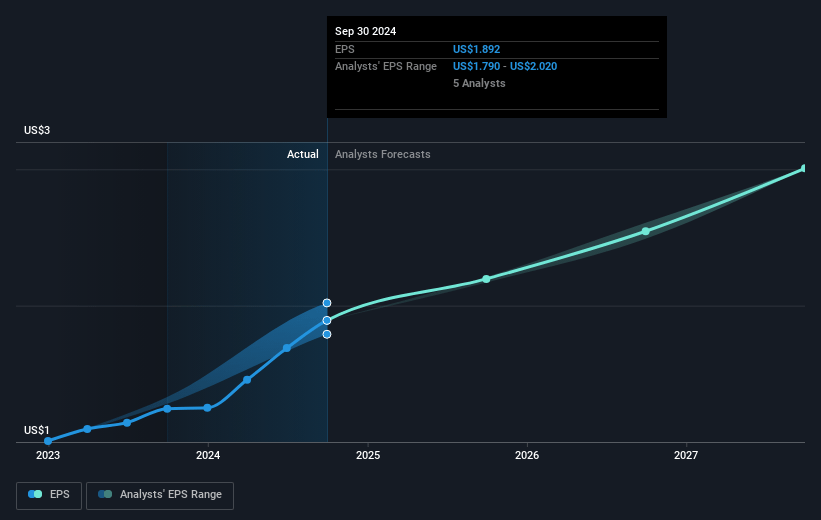

- Analysts expect earnings to reach $394.0 million (and earnings per share of $3.23) by about March 2028, up from $279.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.8x on those 2028 earnings, up from 31.4x today. This future PE is greater than the current PE for the US Personal Products industry at 29.8x.

- Analysts expect the number of shares outstanding to decline by 1.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.22%, as per the Simply Wall St company report.

BellRing Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company anticipates a mid-single-digit increase in input costs, particularly in protein inputs like whey and milk protein, which may threaten net margins as these costs escalate later in the year.

- Dymatize brand is facing domestic headwinds, with the international segment being the primary growth driver; continued pressure in the U.S. could impact overall revenue and growth prospects for this segment.

- The planned packaging redesign, while aimed at modernizing the brand, may incur additional costs in the second half of the year, potentially affecting the company's EBITDA margins.

- The category's increased promotional activities and distribution gains can serve as a double-edged sword, potentially eroding margins if the competitive landscape drives further discounting or aggressive promotional tactics.

- With a significant portion of growth attributed to GLP-1 medication users, stabilization or shrinkage in this consumer base could translate to lower-than-expected revenue growth if demand from these users tapers off.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $85.929 for BellRing Brands based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $94.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $394.0 million, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 7.2%.

- Given the current share price of $68.41, the analyst price target of $85.93 is 20.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.