Narratives are currently in beta

Key Takeaways

- Shifting consumer trends and a strong direct-to-consumer platform in beauty are set to drive impressive online revenue growth.

- Strategic investments in technology and international expansion are expected to enhance offerings, boost efficiency, and unlock new market potentials.

- Significant investment in new brands may pressure net margins and earnings due to costs outpacing revenue contributions amid slow international expansion.

Catalysts

About Oddity Tech- Operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally.

- ODDITY is poised to benefit from a significant consumer shift to online shopping, leveraging its position as the largest direct-to-consumer platform in the beauty industry, which is expected to drive substantial revenue growth as e-commerce becomes an increasingly dominant channel.

- Investment in technology and R&D, including the development of innovative tools like machine learning models and the establishment of ODDITY LABS, is anticipated to enhance product offerings and efficiency, potentially improving net margins and increasing future earnings.

- The launch of new brands, including a direct-to-consumer telehealth platform (Brand 3) and another secret initiative (Brand 4), is expected to open new revenue streams and markets, although material revenue contributions are not expected until post-2025.

- Expanding internationally remains a major growth opportunity, with capabilities ready for expansion in large geographies which could significantly boost revenues when aligned with strategic planning to capture untapped market potential.

- High engagement with a sizeable user base, coupled with a focus on repeat business, suggests increased predictability and resilience in earnings, supported by a strong cash conversion rate and a debt-free position, which can facilitate share buybacks and strategic reinvestment into growth initiatives.

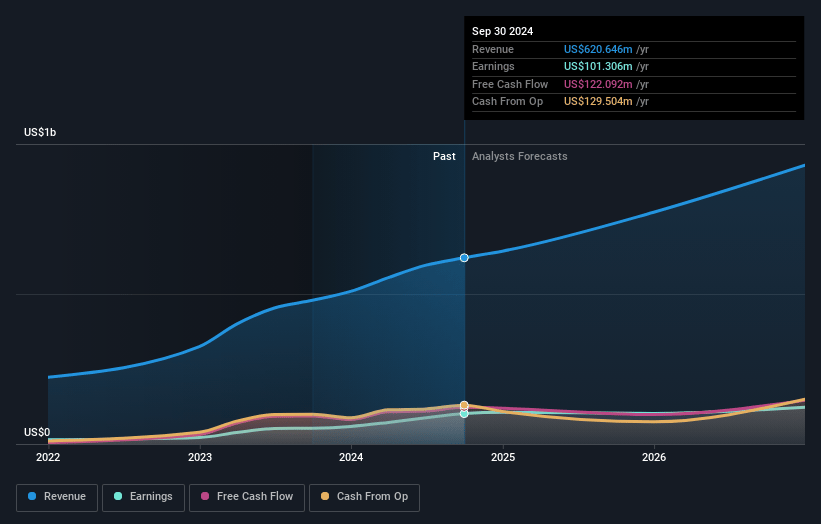

Oddity Tech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oddity Tech's revenue will grow by 20.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.3% today to 15.4% in 3 years time.

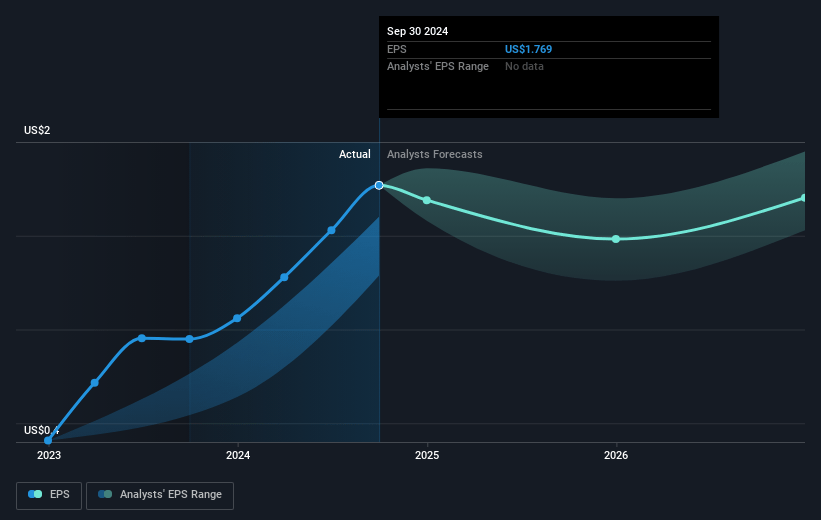

- Analysts expect earnings to reach $167.5 million (and earnings per share of $2.28) by about November 2027, up from $101.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.6x on those 2027 earnings, up from 25.8x today. This future PE is greater than the current PE for the US Personal Products industry at 26.8x.

- Analysts expect the number of shares outstanding to grow by 8.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.72%, as per the Simply Wall St company report.

Oddity Tech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is planning significant investments in new brands (Brand 3 and Brand 4) and ODDITY LABS, which are expected to incur costs in 2025 without contributing materially to revenue, potentially impacting net margins and earnings.

- The expected gross margin compression from levels currently considered unsustainable suggests potential challenges in maintaining profitability, which could negatively affect earnings.

- While existing brands are performing well, the absence of material revenue contributions from new brand initiatives in 2025 might constrain overall revenue growth.

- The intense focus on technology and ongoing investment could lead to increased operational expenses, potentially pressuring net margins if expected efficiencies or revenue growth do not materialize.

- The company’s international expansion has been slow-played, meaning future growth may be geographically constrained, limiting revenue diversification and exposing the company to risks associated with its heavy reliance on the U.S. market.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.43 for Oddity Tech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $66.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.1 billion, earnings will come to $167.5 million, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 7.7%.

- Given the current share price of $45.7, the analyst's price target of $52.43 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives