Last Update 19 Aug 25

Fair value Decreased 40%Flora Growth’s consensus Analyst Price Target was notably reduced from $156.00 to $93.00 due to continued gross margin pressure, underwhelming operational progress despite a strategic shift toward branded U.S. and European opportunities, and softer-than-expected recent results, although long-term confidence in management’s direction remains.

Analyst Commentary

- Gross margin pressure negatively impacted Flora Growth's bottom line results this quarter.

- The company is refocusing its business toward more profitable branded opportunities in the U.S. and Europe.

- Recent performance reflected a step back in operational progress despite the strategic shift.

- Bearish analysts are reducing price targets due to softer-than-expected financial results.

- The long-term Buy rating is maintained based on confidence in the company’s strategic direction.

What's in the News

- Flora Growth Corp. announces a 1-for-39 reverse stock split effective August 4, 2025.

Valuation Changes

Summary of Valuation Changes for Flora Growth

- The Consensus Analyst Price Target has significantly fallen from $156.00 to $93.00.

- The Discount Rate for Flora Growth has fallen slightly from 9.23% to 8.93%.

- The Net Profit Margin for Flora Growth remained effectively unchanged, at 5.61%.

Key Takeaways

- Regulatory changes and strategic U.S. expansion could significantly enhance Flora's presence and revenue growth in the cannabis industry.

- Expansion into the infused beverage market and European operations are expected to drive revenue growth and improve profit margins through innovation and strategic partnerships.

- Challenges in sales, increased competition, and regulatory uncertainty pose risks to Flora Growth's profitability and market expansion efforts.

Catalysts

About Flora Growth- Engages in the growth, cultivation, and development of medicinal cannabis and medicinal cannabis derivative products worldwide.

- The potential cannabis regulatory changes under President-elect Trump's administration, including federal rescheduling procedures and the Cannabinoid Safety and Regulation Act, could significantly enhance Flora's market presence and revenue in the U.S. cannabis industry.

- Flora's strategic expansion into the fast-growing infused beverage market, targeting the rise in demand for non-alcoholic alternatives, is set to drive future revenue growth and enhance profit margins through product innovation.

- The introduction of Parallel Import business in Germany, leveraging pricing differentials within the European market, could lead to increased revenues and improved profit margins as the business scales.

- Enhancement of operations in the European market, with the help of industry veteran Dr. Manfred Ziegler, is expected to improve margins and revenue as strategies to optimize the business model take effect.

- The partnership with Curaleaf and the potential use of Flora's existing GMP facility for enhanced cannabis production may contribute to sustainable long-term revenue growth in the German market.

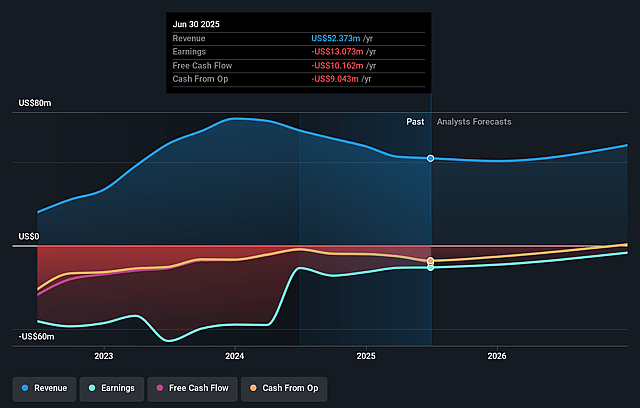

Flora Growth Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Flora Growth's revenue will grow by 8.7% annually over the next 3 years.

- Analysts are not forecasting that Flora Growth will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Flora Growth's profit margin will increase from -25.0% to the average US Personal Products industry of 5.6% in 3 years.

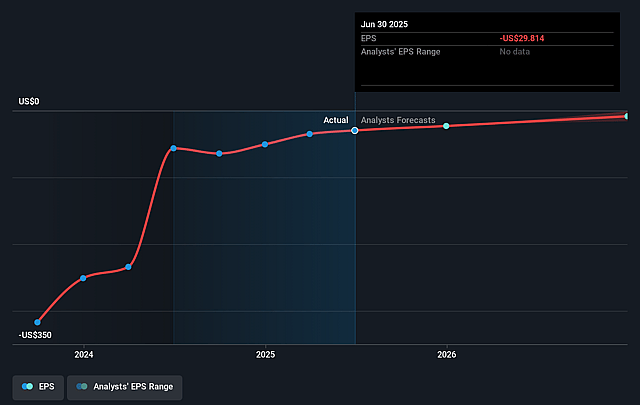

- If Flora Growth's profit margin were to converge on the industry average, you could expect earnings to reach $3.8 million (and earnings per share of $inf) by about September 2028, up from $-13.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 0.0x on those 2028 earnings, up from -1.0x today. This future PE is lower than the current PE for the US Personal Products industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.02%, as per the Simply Wall St company report.

Flora Growth Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in revenues from $17.3 million in Q3 2023 to $12.5 million in Q3 2024, as well as from $58.1 million in the first nine months of 2023 to $46.2 million in the same period of 2024, indicates challenges in maintaining or growing sales, impacting future revenue potential.

- Increased competition and the discontinuation of several unprofitable product lines suggest potential ongoing challenges in market positioning and profitability, which could impact net margins.

- The company's operating expenses increased from $5.5 million in Q3 2023 to $6.5 million in Q3 2024, indicating a potential challenge in managing costs effectively, which could affect overall earnings.

- The reduction in net cash used in operating activities implies improved cash management, but the reliance on investments for new initiatives like the infused beverage market and operations in Germany may strain financial resources if returns are not realized promptly, impacting future earnings.

- The uncertainty surrounding cannabis regulation in both the U.S. and Europe poses a risk to revenue and market expansion efforts, as the company's strategy heavily relies on regulatory advancements, which remain unpredictable and could affect financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $93.0 for Flora Growth based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $156.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $67.3 million, earnings will come to $3.8 million, and it would be trading on a PE ratio of 0.0x, assuming you use a discount rate of 9.0%.

- Given the current share price of $22.55, the analyst price target of $93.0 is 75.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.