Narratives are currently in beta

Key Takeaways

- New leadership and streamlined operations aim to boost revenue and efficiency, positively impacting net margins.

- Aggressive product innovation and strategic market shifts drive revenue growth, supported by significant share buybacks enhancing earnings per share.

- ERP implementation challenges and international growth risks could disrupt operational efficiency, pressure net margins, and moderate consistent revenue growth.

Catalysts

About Zimmer Biomet Holdings- Operates as a medical technology company worldwide.

- Zimmer Biomet expects to normalize operations after addressing their ERP implementation challenges, which should bolster revenues and operational efficiency. This will likely positively impact revenue and net margins as shipping and supply chain disruptions are resolved.

- The company anticipates continued mid-single digit growth in their end markets, fueled by an aging population, technological advancements, and the shift to outpatient settings, which should drive revenue growth.

- An aggressive product innovation pipeline, with over 50 planned product launches, including advancements in their Knee, Hip, and S.E.T. segments, is expected to contribute to revenue growth as these products gain traction in the market.

- The implementation of new leadership across various business segments is aimed at accelerating growth, which can lead to improved operational efficiencies, potentially increasing net margins.

- Continuing share buybacks, totaling over $850 million in 2024, supports earnings per share growth by reducing the number of outstanding shares.

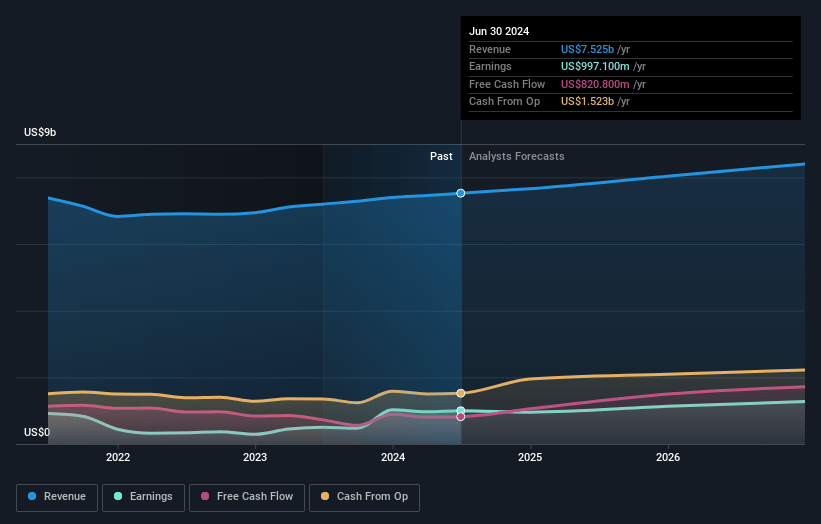

Zimmer Biomet Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zimmer Biomet Holdings's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.3% today to 15.6% in 3 years time.

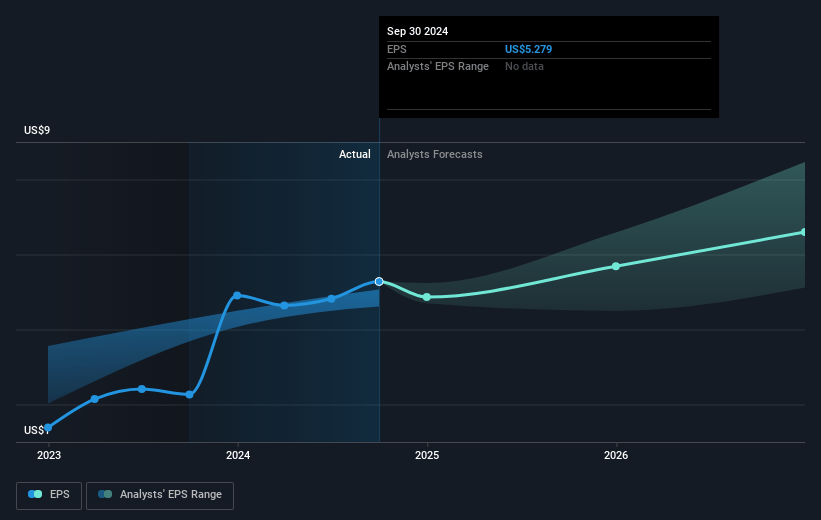

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $6.99) by about November 2027, up from $1.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.5 billion in earnings, and the most bearish expecting $1.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.8x on those 2027 earnings, up from 20.2x today. This future PE is lower than the current PE for the US Medical Equipment industry at 37.2x.

- Analysts expect the number of shares outstanding to decline by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.03%, as per the Simply Wall St company report.

Zimmer Biomet Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ERP implementation challenges may continue to exert pressure on revenue streams and disrupt operational efficiency, affecting net margins and overall earnings stability.

- International growth in regions like EMEA and Asia-Pacific can be impacted by geopolitical risks and market-specific obstacles such as pricing reforms, moderating consistent revenue growth from these markets.

- An increase in debt and interest rates poses a risk to net interest expenditures, potentially affecting Zimmer Biomet's net margins and earnings.

- The ongoing VBP in China and challenges in the international business landscape pose risks to the company's international revenue growth, impacting the financial outlook.

- Execution risks in launching new innovations and maintaining competitive advantages, particularly in swiftly evolving markets, could compromise market share growth and adversely affect future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $124.92 for Zimmer Biomet Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $150.0, and the most bearish reporting a price target of just $107.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.6 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of $109.97, the analyst's price target of $124.92 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives