Key Takeaways

- Persistent market pressures and competitive changes may hinder growth and revenue in the Interventional Urology segment.

- Acquisition and integration challenges could suppress short-term margins despite potential long-term growth from Biotronik's products.

- Strategic moves like share repurchase and acquisitions suggest confidence in financial health, potential revenue growth, improved margins, and enhanced shareholder value.

Catalysts

About Teleflex- Designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide.

- Teleflex's growth in the Interventional Urology business is expected to remain under pressure due to persistent end market challenges and changes in competitive pressures. This can negatively impact revenue projections for the segment.

- The company anticipates a temporary delay in customer orders in its OEM business owing to inventory management focus and a contract loss, leading to negative growth expectations, impacting overall revenue.

- Volume-based procurement challenges in China are anticipated to negatively affect the surgical business, which could place a constraint on revenue growth for 2025.

- A noncash goodwill impairment charge of $240 million was recognized in 2024, indicating challenges in realizing value in the Interventional Urology North America segment, which could dampen future earnings.

- Despite the acquisition of Biotronik's products promising long-term growth, initial integration costs and weak operating margins might dampen margin expansion and earnings in the short term.

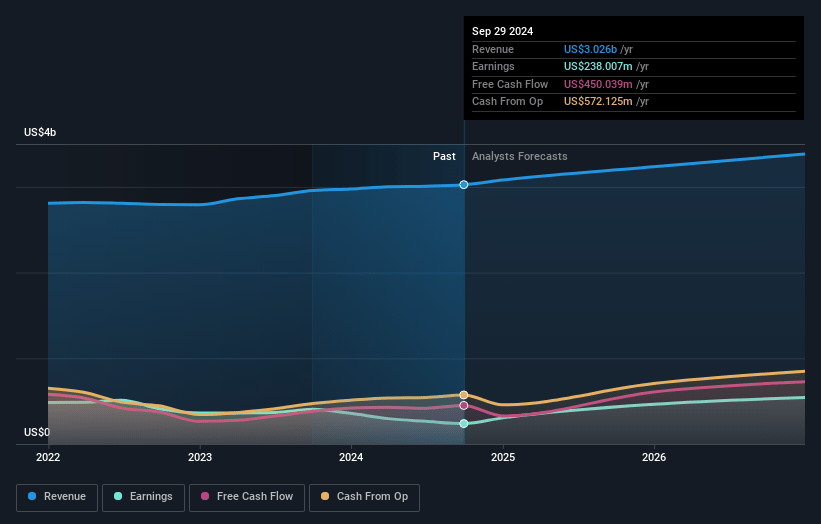

Teleflex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Teleflex compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Teleflex's revenue will decrease by 7.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.3% today to 20.2% in 3 years time.

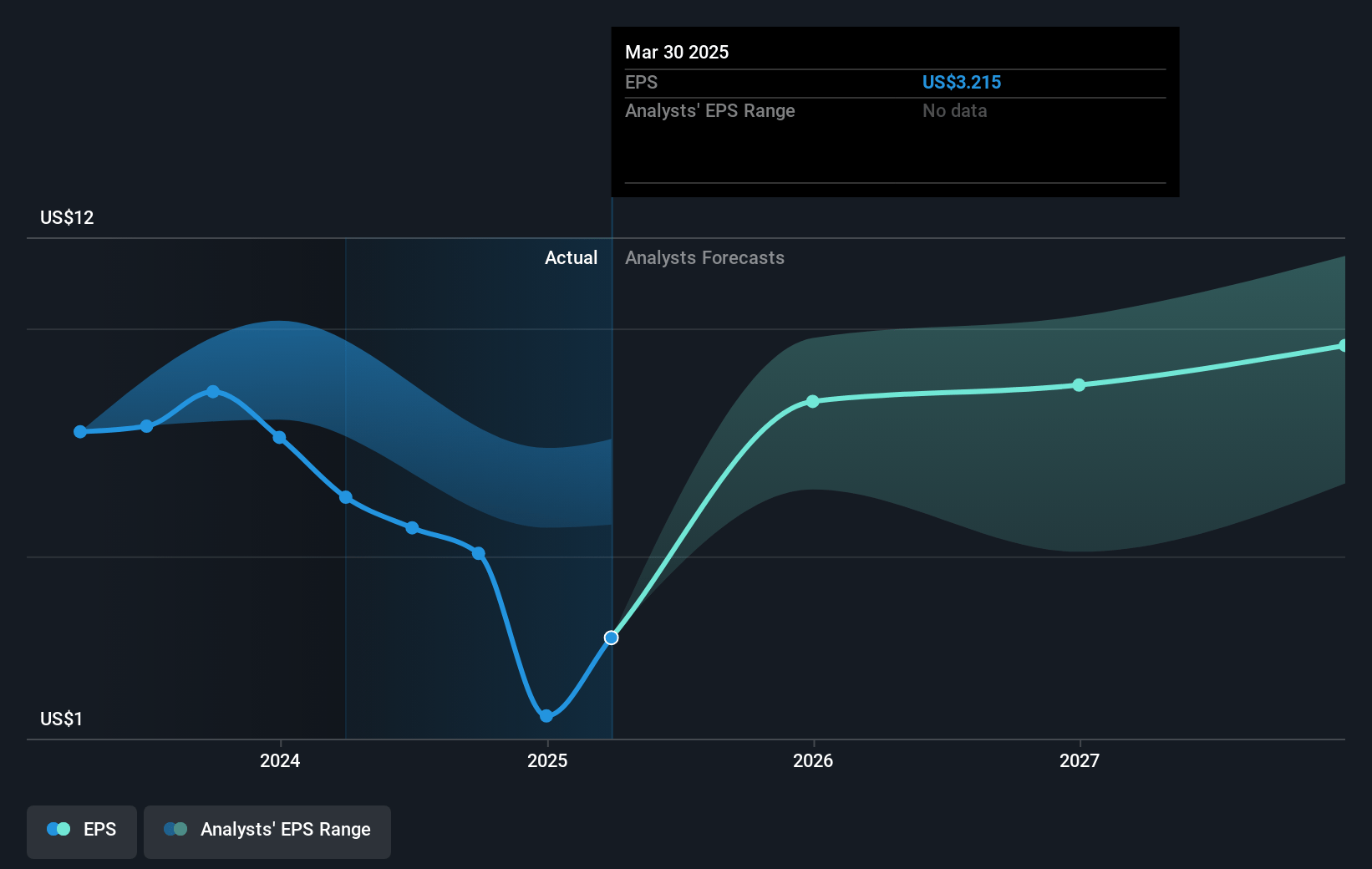

- The bearish analysts expect earnings to reach $495.0 million (and earnings per share of $11.3) by about April 2028, up from $70.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 83.7x today. This future PE is lower than the current PE for the US Medical Equipment industry at 28.6x.

- Analysts expect the number of shares outstanding to decline by 1.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

Teleflex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The announcement of an accelerated $300 million share repurchase plan indicates confidence in the company's future cash flow and overall financial health, which could positively impact the earnings per share.

- The acquisition of the Vascular Intervention business and expected improvements in revenue from Biotronik products could drive sustainable revenue growth and improve margins, potentially enhancing the long-term value creation for the company.

- Strategic focus and separation into RemainCo and NewCo could lead to increased efficiency and more targeted investment strategies, which might positively influence both entities' operational margins and profitability.

- Teleflex's strong cash flow from operations, which increased 24.7% year-over-year, suggests robust financial efficiency and potential to support further growth or investment, positively impacting net margins.

- A disciplined capital allocation strategy, including capitalizing on growth opportunities through acquisitions and share repurchases, could enhance shareholder value and stabilize earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Teleflex is $140.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Teleflex's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $495.0 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 7.5%.

- Given the current share price of $131.44, the bearish analyst price target of $140.0 is 6.1% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:TFX. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.