Last Update04 Aug 25Fair value Increased 7.73%

The upward revision in ResMed’s consensus price target reflects a modest increase in its future P/E multiple amid stable profit margins, resulting in a new fair value estimate of $289.71.

What's in the News

- Repurchased 419,000 shares for $100 million, completing 9,210,000 shares repurchased ($863.38 million) under the long-term buyback program.

- Declared a quarterly cash dividend of $0.60 per share, payable to shareholders of record in August.

- Expressed intention to pursue tuck-in acquisitions and continue investing in R&D and share buybacks.

- Dropped from the Russell 1000 Dynamic Index.

Valuation Changes

Summary of Valuation Changes for ResMed

- The Consensus Analyst Price Target has risen from $268.93 to $289.71.

- The Future P/E for ResMed has risen slightly from 26.96x to 27.84x.

- The Net Profit Margin for ResMed remained effectively unchanged, moving only marginally from 28.26% to 28.76%.

Key Takeaways

- Strategic acquisitions, innovation, and digital health adoption are broadening market reach, deepening customer retention, and driving resilient revenue and margin growth.

- Operational efficiencies and increased awareness in sleep health strengthen competitive advantages, fueling long-term earnings expansion and greater profitability.

- Competitive, regulatory, and market shifts threaten ResMed's pricing power, market share, and profitability, especially as its hardware-focused model faces digital disruption and rising compliance costs.

Catalysts

About ResMed- Develops, manufactures, distributes, and markets medical devices and cloud-based software applications for the healthcare markets.

- Strategic investments in expanding the diagnosis and treatment funnel-including acquisitions like VirtuOx, Ectosense, and Somnoware-are improving patient flow from screening to therapy, positioning ResMed to capture a larger share of the substantial underpenetrated global sleep apnea and respiratory market, supporting long-term revenue growth.

- Increased global awareness of sleep health issues, amplified by direct-to-consumer marketing campaigns and education programs for primary care physicians, is driving higher diagnosis and treatment rates, translating to elevated demand for ResMed's products and sustained top-line revenue growth.

- Acceleration in adoption of home-based, cloud-connected therapy solutions and digital health platforms (including software like Brightree and AirView) enhances recurring high-margin revenue streams and increases both user retention and net profit margins over time.

- Ongoing innovation in product development-including new releases of CPAP devices, mask interfaces, and integration of AI-driven features-strengthens ResMed's competitive differentiation and supports premium pricing power, driving both revenue and margin expansion.

- Optimization initiatives in procurement, manufacturing, and logistics-along with the build-out of the U.S. manufacturing footprint-are structurally improving gross margins, which, when combined with operating leverage from global scale, are expected to boost overall earnings and free cash flow.

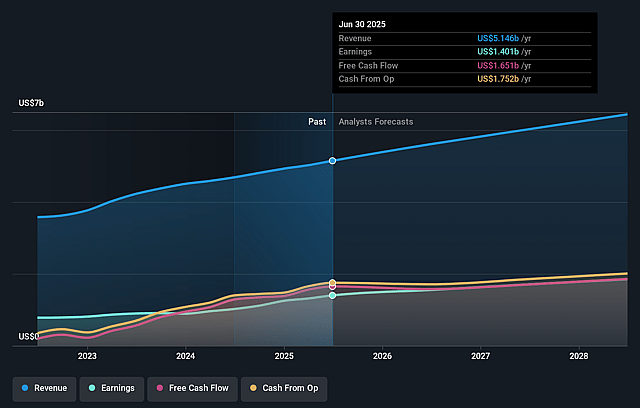

ResMed Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ResMed's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 27.2% today to 28.8% in 3 years time.

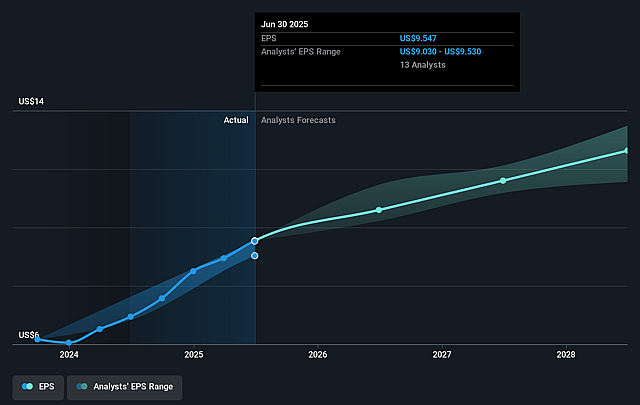

- Analysts expect earnings to reach $1.9 billion (and earnings per share of $12.63) by about August 2028, up from $1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.2x on those 2028 earnings, down from 29.8x today. This future PE is greater than the current PE for the AU Medical Equipment industry at 27.7x.

- Analysts expect the number of shares outstanding to decline by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

ResMed Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential resumption or tightening of CMS competitive bidding programs in the US could pressure pricing and reimbursement rates for ResMed's core devices, leading to reduced revenue growth and compressed net margins.

- Intensifying competition in the sleep apnea and respiratory market-including from alternative therapies such as GLP-1 drugs and hypoglossal nerve stimulators-may slow device adoption and erode ResMed's market share, negatively impacting topline revenue and margins.

- Heavy dependence on positive secular trends (aging population, home-based care, and sleep disorder prevalence) exposes ResMed to risk if healthcare cost containment or stricter reimbursement policies emerge globally, which could limit growth and pressure earnings.

- The accelerating transition toward digital and preventative health, as well as commoditization of respiratory medical equipment, may lower average selling prices and challenge ResMed's hardware-centric business model, impacting net margin expansion and longer-term profitability.

- Rising regulatory and compliance demands-especially related to data privacy, cybersecurity, and evolving healthcare software oversight-could increase R&D and SG&A costs, pose legal risks, and potentially delay new product launches, putting pressure on future earnings and operating leverage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $289.714 for ResMed based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $325.0, and the most bearish reporting a price target of just $215.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.4 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 28.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of $285.0, the analyst price target of $289.71 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.