Narratives are currently in beta

Key Takeaways

- Recent contract wins and Medicaid expansions are expected to boost premium revenue and improve earnings.

- Planned acquisition and efficiency improvements will enhance market share and long-term earnings growth.

- Rising medical costs and rate adjustments pose financial risks, while market exits and strategic acquisitions present challenges and opportunities for Molina Healthcare's growth and stability.

Catalysts

About Molina Healthcare- Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

- Molina Healthcare expects revenue growth from recent contract wins and expansions, such as the awarded contracts in Michigan and Massachusetts, signaling potential future revenue increases. This growth is projected to add substantially to their premium revenue, likely improving earnings as these contracts are implemented.

- The company anticipates narrowing the disparity between medical cost trends and rates through ongoing and future rate increases in Medicaid, which should help stabilize and potentially improve net margins over the long term.

- Molina's new Medicaid store additions are expected to reach target margins, indicating improved operational efficiency and profitability, which could boost overall earnings.

- The planned acquisition of ConnectiCare is expected to close in early 2025, with potential for increased revenue and market share, contributing to long-term earnings growth.

- Efficiency improvements, such as continued G&A efficiencies and maintained strong performance in the Marketplace segment, should support higher net margins and enhance earnings growth.

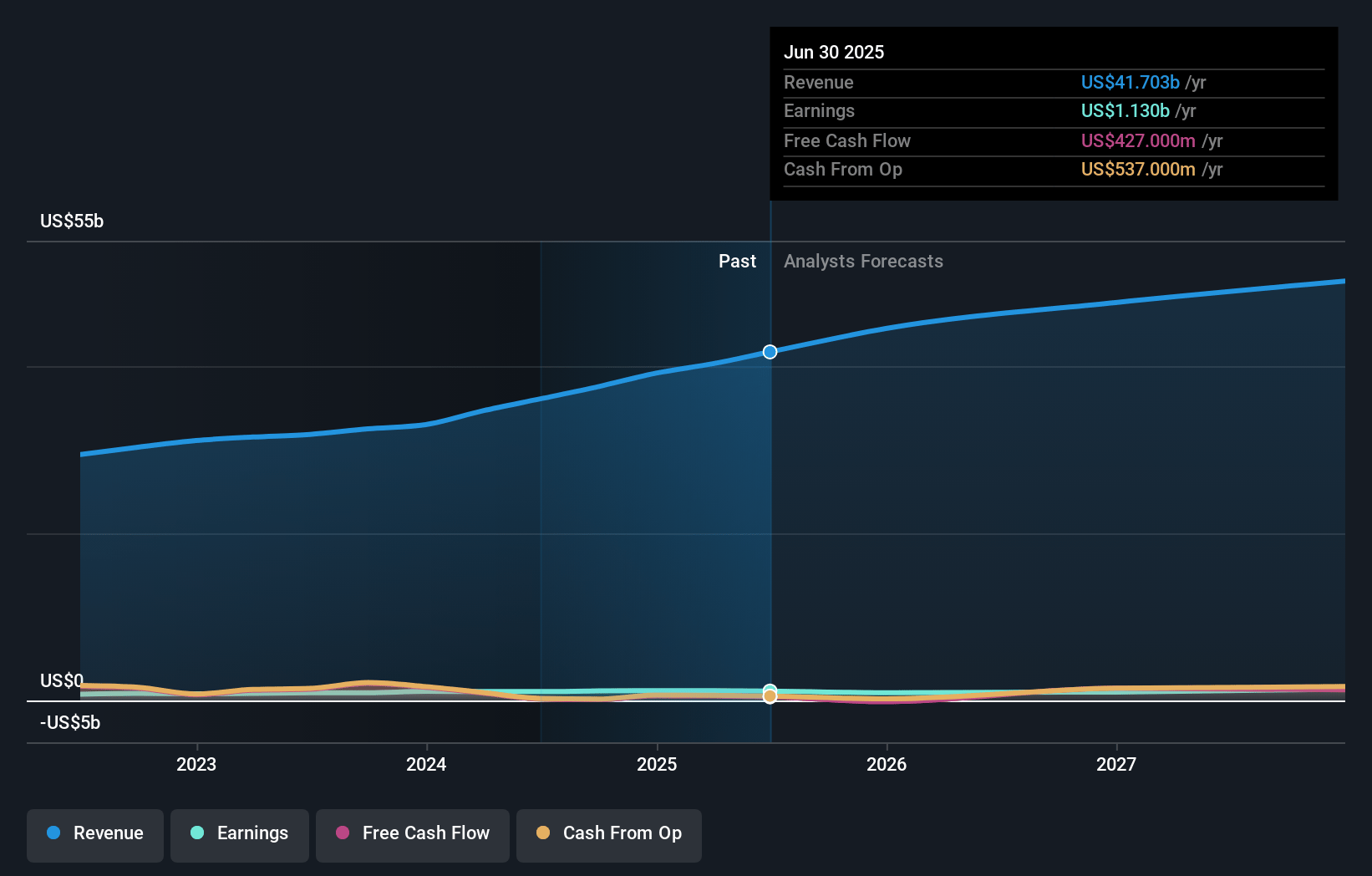

Molina Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Molina Healthcare's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 3.6% in 3 years time.

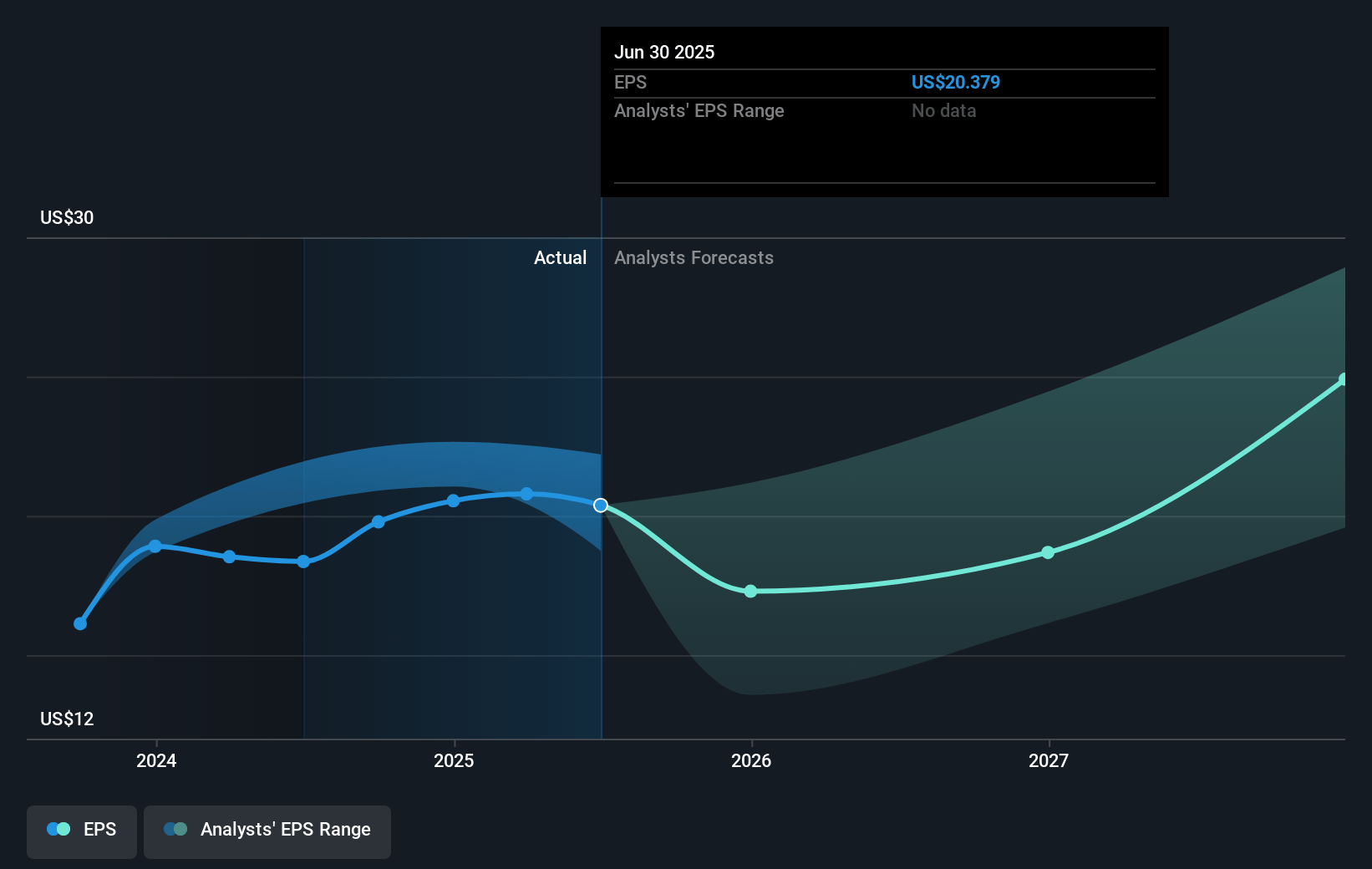

- Analysts expect earnings to reach $1.8 billion (and earnings per share of $31.61) by about November 2027, up from $1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2027 earnings, down from 15.5x today. This future PE is lower than the current PE for the US Healthcare industry at 24.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Molina Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increase in Molina Healthcare's consolidated Medical Care Ratio (MCR) to 89.2%, driven by higher-than-expected medical costs in Medicaid and Medicare, signals a potential impact on net margins due to rising medical expenses.

- The retroactive premium rate reduction in California has already negatively affected Molina's revenue, indicating possible further financial strain if similar adjustments occur without increased clarity from state methodologies.

- The variability in Medicaid redetermination-related acuity shifts and higher utilization among continuing populations may lead to ongoing revenue and earnings fluctuations if state rate adjustments lag behind actual medical cost trends.

- Molina's decision to exit certain MAPD markets to focus on dual eligible populations might limit revenue streams, as shrinking market presence in traditional areas can reduce overall growth opportunities and increase reliance on specific market segments.

- The pending acquisition of ConnectiCare and market expansions carry the risk of integration and execution challenges, which, if not managed properly, could disrupt operational efficiency and affect earnings realization.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $370.78 for Molina Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $414.85, and the most bearish reporting a price target of just $309.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $50.6 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 5.9%.

- Given the current share price of $309.3, the analyst's price target of $370.78 is 16.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

MOH: Expanding Government Contracts in Medicare Makes for Moderate Growth But with Certain Risks such as Medicaid rediterminations

Catalysts Membership Growth : MOH has seen a 9% increase in members year over year, reaching approximately 5.7 million members as of March 31, 2024. This growth is driven by new contract wins, acquisitions, and expansion.

View narrativeUS$411.65

FV

28.5% undervalued intrinsic discount7.42%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

about 1 month ago author updated this narrative