Key Takeaways

- Growth through acquisitions and new contracts is expected to drive significant revenue, indicating successful market expansion strategies.

- Strategic investments in marketplace pricing and disciplined cost management aim to sustain margins, drive membership growth, and support earnings stability.

- Unexpected medical cost pressures and potential Medicaid funding cuts could threaten Molina's margins, earnings, and revenue growth, challenging long-term profitability.

Catalysts

About Molina Healthcare- Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

- The acquisition of ConnectiCare and new contract wins, including Medicaid managed care services in Georgia and Duals contracts in multiple states, are expected to contribute over $5 billion in revenue. This expansion into new markets and segments should drive significant revenue growth.

- Effective growth initiatives, including successful defense of key Medicaid contracts and expansion into new services, highlight Molina's ability to secure and increase premium revenue from existing services, expected to lead to sustained revenue growth.

- While experiencing industry-wide medical cost pressures, Molina's strategic investment in marketplace pricing and benefit designs aims to sustain mid-single-digit pretax margins by leveraging past excess margins to competitively position their products.

- Continued strong performance and disciplined cost management in the Marketplace segment, including a reinvestment strategy from outperforming margins, are aimed at driving membership growth and maintaining solid pretax margins of 6%, thereby supporting earnings stability.

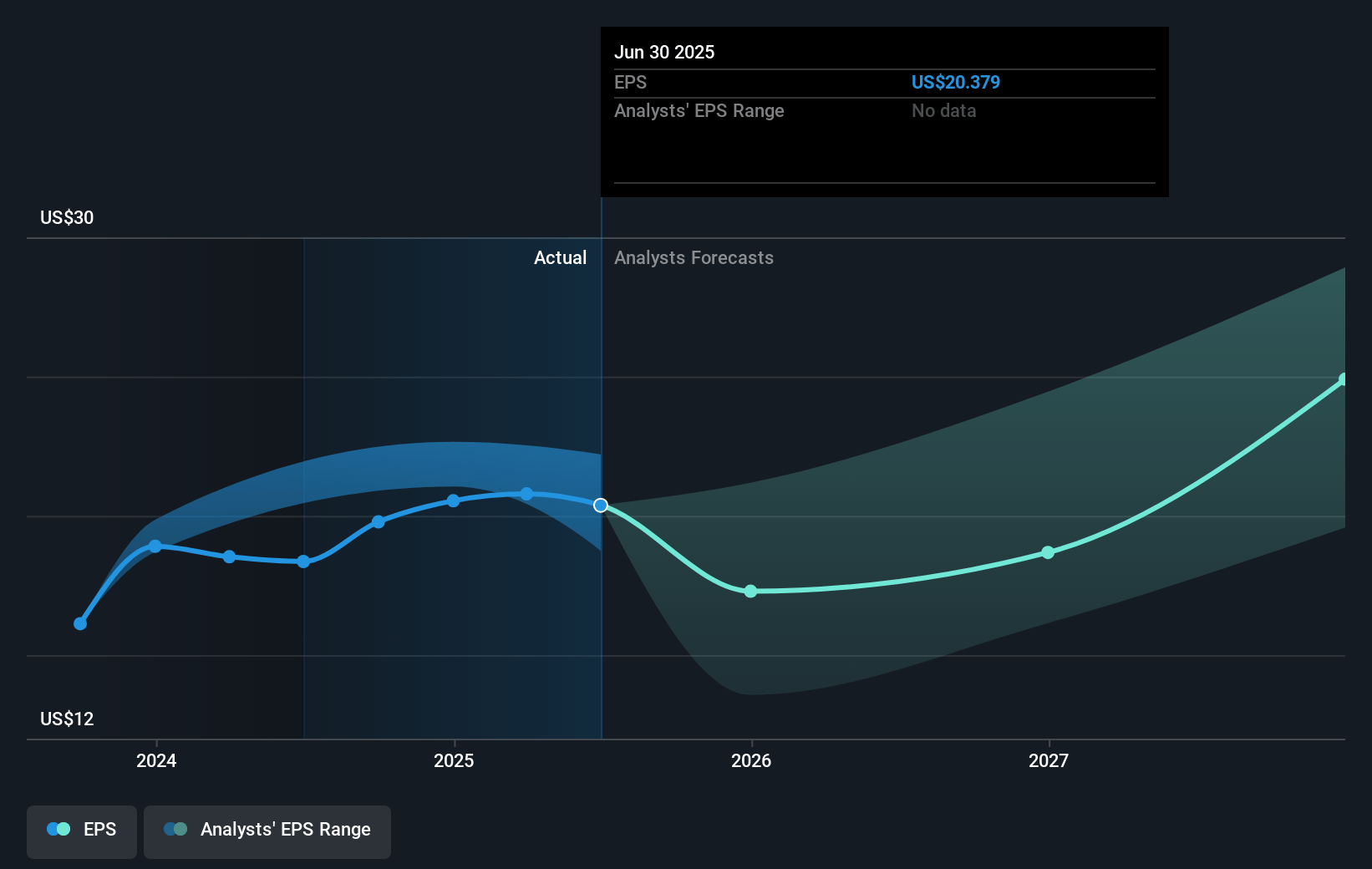

- With the 2025 guidance projecting a minimum of 8% year-over-year EPS growth, the harvest of embedded earnings power, and identification of cost efficiencies, Molina aims to support future EPS growth and enhance shareholder value.

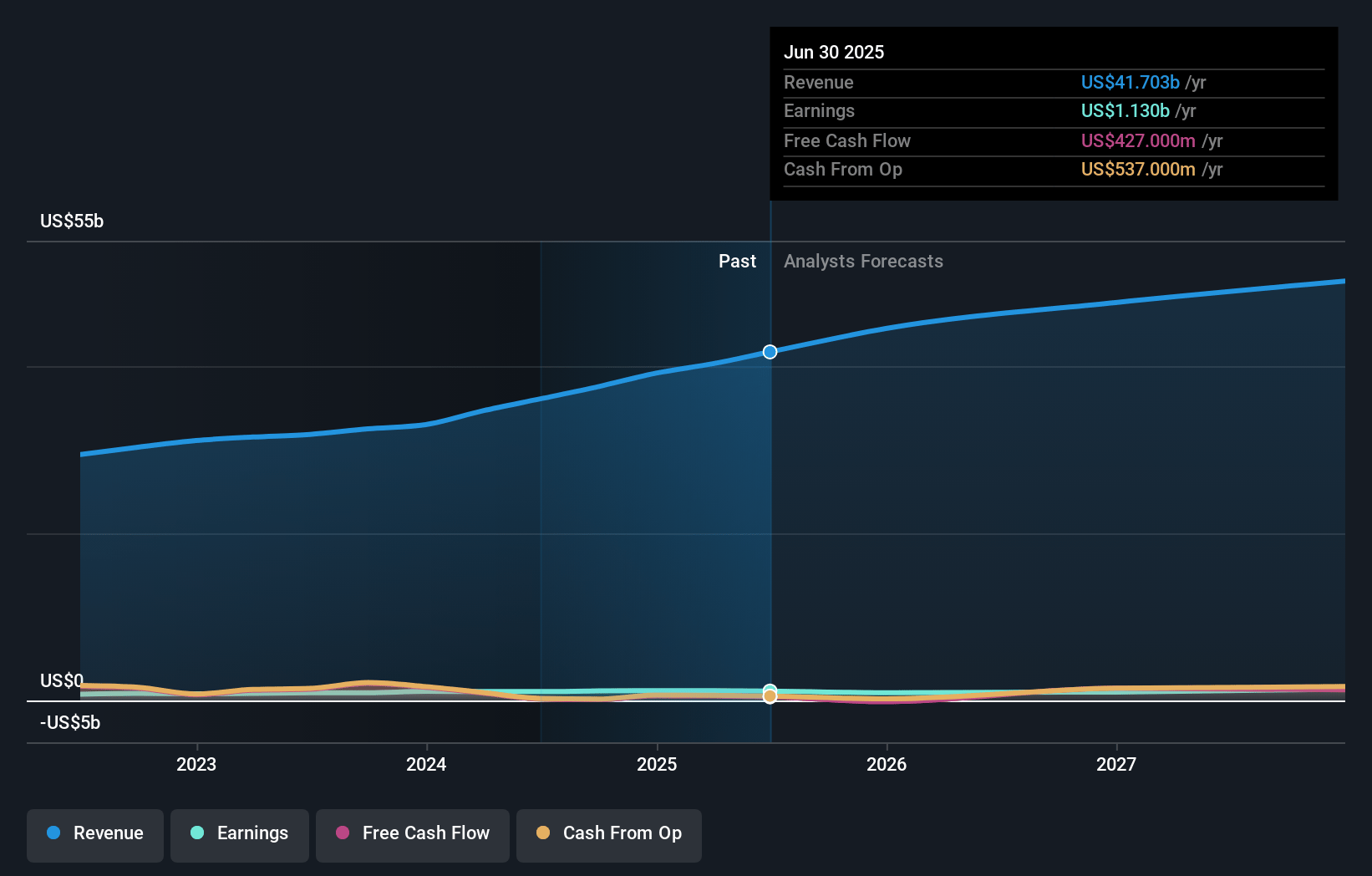

Molina Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Molina Healthcare's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 3.3% in 3 years time.

- Analysts expect earnings to reach $1.7 billion (and earnings per share of $29.46) by about April 2028, up from $1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.5x on those 2028 earnings, down from 15.4x today. This future PE is lower than the current PE for the US Healthcare industry at 23.2x.

- Analysts expect the number of shares outstanding to decline by 5.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Molina Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The unexpected medical cost pressures in Medicaid and Medicare, alongside higher-than-anticipated utilization trends, could negatively impact Molina's net margins and earnings if these trends persist or worsen.

- The failure to obtain material benefits from risk corridors implies financial risk in managing medical cost pressures, potentially affecting the company's earnings.

- The loss of the Virginia Medicaid contract, despite being under protest, represents a potential threat to revenue and long-term business growth if it is not reinstated.

- Lower-than-expected reimbursement rates for Medicare and Medicaid, which did not keep pace with medical cost trends, could strain net margins and challenge profitability if not adequately addressed.

- The political uncertainty surrounding potential cuts to Medicaid funding could impact revenue and business operations if significant policy changes are enacted.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $349.731 for Molina Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $400.0, and the most bearish reporting a price target of just $279.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $50.6 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 11.5x, assuming you use a discount rate of 6.2%.

- Given the current share price of $332.38, the analyst price target of $349.73 is 5.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.