Key Takeaways

- Expansion of workflow modules and AI tools is driving platform growth, increasing user engagement, and bolstering high-margin SaaS opportunities.

- Strong industry tailwinds and leading clinician network position the company for sustained market share gains and recurring, higher-margin revenue streams.

- Heavy reliance on pharma advertising, slowing user growth, rising competition, regulatory risks, and industry consolidation threaten long-term growth, profitability, and pricing power.

Catalysts

About Doximity- Operates a cloud-based digital platform for medical professionals in the United States.

- Doximity is leveraging robust adoption of new workflow modules, such as point-of-care and formulary products, which are growing at over 100% year-over-year and now account for 20% of pharma sales; this ongoing innovation is rapidly expanding the platform’s addressable market and expected to unlock significant incremental revenue and net retention upside over the next three to five years.

- Increased integration of AI-powered tools, which saw physician usage rise 60% quarter-over-quarter, is streamlining clinician workflow and reducing administrative burden; as digital transformation accelerates in healthcare, this positions Doximity to expand user engagement and implement higher-margin, data-driven SaaS solutions, supporting both revenue growth and further margin expansion.

- The company’s client portal is driving higher customer engagement and upsell velocity, as customers using the portal show higher growth rates; with a full rollout to all clients in 2025 and growing adoption among agency partners, Doximity will benefit from enhanced data transparency and self-serve marketing tools, increasing deal sizes and recurring subscription-based revenue.

- Long-term under-indexing of digital spend by pharma—currently at only about one-third of marketing budgets compared to over 70% in other industries—provides a powerful, multi-year tailwind as secular shifts towards digital health and data-driven targeting continue, setting the stage for sustained double-digit top-line growth as Doximity captures accelerating market share.

- Strengthening physician shortages and rising administrative pressures are fueling demand for secure, cloud-based professional collaboration and telehealth solutions; Doximity’s #1 ranking and entrenched network among clinicians, including nurse practitioners and physician assistants, enhances its competitive moat and positions the company for lasting customer stickiness, supporting expansion in high-margin SaaS and advertising revenues and underpinning long-term earnings power.

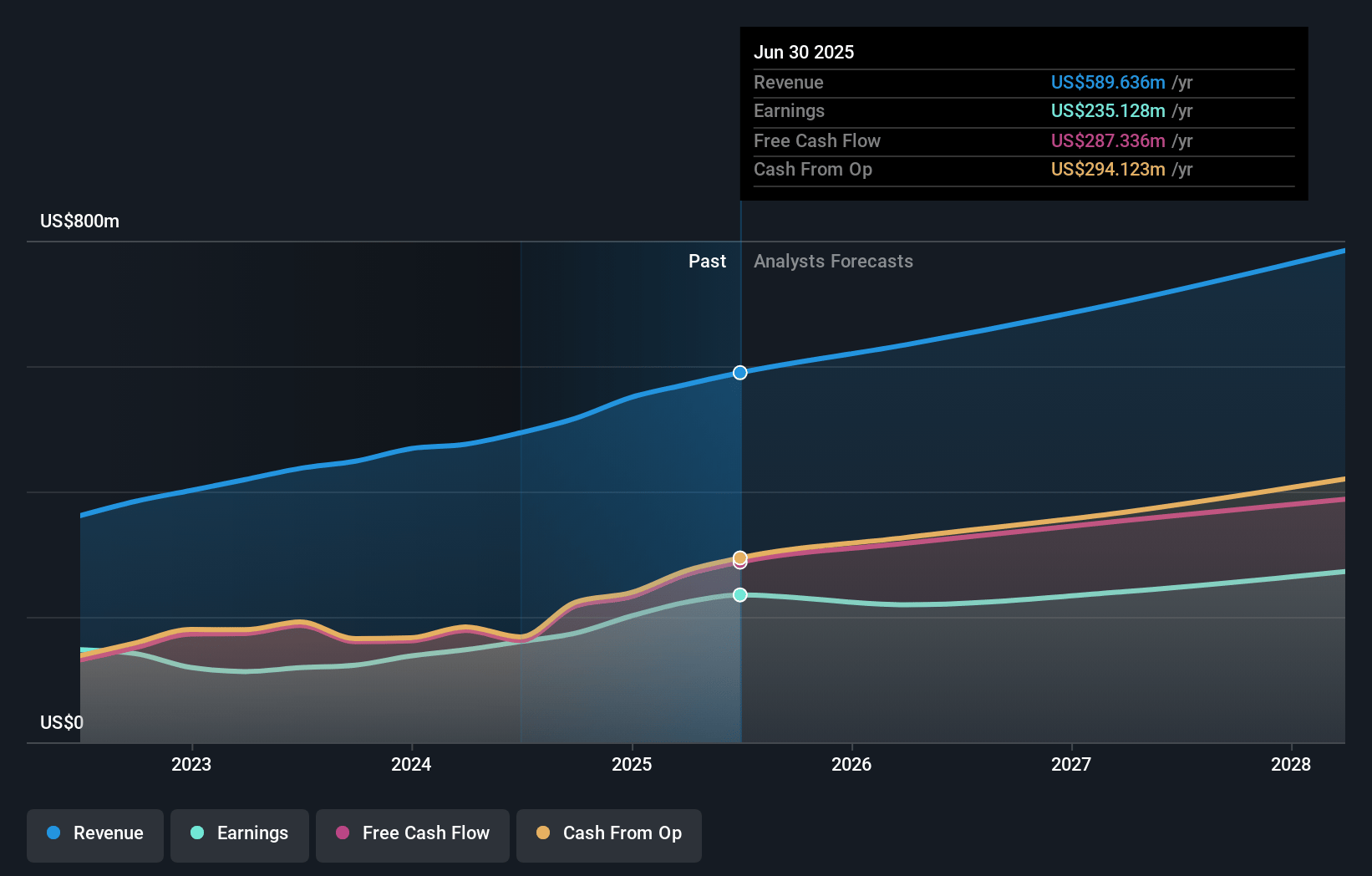

Doximity Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Doximity compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Doximity's revenue will grow by 16.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 36.6% today to 37.6% in 3 years time.

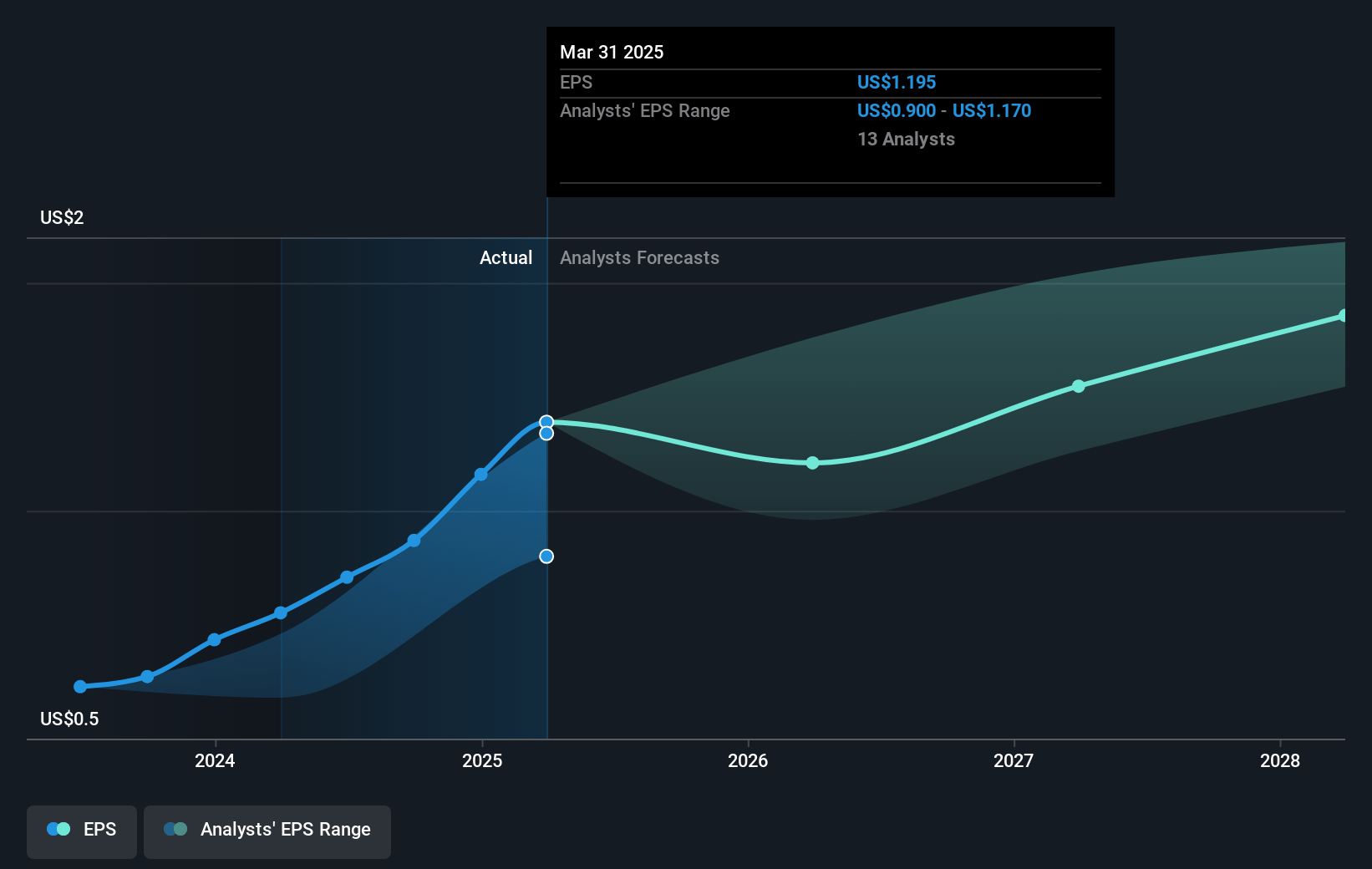

- The bullish analysts expect earnings to reach $326.1 million (and earnings per share of $1.63) by about April 2028, up from $201.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 66.4x on those 2028 earnings, up from 48.8x today. This future PE is greater than the current PE for the US Healthcare Services industry at 49.2x.

- Analysts expect the number of shares outstanding to grow by 1.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Doximity Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Doximity’s significant dependence on pharmaceutical advertising revenue exposes its results to industry-specific downturns, tighter pharmaceutical marketing budgets, and healthcare spending shifts, which could lead to prolonged periods of revenue stagnation or even declines.

- A maturing core user base that is already highly penetrated among physicians, with only gradual progress in expanding to nurse practitioners and physician assistants, could limit long-term user growth and weaken the platform’s appeal to advertisers, ultimately restraining both future top-line growth and earnings expansion.

- The accelerating adoption of artificial intelligence, automation, and digital communication tools by larger technology companies and EHR systems may commoditize Doximity’s platform functions, intensify competition, and erode its competitive edge, which could pressure net margins and slow revenue growth.

- Growing regulatory scrutiny and heightened data privacy requirements around digital healthcare information could result in increased compliance costs and limit the company’s capacity to innovate and monetize its data-driven services, negatively impacting net margins and future profitability.

- Industry consolidation among hospitals, health systems, and pharmaceutical companies may centralize purchasing power and reduce the number of potential clients for advertising and hiring, leading to greater pricing pressure on Doximity’s core business and a potential long-term decline in average contract values and overall revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Doximity is $90.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Doximity's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $866.2 million, earnings will come to $326.1 million, and it would be trading on a PE ratio of 66.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of $52.4, the bullish analyst price target of $90.0 is 41.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:DOCS. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.