Key Takeaways

- Resolving orthopedic supply challenges and strategic consultancy could improve sales, operational efficiency, and net margins.

- Growth in AirSeal, Buffalo Filter, and BioBrace is positioned to drive revenue and profitability through strategic expansion and product optimization.

- Supply chain challenges, tariffs, single-source risks, and competitive pressures could hinder CONMED's revenue and margins; strategic execution is critical to overcoming these issues.

Catalysts

About CONMED- A medical technology company, develops, manufactures, and sells devices and equipment for surgical procedures in the United States and internationally.

- CONMED is focused on resolving supply challenges in its Orthopedic business, which if successfully addressed, could improve sales and operational efficiency, positively impacting revenue growth and operating margins.

- The company has engaged a top-tier consulting firm to turn operations from a weakness to a strength, potentially leading to improved operating leverage and expanded net margins.

- AirSeal is expected to continue its double-digit growth driven by its importance in robotic and laparoscopic procedures, which could significantly drive revenue growth.

- CONMED is strategically expanding its Buffalo Filter and BioBrace product lines, both being in early growth stages, which could bolster future sales and profitability.

- The company aims to improve the durability, growth, and profitability of its portfolio by conducting a deep dive into its product lines, potentially leading to optimized product offerings and enhanced earnings.

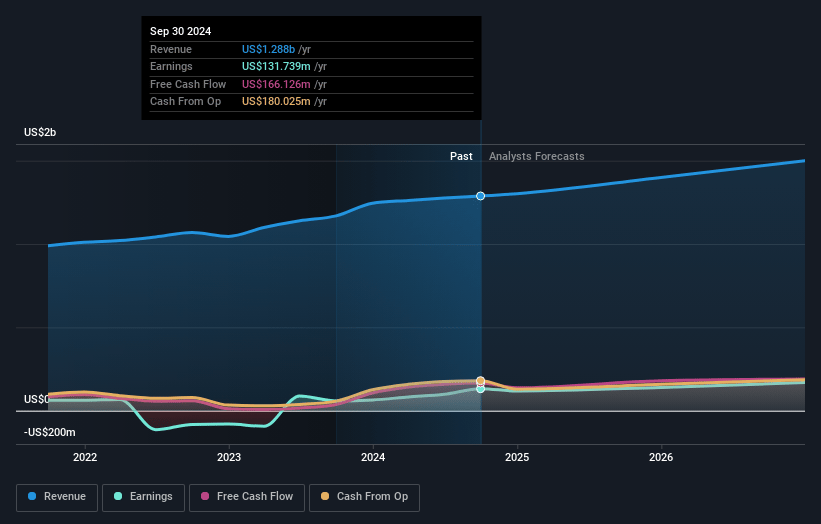

CONMED Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CONMED's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.1% today to 10.5% in 3 years time.

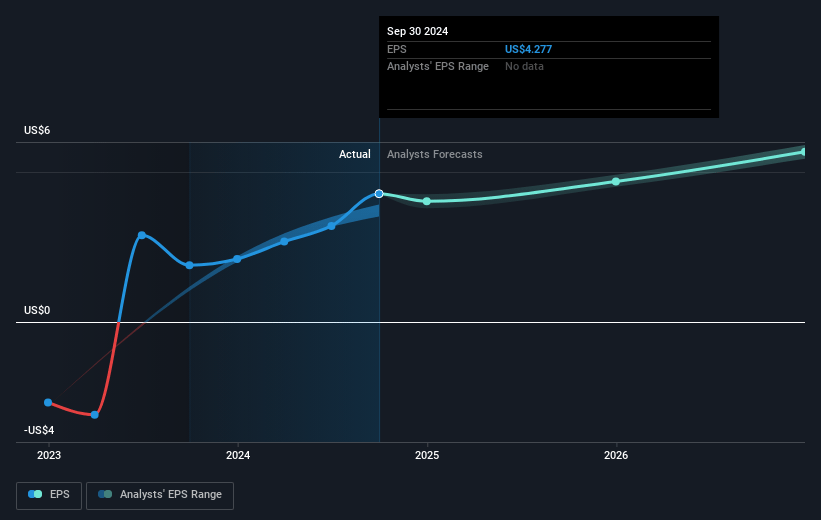

- Analysts expect earnings to reach $160.4 million (and earnings per share of $5.49) by about April 2028, up from $132.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2028 earnings, up from 12.0x today. This future PE is lower than the current PE for the US Medical Equipment industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

CONMED Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- CONMED faces ongoing supply chain challenges, particularly in its Orthopedic business, which could hinder the company's ability to meet demand and negatively impact revenue growth.

- The prospect of tariffs from the Trump administration and changes in international trade policies introduce financial uncertainty, potentially increasing costs and negatively affecting earnings.

- The company's heavy reliance on single-source supply chains could pose risks to operational stability and cost management, impacting gross margins if not addressed effectively.

- Increased competitive pressures, particularly in the AirSeal market and other key product lines, may pressure pricing and market share, potentially affecting future revenue.

- CONMED's growth projections depend heavily on overcoming its operational weaknesses and executing strategic shifts, which carry execution risks, potentially affecting financial outcomes like net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $74.429 for CONMED based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $91.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $160.4 million, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 8.2%.

- Given the current share price of $51.17, the analyst price target of $74.43 is 31.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.