Narratives are currently in beta

Key Takeaways

- Successful integration of Covenant Health drives margin improvement and growth through positive revenue and EBITDA contributions.

- VITAS and Roto-Rooter initiatives signal promising revenue growth and improved earnings through strategic expansion and marketing strategies.

- Declines in Roto-Rooter revenue, marketing issues, and weather impacts challenge Chemed's profitability and revenue stability.

Catalysts

About Chemed- Provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States.

- The acquisition of Covenant Health is meeting all internal financial projections, contributing positively to revenue and EBITDA, and is expected to drive further growth due to successful integration, enhancing net margins.

- The expansion of VITAS' new program in Pasco County, Florida, accepted its first patient and offers a promising growth trajectory for 2025 and beyond, expected to boost revenue.

- VITAS' strong performance metrics, including a 15.5% increase in average daily census and successful workforce expansion, indicate potential for sustained revenue growth and improved earnings.

- The implementation of new marketing strategies at Roto-Rooter, including a change in SEM provider, aims to improve call count and residential revenue, which could positively impact future earnings.

- The sequential improvement in commercial revenue at Roto-Rooter, combined with targeted initiatives, could signal a turnaround and contribute to earnings growth and margin stabilization.

Chemed Future Earnings and Revenue Growth

Assumptions

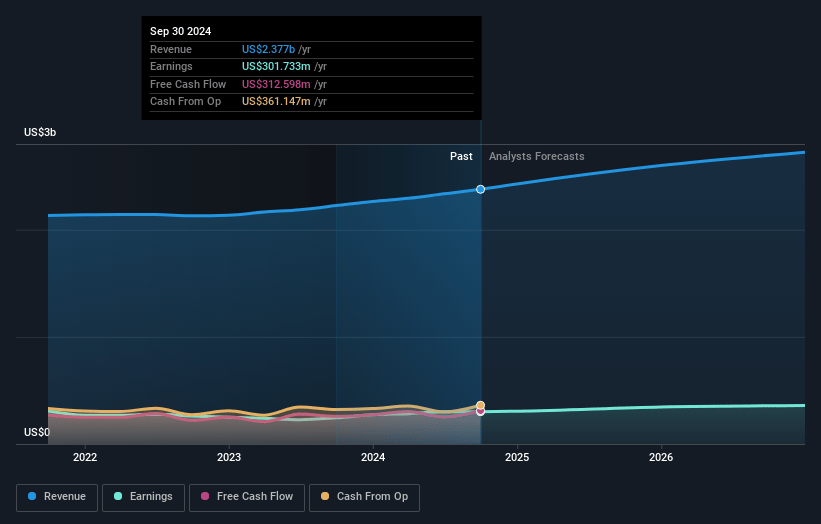

How have these above catalysts been quantified?- Analysts are assuming Chemed's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.7% today to 13.5% in 3 years time.

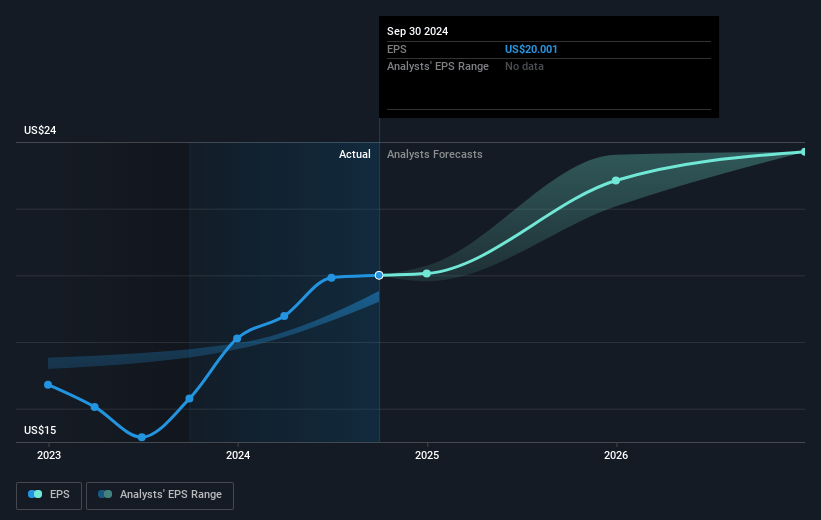

- Analysts expect earnings to reach $386.6 million (and earnings per share of $25.57) by about November 2027, up from $301.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.6x on those 2027 earnings, up from 27.9x today. This future PE is greater than the current PE for the US Healthcare industry at 24.8x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Chemed Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Roto-Rooter's residential and commercial revenue declines indicate lower demand and increased competition, potentially impacting overall revenue and margins.

- The transition to a new search engine marketing firm introduced ramp-up costs and disruption, leading to less effective paid search marketing, which could negatively impact revenue and profitability.

- Abnormally dry weather in key regions affected residential demand and may continue to impact revenue inconsistently across quarters.

- The decline in free Google searches necessitates increased spending on paid advertising, putting pressure on net margins and potentially leading to reduced profitability.

- The impact of hurricanes Helene and Milton suggests potential prolonged negative effects on admissions and revenue in affected areas for VITAS.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $663.67 for Chemed based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.9 billion, earnings will come to $386.6 million, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 5.9%.

- Given the current share price of $564.89, the analyst's price target of $663.67 is 14.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives