Key Takeaways

- BD's strategic separation and innovation pipeline are expected to boost growth and capitalize on market opportunities in healthcare solutions.

- Strong cash flow, operational efficiency, and shareholder returns underscore BD's confidence in future earnings growth and intrinsic value.

- The planned separation, tariff changes, and foreign currency risks could threaten Becton Dickinson's net margins and revenue growth.

Catalysts

About Becton Dickinson- Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

- The planned separation of BD's Biosciences and Diagnostic Solutions business is expected to enhance strategic focus, potentially leading to tailored investments and capital allocation, which could drive revenue growth for both the new BD and the separated entity. This could enable both entities to capitalize on market opportunities individually, impacting revenue positively.

- Strong execution in Q1 2025 delivered 9.6% revenue growth, driven by volume and share gains across core devices, along with adjusted gross and operating margin expansions. This operational efficiency can contribute to improved net margins, enhancing overall earnings growth.

- BD is actively progressing on its innovation pipeline, with notable developments in its connected care strategy, advanced patient monitoring, and several regulatory milestones. These innovations are poised to drive future revenue growth by expanding into high-value markets and addressing critical healthcare needs.

- The company's strategic focus on high-growth platforms such as advanced patient monitoring, urinary incontinence solutions, and biologic drug delivery, supported by sustained R&D investments, positions BD to achieve higher WAMGR (Weighted Average Market Growth Rate). This focus is expected to positively impact revenue and earnings.

- BD's strong cash flow and operational performance have enabled substantial shareholder returns, including a $750 million accelerated share buyback. This action suggests confidence in the company's intrinsic value and is likely aimed at enhancing EPS growth.

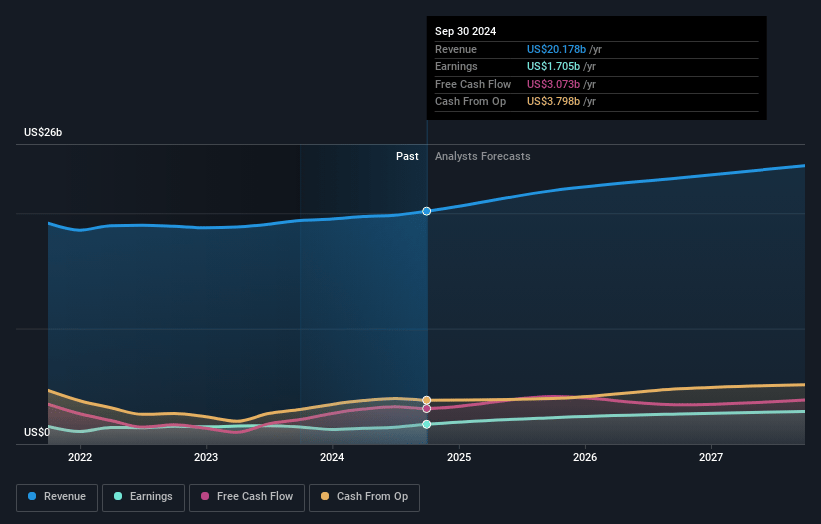

Becton Dickinson Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Becton Dickinson's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.4% today to 11.9% in 3 years time.

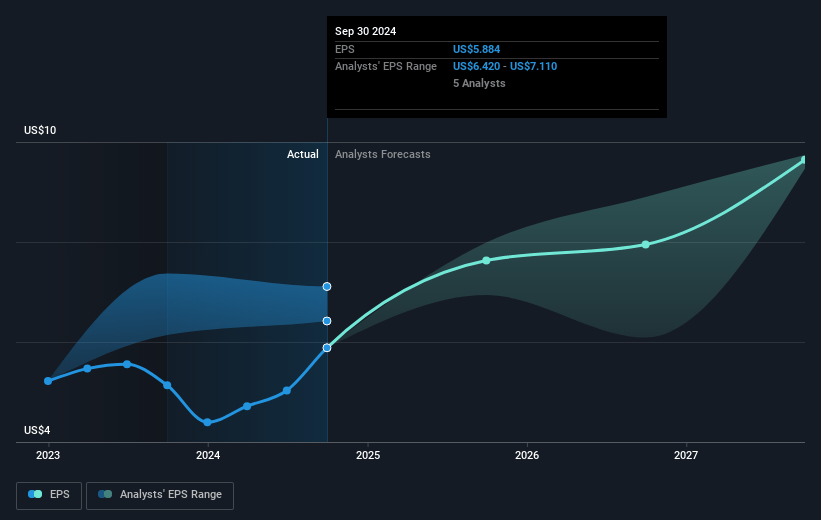

- Analysts expect earnings to reach $2.9 billion (and earnings per share of $10.0) by about March 2028, up from $1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.4x on those 2028 earnings, down from 38.6x today. This future PE is greater than the current PE for the US Medical Equipment industry at 28.7x.

- Analysts expect the number of shares outstanding to decline by 0.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.35%, as per the Simply Wall St company report.

Becton Dickinson Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The planned separation of BD's Biosciences and Diagnostic Solutions could lead to dis-synergies and increased costs, which might affect the company's overall net margins.

- The separation could create uncertainty and a potential disruption in the revenue streams of the impacted segments until the transition is complete.

- Tariff changes, especially those related to exports from China, Mexico, and Canada, could increase BD’s costs and impact net margins and earnings.

- Reduced research funding in market regions such as China and the U.S. can adversely affect revenue growth in the Biosciences segment.

- Ongoing foreign currency translation headwinds pose a risk to revenue estimates and earnings if exchange rates become less favorable over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $276.769 for Becton Dickinson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $327.54, and the most bearish reporting a price target of just $245.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $24.3 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 33.4x, assuming you use a discount rate of 7.3%.

- Given the current share price of $232.12, the analyst price target of $276.77 is 16.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.