Key Takeaways

- Abbott's focus on innovation and high-growth markets aims to drive strong revenue growth and market share improvement.

- Margin expansion and product mix improvements are expected to enhance net margins and support earnings growth potential.

- Currency fluctuations, tax changes, pricing pressures, competition, and supply chain issues may negatively impact Abbott’s revenue and market position.

Catalysts

About Abbott Laboratories- Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

- Abbott's focus on expanding its strong product portfolio in high-growth markets like Structural Heart, with continued innovation and investments, is expected to drive robust revenue growth and market share gains, impacting future revenues positively.

- The company's plan to improve gross margins through continuous improvement programs and favorable product mix, driven by higher-margin products outpacing average company growth, will likely positively impact net margins.

- Abbott's strategy to elevate growth in traditionally slower segments, such as CRM and Vascular, by accelerating innovation and leveraging newly launched leadless pacemaker technology, could improve overall earnings and revenue diversification.

- The anticipated expansion in Continuous Glucose Monitoring through increased market penetration and new applications, including the basal insulin coverage and the Lingo launch in non-diabetic markets, is set to enhance revenue streams.

- Margin expansion through operating leverage and efficiencies across the portfolio, aligned with product mix improvements, indicates sustained earnings growth potential, supporting the thesis of an undervalued stock based on future potential earnings growth.

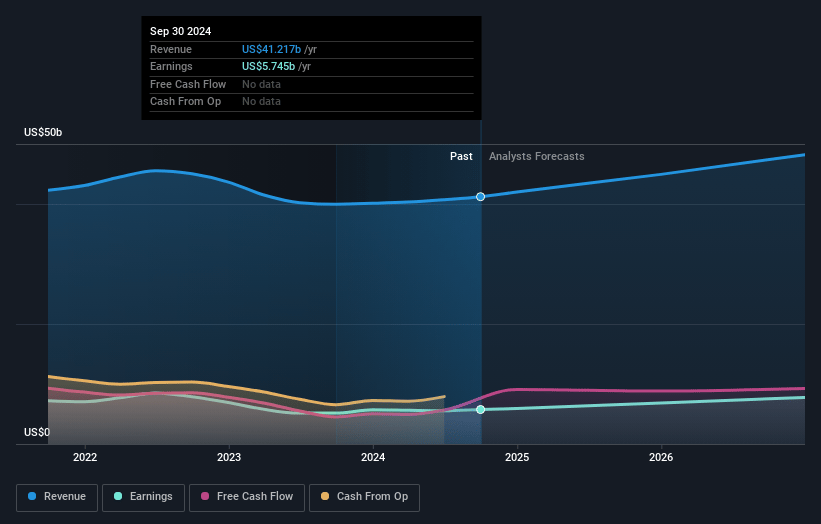

Abbott Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Abbott Laboratories's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 31.8% today to 17.4% in 3 years time.

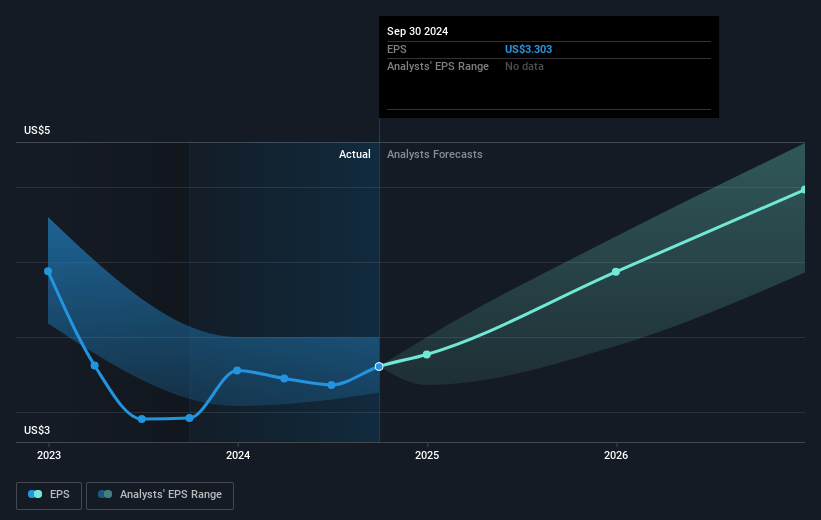

- Analysts expect earnings to reach $8.9 billion (and earnings per share of $5.18) by about April 2028, down from $13.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.3x on those 2028 earnings, up from 16.1x today. This future PE is greater than the current PE for the GB Medical Equipment industry at 25.7x.

- Analysts expect the number of shares outstanding to decline by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.0%, as per the Simply Wall St company report.

Abbott Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Abbott may experience revenue impacts due to foreign exchange fluctuations, as the strengthening U.S. dollar has already had an unfavorable impact on sales in the last quarter and is expected to continue this trend in 2025.

- The increase in the adjusted tax rate, driven by the adoption of the Pillar 2 tax framework, could negatively affect net margins by adding approximately $200 million in expenses, limiting investment in growth initiatives.

- The pricing pressures related to Volume-Based Procurement (VBP) in China for Abbott's Diagnostics business represent a headwind that can impact growth in this key market, potentially affecting overall revenue and earnings.

- Competitive intensity in certain high-growth areas like Electrophysiology (EP) could challenge Abbott’s ability to sustain market share, potentially affecting revenue and market position in this segment.

- Supply chain constraints, such as those experienced with continuous glucose monitors (Libre 3), can limit sales growth opportunities and delay capturing market demand, affecting revenue outcomes in the Diabetes Care segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $136.472 for Abbott Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $158.0, and the most bearish reporting a price target of just $111.34.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $51.1 billion, earnings will come to $8.9 billion, and it would be trading on a PE ratio of 32.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $123.95, the analyst price target of $136.47 is 9.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.