Narratives are currently in beta

Key Takeaways

- Strategic partnerships and R&D advancements, including biosimilars and CGM systems, are poised to drive significant revenue growth in Diabetes Care and emerging markets.

- Strong growth in Nutrition and MedTech segments, alongside Diagnostics expansion and new product launches, indicate sustained revenue and earnings potential.

- Economic fluctuations, international business challenges, legal risks, and competitive pressures threaten Abbott's revenue and market share growth across key product lines and regions.

Catalysts

About Abbott Laboratories- Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

- Abbott has recently entered several strategic partnerships, including a unique global partnership with Medtronic, aimed at expanding the connectivity of its FreeStyle Libre CGM sensor with automated insulin delivery systems, which could significantly enhance revenue growth in the Diabetes Care segment.

- The company has made key advancements in its R&D pipeline, including the development of biosimilars expected to launch in emerging markets by late 2025, which could contribute to increased future revenue.

- Abbott's nutrition segment is seeing strong growth led by the U.S. market, particularly in Adult Nutrition with brands like Ensure and Glucerna. Continued expansion and product diversification in this segment are likely to help sustain this growth, positively impacting revenue.

- The Diagnostics segment is capitalizing on growing global demand for routine testing and has secured recent large account wins, indicating sustained revenue growth potential into 2025.

- Abbott's successful business in MedTech, exemplified by a 13% growth in the segment and the U.S. launch of new products such as Lingo glucose monitoring sensor and enhanced TactiFlex Duo catheter, reflects potential for increased earnings through product innovation and market expansion.

Abbott Laboratories Future Earnings and Revenue Growth

Assumptions

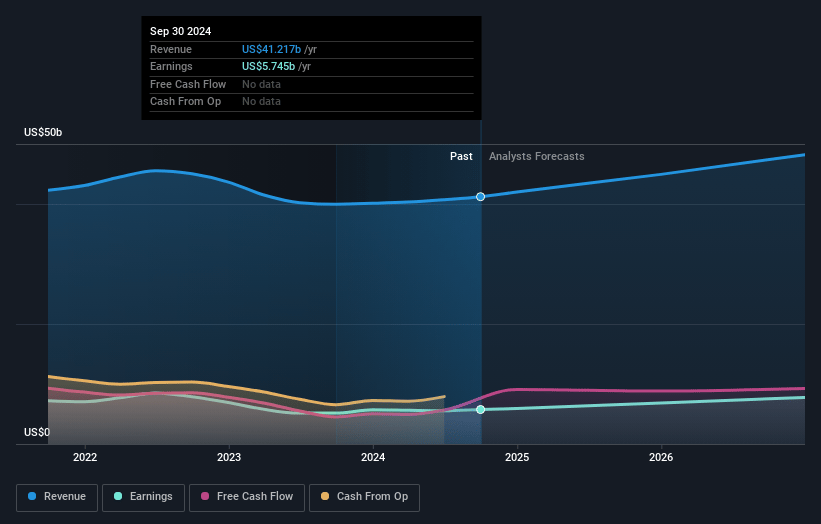

How have these above catalysts been quantified?- Analysts are assuming Abbott Laboratories's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.6% today to 16.1% in 3 years time.

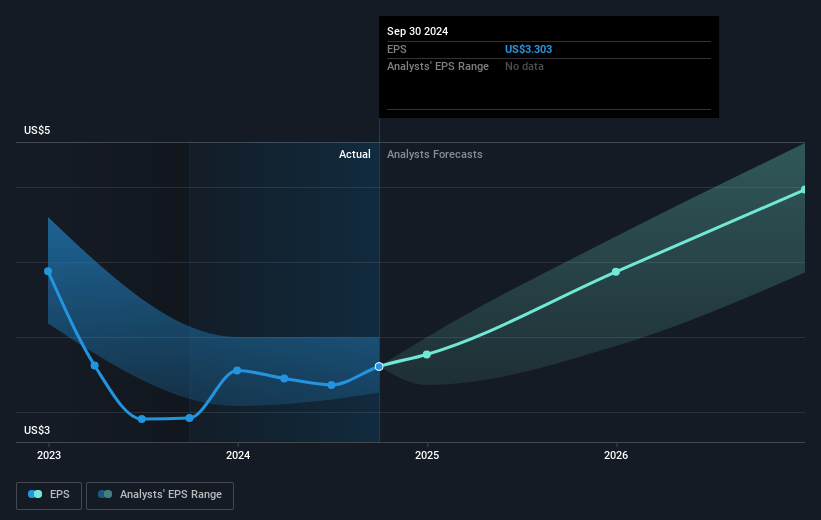

- Analysts expect earnings to reach $7.9 billion (and earnings per share of $4.57) by about October 2027, up from $5.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $6.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.3x on those 2027 earnings, down from 36.5x today. This future PE is lower than the current PE for the GB Medical Equipment industry at 37.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

Abbott Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Economic and foreign exchange fluctuations could adversely impact Abbott's reported sales growth and revenue in international markets, as seen with the unfavorable year-over-year impact on sales due to forex changes.

- Challenges in Abbott's international Pediatric Nutrition business due to commercial execution issues could negatively affect market share and revenue growth if not addressed adequately.

- The impact of volume-based procurement (VBP) implementation in China on Abbott's Core Laboratory Diagnostics sales, resulting in decreased growth in that region, poses a risk to revenue if similar pricing pressures occur in other key markets.

- Pending litigation concerning infant formula and NEC presents potential financial liabilities and risks to revenue and profitability if adverse rulings lead to significant settlements or decreased product sales.

- Increased competition and evolving market dynamics in the CGM sector could pressure Abbott's ability to sustain high revenue growth rates from its flagship FreeStyle Libre product line, impacting future sales projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $125.96 for Abbott Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $143.0, and the most bearish reporting a price target of just $104.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $49.3 billion, earnings will come to $7.9 billion, and it would be trading on a PE ratio of 33.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $116.05, the analyst's price target of $125.96 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives