Narratives are currently in beta

Key Takeaways

- Strategic sales force restructuring and focus on innovative product launches are set to drive significant revenue growth and market expansion.

- Strong cash position supports reinvestment in operations, enabling product portfolio expansion and tapping into the growing hospital monitoring market.

- Slowing order growth and decreased device revenue, coupled with regulatory risks and increased expenses, pose challenges to profitability and future strategic direction.

Catalysts

About Zynex- Designs, manufactures, and markets medical devices to treat chronic and acute pain; and activate and exercise muscles for rehabilitative purposes with electrical stimulation.

- Zynex has streamlined its sales force, focusing on productivity improvements, which has led to a 25% increase in revenue per sales rep. This strategic focus is expected to enhance sales efficiency, driving future revenue growth.

- The FDA clearance for the TensWave device and the anticipated commercialization of the NiCO laser-based pulse oximeter are pivotal new product launches expected in mid-2025, both of which could significantly expand revenue streams.

- Zynex is advancing its product portfolio with the addition of new rehabilitation products, which have seen order growth from low double digits in 2022 to over 31% in total orders by the third quarter of 2024. This diversification is projected to impact revenue positively.

- The ramp-up of the Hospital Monitoring division taps into a large and growing market, which is likely to drive revenue growth as new technologies like the blood and fluid monitor gain traction in hospital settings.

- Zynex maintains a strong cash position, which allows for continued reinvestment in the business and potential shareholder returns, providing flexibility for increased earnings and operational expansion.

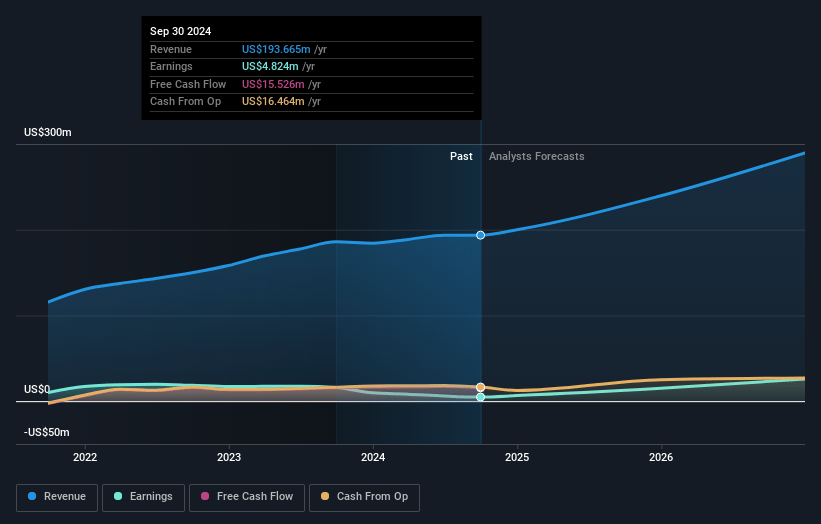

Zynex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zynex's revenue will grow by 19.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.5% today to 10.5% in 3 years time.

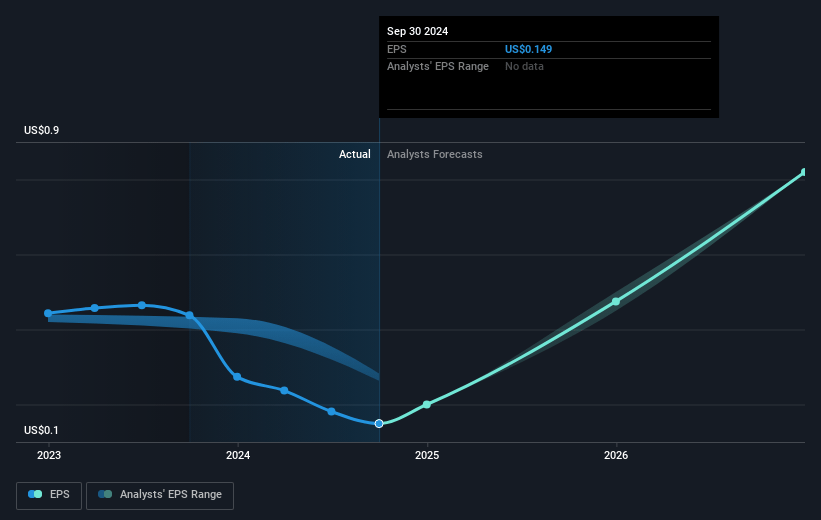

- Analysts expect earnings to reach $34.7 million (and earnings per share of $1.1) by about November 2027, up from $4.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.1x on those 2027 earnings, down from 53.7x today. This future PE is lower than the current PE for the US Medical Equipment industry at 37.2x.

- Analysts expect the number of shares outstanding to decline by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.97%, as per the Simply Wall St company report.

Zynex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slowing order growth due to sales rep pruning, which may impact future revenue increases and overall sales productivity as observed in the third quarter results.

- Decrease in device revenue and slightly lower gross profit margins could affect profitability if trends continue without offsetting new product successes or efficiencies.

- Increased G&A expenses due, in part, to more investment in the Zynex Monitoring division, which may compress net margins until the division becomes profitable.

- Continued reliance on FDA clearance for new products like the NiCO pulse oximeter introduces regulatory risk, potentially impacting future revenue and earnings if clearances are delayed or denied.

- The strategic review process with potential acquisition interests poses uncertainty and potential risks to operational focus and future strategic direction if not resolved favorably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.5 for Zynex based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.5, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $330.7 million, earnings will come to $34.7 million, and it would be trading on a PE ratio of 19.1x, assuming you use a discount rate of 7.0%.

- Given the current share price of $8.13, the analyst's price target of $17.5 is 53.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives