Key Takeaways

- Resolved TRICARE payment suspension and anticipated FDA approval could significantly boost revenue and market share in patient monitoring.

- Restructuring efforts and diversification of revenue streams are likely to improve profitability and long-term financial performance.

- Challenges including TRICARE payment suspension, staff turnover, auditor change, FDA delays, and intense competition may impact Zynex's revenue growth and market confidence.

Catalysts

About Zynex- Designs, manufactures, and markets medical devices to treat chronic and acute pain, and activate and exercise muscles for rehabilitative purposes with electrical stimulation.

- Resolution of the TRICARE temporary payment suspension is expected to significantly increase revenue when resolved, as TRICARE will be responsible for paying all appropriately processed claims during the hold. This could provide a substantial boost to future earnings.

- The restructuring efforts and workforce reductions are anticipated to save approximately $35 million annually, which could improve net margins and lead to a quicker return to profitability.

- The anticipated FDA approval and subsequent commercialization of the NiCO pulse oximeter could open up a significant growth opportunity in the multibillion-dollar patient monitoring market, potentially increasing future revenues and market share.

- Diversification of revenue streams and increased focus on new areas like personal injury, alongside trimming unproductive sales reps, are expected to enhance the company's revenue base and improve overall sales productivity.

- With plans to accelerate the hospital monitoring division and diversify product offerings, Zynex is positioned to achieve further growth, which could positively impact long-term revenue projections and overall financial performance.

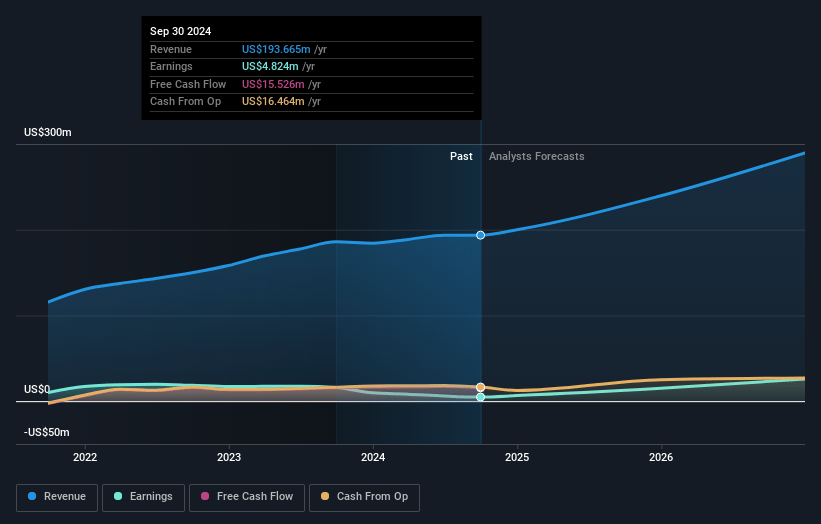

Zynex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zynex's revenue will grow by 1.3% annually over the next 3 years.

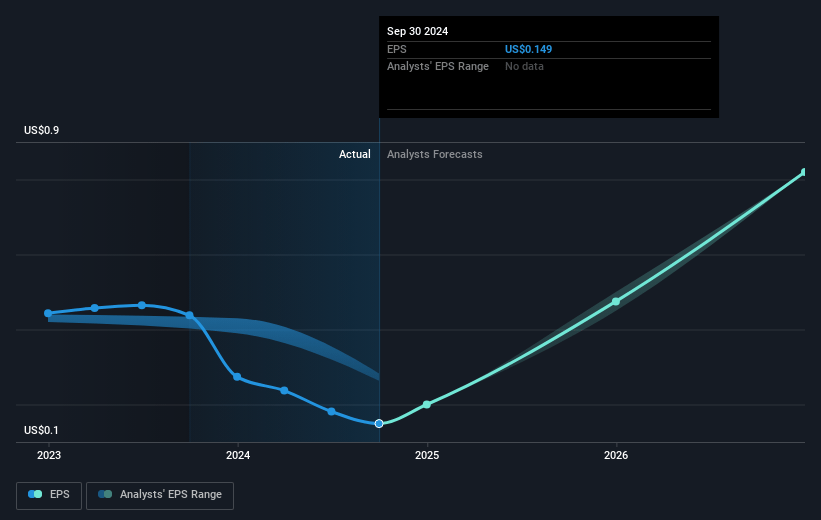

- Analysts are not forecasting that Zynex will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Zynex's profit margin will increase from 1.6% to the average US Medical Equipment industry of 12.9% in 3 years.

- If Zynex's profit margin were to converge on the industry average, you could expect earnings to reach $25.8 million (and earnings per share of $0.86) by about May 2028, up from $3.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, down from 22.5x today. This future PE is lower than the current PE for the US Medical Equipment industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 0.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.23%, as per the Simply Wall St company report.

Zynex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The temporary payment suspension by TRICARE could severely impact Zynex's revenue, as previous revenue calculations did not include bills to TRICARE, and there is uncertainty regarding the timing and outcome of TRICARE's review.

- The high turnover and reduction of staff, including sales reps, could reduce sales productivity and negatively affect revenue growth if not carefully managed.

- The company's auditor change led to market misinterpretations, contributing to a decline in stock price, which may hinder future investor confidence and investment.

- Potential delays or challenges in the FDA approval process for the NiCO pulse oximeter could push revenue expectations further out, impacting projected earnings.

- Intense competition and technological limitations of current market products may pose significant barriers, potentially impacting market penetration and future revenue from new product launches like NiCO.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.0 for Zynex based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $200.1 million, earnings will come to $25.8 million, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 9.2%.

- Given the current share price of $2.23, the analyst price target of $10.0 is 77.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.