Key Takeaways

- Development of advanced medical devices and new product lines is poised to boost revenue and stabilize earnings against market disruptions.

- Restructuring for efficiency and expansion into untapped markets could enhance profitability and drive long-term growth despite current challenges.

- Revenue uncertainty due to TRICARE suspension, FDA delays, and slow product uptake may impact earnings and investor confidence despite restructuring efforts.

Catalysts

About Zynex- Designs, manufactures, and markets medical devices to treat chronic and acute pain; and activate and exercise muscles for rehabilitative purposes with electrical stimulation.

- The development and FDA submission of the NiCO pulse oximeter, which uses advanced laser technology to provide more accurate readings than current LED-based devices, presents a significant growth opportunity in the multibillion-dollar patient monitoring market. Successful commercialization of this product could boost revenue significantly.

- The restructuring of the sales force and corporate staff is expected to decrease overall expenses, potentially increasing net margins. A focus on efficiency and streamlined operations should allow Zynex to maintain profitability even in the face of reduced revenues from certain sources.

- Diversification into new product lines, such as bracing, cold, and compression products, aligns with the current sales force's focus on pain and rehab. This diversification is expected to enhance revenue streams and stabilize earnings against potential disruptions in traditional product sales.

- Once resolved, the temporary suspension of payments from TRICARE could lead to a surge in revenue, as accumulated claims are processed and paid. This reinstated revenue source could drive earnings growth once the issue is settled.

- The commitment to expanding sales efforts in new channels, such as national workers' compensation and the Veterans Administration (VA), represents untapped market opportunities that could lead to increased revenues and long-term growth for Zynex's products.

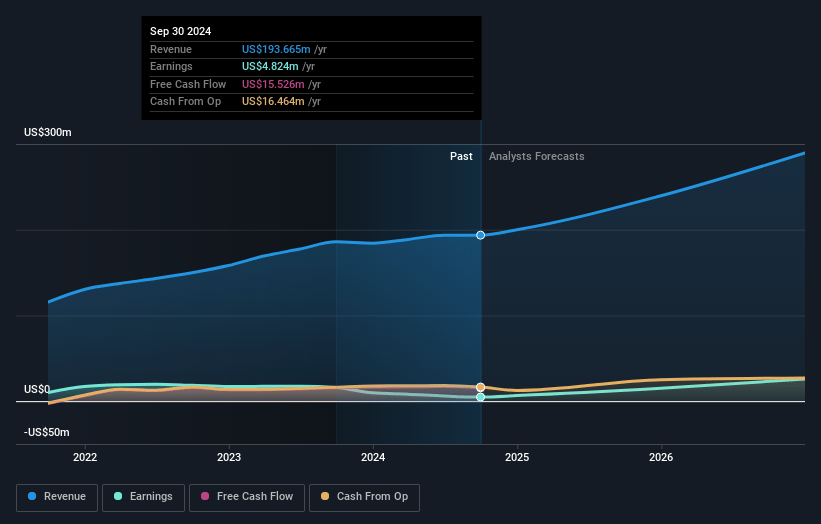

Zynex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zynex's revenue will grow by 19.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.5% today to 10.6% in 3 years time.

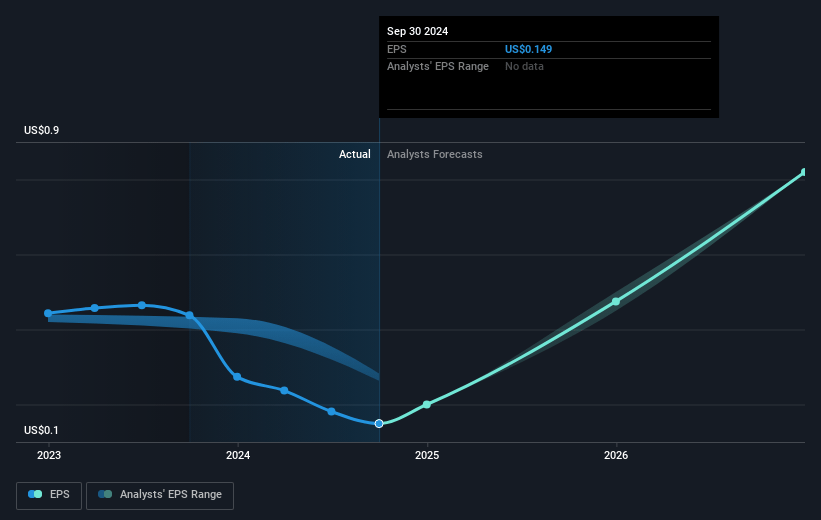

- Analysts expect earnings to reach $35.1 million (and earnings per share of $1.12) by about March 2028, up from $4.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 46.2x today. This future PE is lower than the current PE for the US Medical Equipment industry at 31.3x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

Zynex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The temporary suspension of payments from TRICARE represents a significant risk, as TRICARE accounts for 20% to 25% of Zynex's revenue. This suspension could lead to a substantial decrease in revenue if not resolved quickly.

- Zynex is facing uncertainty regarding the FDA submission and approval timeline for its NiCO pulse oximeter, which could delay entering a potential new revenue stream and impact future earnings.

- The restructuring and headcount reduction measures, while potentially reducing immediate costs, signal challenges in maintaining sales and operational efficiency, potentially affecting net margins if the restructuring does not achieve the intended efficiency improvements.

- The company's inability to provide full 2025 guidance due to the TRICARE issue indicates uncertainty in revenue projections and earnings visibility, which could lead to market volatility and impact investor confidence.

- Although Zynex is undergoing product diversification, the slower-than-expected uptake of new products may limit revenue growth, making it difficult to offset short-term disruptions like the TRICARE suspension.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.5 for Zynex based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.5, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $330.7 million, earnings will come to $35.1 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of $7.0, the analyst price target of $17.5 is 60.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.