Key Takeaways

- Expanding demand for in-home respiratory care and strategic geographic growth position the company to capture a larger, profitable market.

- Technology investments and an asset-light model support higher margins, strong cash flow, and provide flexibility for future acquisitions.

- Heavy reliance on government reimbursement, margin pressure from lower-margin growth areas, geographic concentration, competitive threats, and shrinking long-term demand threaten sustainable revenue and earnings growth.

Catalysts

About Viemed Healthcare- Through its subsidiaries, provides home medical equipment (HME) and post-acute respiratory healthcare services in the United States.

- Increasing prevalence of chronic respiratory illnesses and the rapidly aging U.S. population create a continually expanding pool of patients requiring in-home respiratory care and sleep therapy; this sustained demand supports ongoing double-digit revenue growth and an expanding addressable market for the foreseeable future.

- Structural healthcare cost pressures and the ongoing industry shift toward value-based, home-centered care models have accelerated the transition of chronic disease management out of hospitals and into patient homes, positioning Viemed as a preferred provider and likely supporting higher utilization rates, stronger reimbursement terms, and improved net margins over time.

- The company’s accelerated geographic expansion, evidenced by successful entries into underserved regions and major markets like Chicagoland through acquisitions like Lehan’s Medical Equipment, opens new, high-potential patient populations and enables Viemed to leverage operational scale for incremental top-line and EBITDA growth.

- Ongoing investment in technology-driven service offerings, such as remote patient monitoring and an expanding virtual care platform, is expected to enhance patient adherence, drive higher lifetime value per patient, and reduce per-patient servicing costs, resulting in expanding gross margins and growing free cash flow.

- Viemed’s robust operating leverage, underpinned by its asset-light business mix shift and integration of tuck-in acquisitions with higher margin profiles, combined with a debt-free balance sheet and significant liquidity, creates capacity to both accelerate revenue growth through strategic M&A and drive long-term earnings accretion.

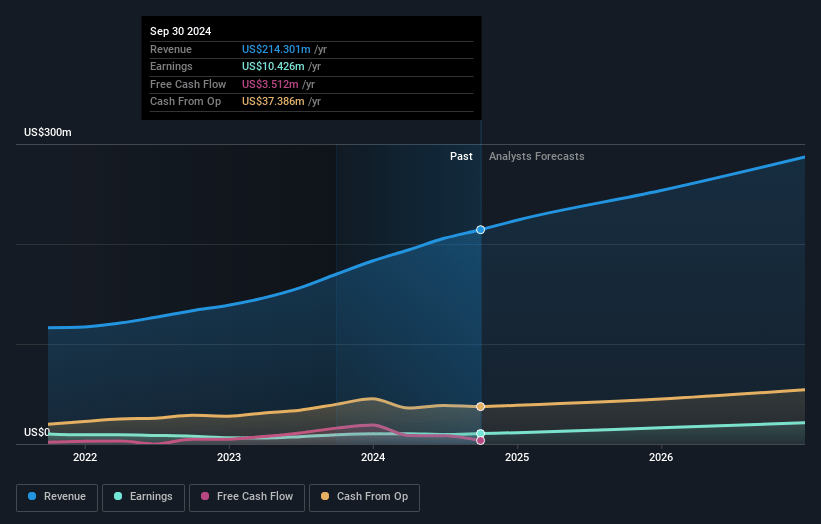

Viemed Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Viemed Healthcare compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Viemed Healthcare's revenue will grow by 10.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.3% today to 8.3% in 3 years time.

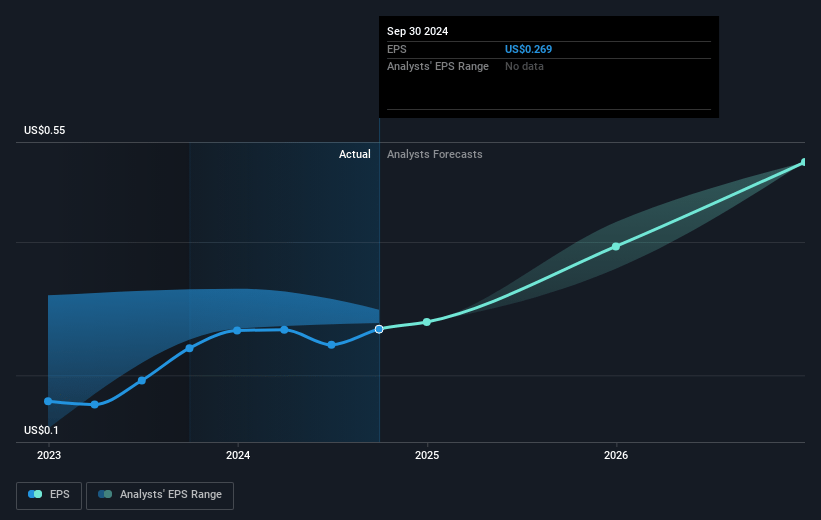

- The bullish analysts expect earnings to reach $26.0 million (and earnings per share of $0.63) by about May 2028, up from $12.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.3x on those 2028 earnings, up from 21.7x today. This future PE is greater than the current PE for the US Healthcare industry at 21.5x.

- Analysts expect the number of shares outstanding to grow by 1.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Viemed Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Viemed’s heavy reliance on Medicare and Medicaid reimbursement exposes it to potential government budget cuts and regulatory changes, as highlighted in the call with management noting ongoing proposals to revise national coverage and possible shifts in reimbursement rates, which could significantly pressure revenue growth and net margins.

- The company’s margin profile is increasingly influenced by rapid growth in lower-margin, CapEx-light segments such as sleep and staffing, with management pointing out that gross margin has declined as these businesses now represent a larger portion of revenue, raising the risk that future revenue growth may not translate proportionally into earnings or cash flow expansion.

- Viemed’s expansion remains concentrated in certain geographic regions and through specific acquisitions, as seen with its efforts to enter the Chicago market via the Lehan’s Medical Equipment deal, which may limit long-term revenue diversification and expose the company to adverse local regulatory or economic developments that could dampen growth.

- Viemed faces elevated competition risk from industry consolidation and potential technological disruption, with management acknowledging that their value proposition is based on service rather than commodity equipment, raising concern that well-capitalized competitors or new virtual care platforms could erode market share and impact contract wins, ultimately affecting future revenues.

- The overall industry may see a shrinking demand pool for advanced at-home respiratory services over time, as population health initiatives and improved disease management reduce the prevalence of target patients, while stricter compliance requirements and documentation audits could further increase administrative costs, impacting Viemed’s ability to sustain long-term growth in both revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Viemed Healthcare is $15.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Viemed Healthcare's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $314.0 million, earnings will come to $26.0 million, and it would be trading on a PE ratio of 28.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of $6.76, the bullish analyst price target of $15.0 is 54.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.