Narratives are currently in beta

Key Takeaways

- Opening of the new experience center and investments in training may boost ICL adoption, expanding market share and enhancing revenue growth.

- Strong sales in EMEA and anticipated technology advancements indicate sustained revenue growth potential and improved earnings through increased demand.

- Competitive pressures and increased expenses may impact STAAR Surgical's market share and margins amid a challenging macroeconomic environment and declining refractive market in the U.S.

Catalysts

About STAAR Surgical- Designs, develops, manufactures, markets, and sells implantable lenses for the eye, and companion delivery systems to deliver the lenses into the eye.

- The opening of the new EVO ICL Experience Center in Southern California, which is designed to enhance skills and practices, might increase adoption and sales of ICL lenses, impacting future revenue growth.

- Investments in training and educational programs to improve surgeon confidence and expand market share, particularly in lower diopter strategies, could expand the total addressable market and boost revenues.

- The ongoing growth of the fast lane agreements under the U.S. Highway 93 commercial strategy suggests potential for future revenue growth by increasing ICL adoption among refractive procedures.

- Strong sales growth in the EMEA region, particularly in distributor markets like the Middle East, suggests continued revenue growth potential due to enhanced market presence and demand.

- Anticipated next-generation technology and continued focus on surgeon and patient satisfaction may lead to sustained demand and improved margins, potentially boosting earnings over the long term.

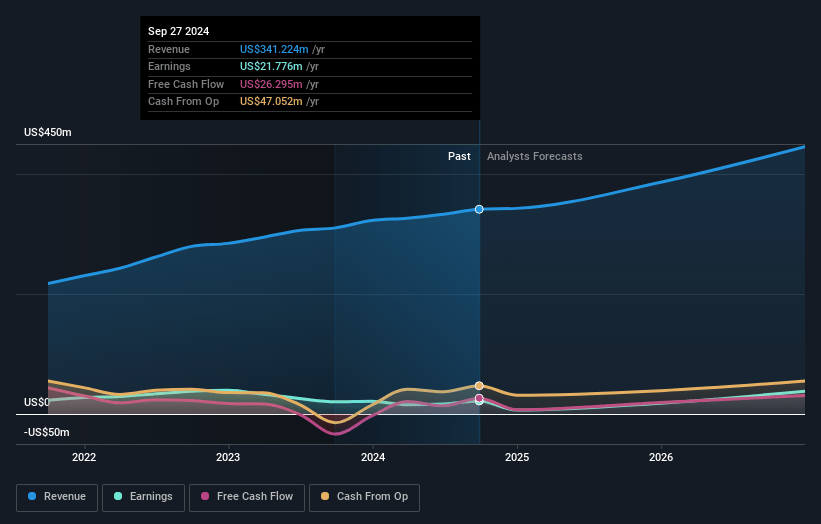

STAAR Surgical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming STAAR Surgical's revenue will grow by 14.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.4% today to 9.5% in 3 years time.

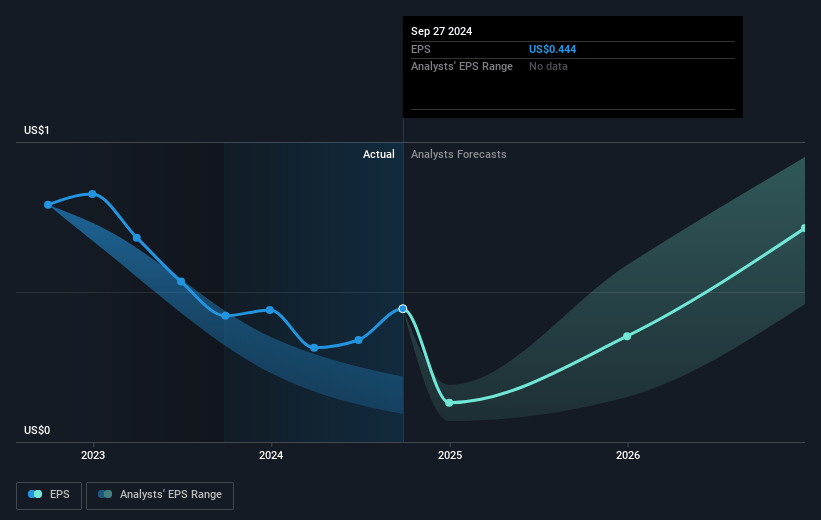

- Analysts expect earnings to reach $48.9 million (and earnings per share of $0.87) by about November 2027, up from $21.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 60.9x on those 2027 earnings, down from 64.3x today. This future PE is greater than the current PE for the US Medical Equipment industry at 37.2x.

- Analysts expect the number of shares outstanding to grow by 4.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.49%, as per the Simply Wall St company report.

STAAR Surgical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The macroeconomic environment softened in key markets like China during the second half of the quarter, which could impact future revenues if the situation does not improve as expected.

- Gross profit margin decreased to 77.3% from 79.2% the previous year, primarily due to reduced unit production and less absorption of fixed overhead which could affect the net margins.

- Operating expenses increased by 10% year-over-year, driven by higher facilities costs and compensation-related expenses, potentially lowering net margins.

- The U.S. refractive market was down 18% year-over-year despite STAAR's growth, indicating a challenging market environment that could affect future revenue growth.

- The European Society of Cataract Refractive Surgeons meeting highlighted competitive pressures, such as the potential launch of competing products like iBright in 2025, which could impact future market share and revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $44.07 for STAAR Surgical based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $514.2 million, earnings will come to $48.9 million, and it would be trading on a PE ratio of 60.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of $28.44, the analyst's price target of $44.07 is 35.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives