Narratives are currently in beta

Key Takeaways

- Strategic partnerships and revenue models are driving top-line growth through diversification, increased system placements, and enhanced utilization.

- Geographic expansion and product innovation, including transdermal infusion development, indicate potential for future revenue growth and diversification.

- Heavy reliance on a major customer, ongoing regulatory challenges, and long sales cycles could hinder Sensus' revenue growth and market expansion efforts.

Catalysts

About Sensus Healthcare- A medical device company, manufactures and sells radiation therapy devices to healthcare providers worldwide.

- The expansion of the Fair Deal arrangement with Platinum Dermatology Partners, covering 130 clinical sites, is expected to provide significant recurring revenue starting in 2025, enhancing long-term revenue growth through increased utilization of SRT systems.

- The strategic partnership and shared revenue model with Platinum Dermatology Partners, along with the successful launch of new sales and leasing options, are likely to drive top-line growth by diversifying revenue streams and increasing system placements.

- The ongoing exploration of international markets, including recent shipments to Israel and interest at the Vietnam conference, indicates potential for revenue growth through geographic expansion, entering new territories annually.

- The emphasis on broadening SRT system applications, especially within prestigious institutions like Swedish Hospital in Seattle, highlights a strategic focus that could enhance revenue by tapping into the radiation oncology market and lengthening sales cycles.

- The development work on the transdermal infusion product and expected submission of a 510(k) application signify potential future revenue streams and give insight into diversification and innovation, which could positively impact both revenue and earnings.

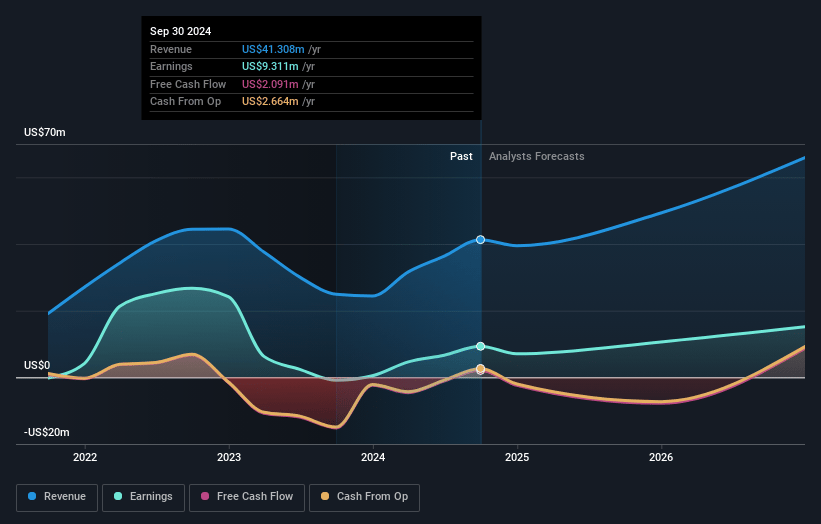

Sensus Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sensus Healthcare's revenue will grow by 18.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 22.5% today to 24.3% in 3 years time.

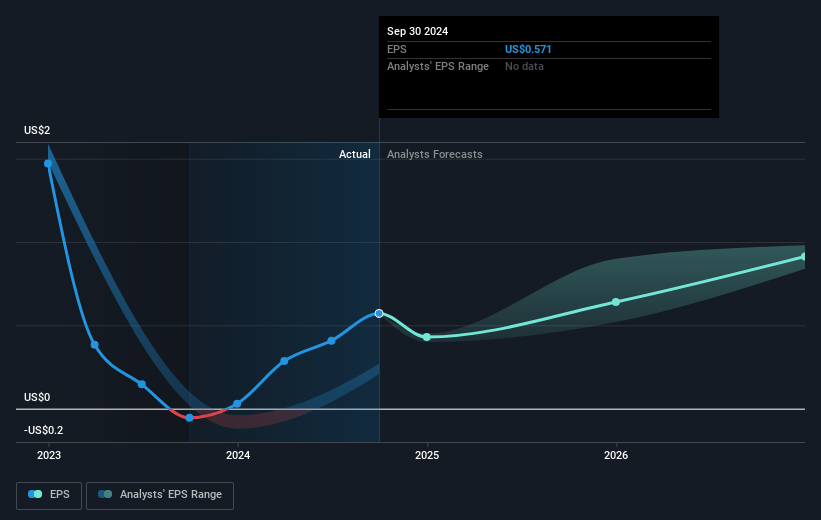

- Analysts expect earnings to reach $16.5 million (and earnings per share of $0.99) by about November 2027, up from $9.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2027 earnings, down from 15.7x today. This future PE is lower than the current PE for the US Medical Equipment industry at 35.4x.

- Analysts expect the number of shares outstanding to grow by 0.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.45%, as per the Simply Wall St company report.

Sensus Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant portion of the company's current revenue growth is tied to a single large customer, representing about 50% of placements. This dependency could pose a risk to future revenues if the relationship changes or customer needs shift.

- The development and approval of the transdermal infusion product (TDI) is still ongoing, with the company planning to submit a 510(k) application to the FDA. Delays or issues in regulatory approval could affect future revenue and earnings.

- The hospital market, a target for Sensus' expansion, typically has a longer sales cycle. Delayed sales or slower-than-expected adoption in this market could negatively impact future earnings and revenue growth.

- The Fair Deal agreements do not provide immediate revenue like outright sales but instead offer recurring revenue models. This could result in less predictable and slower revenue recognition compared to traditional sales, impacting net margins.

- International expansion plans may face obstacles due to reliance on distributors and potential regulatory and market access issues in new territories. These factors could slow down revenue generation and affect international market earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.25 for Sensus Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $68.1 million, earnings will come to $16.5 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 6.5%.

- Given the current share price of $8.94, the analyst's price target of $11.25 is 20.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives