Key Takeaways

- The company anticipates notable earnings growth driven by increased revenue from QSP models and cross-selling post-acquisition units.

- A disciplined growth strategy aiming for higher EBITDA margins supports potential profitability amidst challenging macroeconomic conditions.

- Declining service initiation pace, rising costs, and macroeconomic caution pressure revenue and profit margins, while uncertain contract renewals add volatility and affect predictability.

Catalysts

About Simulations Plus- Develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology worldwide.

- The Quantitative Systems Pharmacology (QSP) unit showed significant growth, with an 89% revenue surge driven by a model license for atopic dermatitis. This catalyst is expected to impact future software revenue positively as they continue to develop and sell high-value licenses to pharma clients.

- The successful cross-selling and integration of Adaptive Learning and Insights (ALI) and Medical Communication (MC) business units post-acquisition indicate potential for increased revenue through expanded offerings and customer base in the medical communication training sector.

- Strong service bookings and a growing backlog of $20.4 million, up 18% quarter-over-quarter, suggest a revenue increase for the services segment in the latter half of the fiscal year as these projects are initiated.

- The team is focused on a disciplined growth strategy, including expanding cross-selling opportunities and aiming for higher adjusted EBITDA margins of 35-40%, which could lead to improved net margins and profitability.

- Despite challenging macroeconomic conditions, the company's expectation of year-over-year revenue growth of 28-33% and a sequential revenue uplift in fiscal Q4 highlights an anticipated increase in earnings and shareholder value.

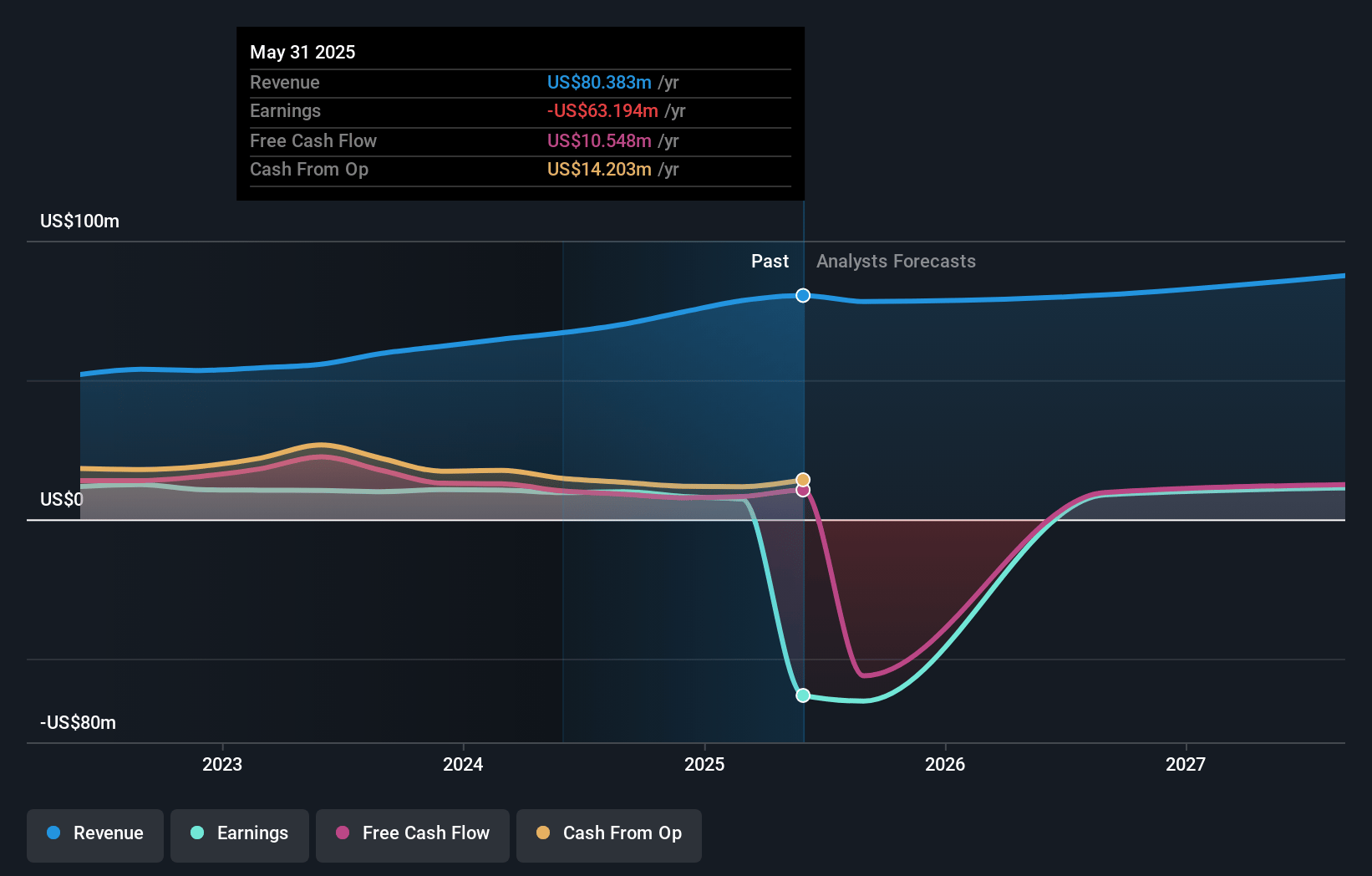

Simulations Plus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Simulations Plus's revenue will grow by 17.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.2% today to 19.5% in 3 years time.

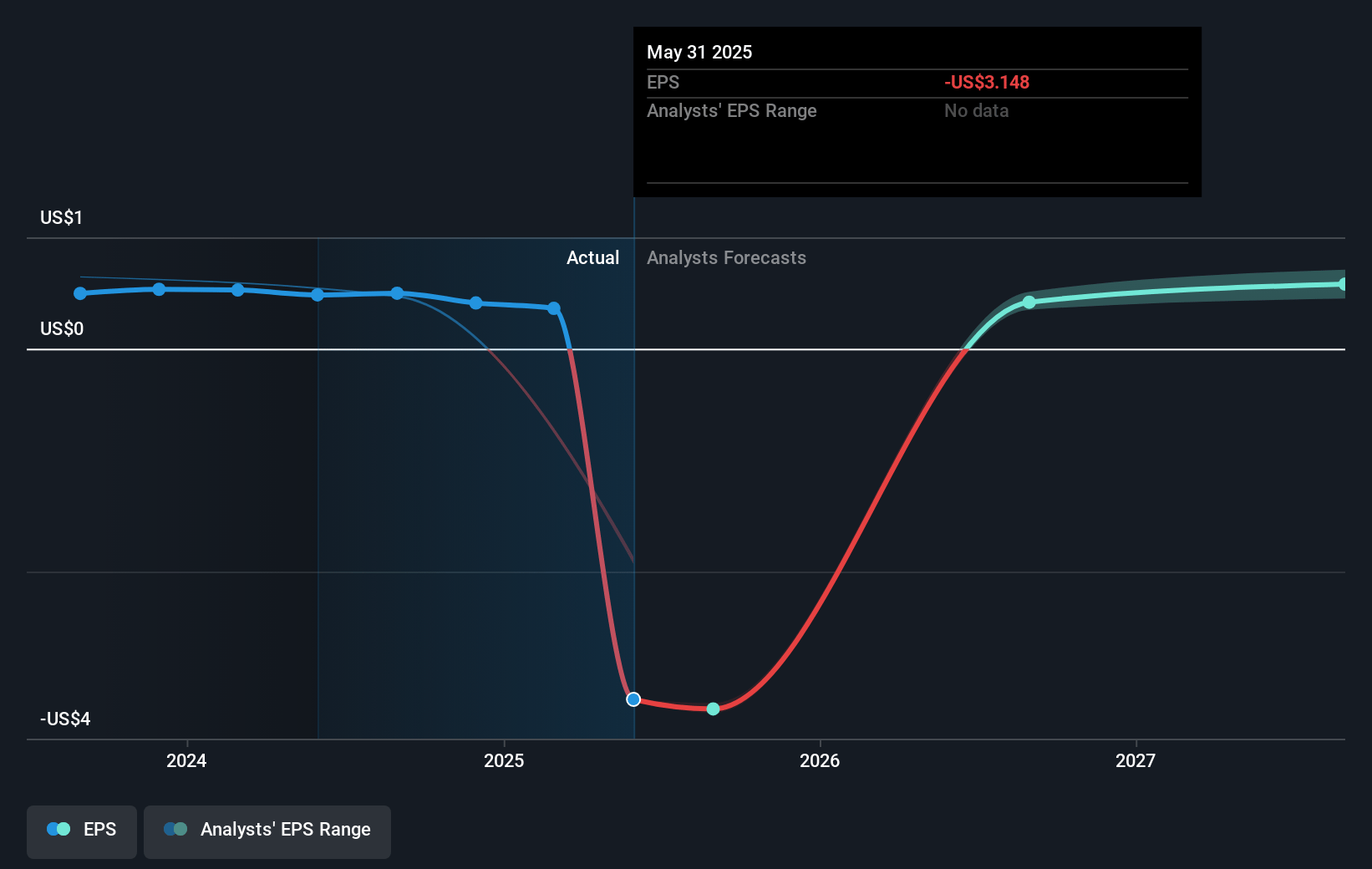

- Analysts expect earnings to reach $24.6 million (and earnings per share of $0.83) by about April 2028, up from $7.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.6x on those 2028 earnings, down from 98.0x today. This future PE is lower than the current PE for the US Healthcare Services industry at 49.2x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Simulations Plus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slow project initiation and pacing by clients in the Services segment could delay revenue realization, impacting short-term revenue and earnings growth.

- Declining gross margins, driven by increased costs in both software and services, could pressure net margins and affect profit growth.

- The macroeconomic environment, with customers adopting a cautious cost-conscious approach, may limit growth opportunities and affect future revenue streams.

- Uncertain revenue growth in the Medical Communications and Adaptive Learning and Insights units, combined with reliance on large contracts, could lead to revenue volatility and affect earnings predictability.

- The slow renewal rates and deferred renewals in specific product lines, such as GastroPlus, may create revenue gaps or inconsistencies, impacting both top-line growth and net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $44.2 for Simulations Plus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $126.2 million, earnings will come to $24.6 million, and it would be trading on a PE ratio of 44.6x, assuming you use a discount rate of 7.4%.

- Given the current share price of $35.38, the analyst price target of $44.2 is 20.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.