Key Takeaways

- Strong product launches and a robust innovation pipeline suggest promising future revenue growth and strengthened market positioning.

- Strategic expansion of commercial initiatives and enhanced reimbursement profiles are expected to improve sales efficiency and net margins.

- SI-BONE's growth is threatened by innovation risks, payer requirement changes, economic downturn impacts, legal uncertainties, and reliance on high growth expectations.

Catalysts

About SI-BONE- A medical device company, focuses on solving musculoskeletal disorders of the sacropelvic anatomy in the United States and internationally.

- SI-BONE's strong revenue growth in Q4 2024 and broad-based performance across its innovative platform indicate a promising outlook for continued revenue expansion driven by the success of recent product launches such as TORQ, INTRA, Granite 9.5, and TNT. These products are expected to be significant growth drivers in 2025 and beyond, positively impacting future revenue growth.

- The expansion of SI-BONE's commercial initiatives, including the selective increase in its direct sales force and leveraging a hybrid model with third-party agents, is anticipated to enhance sales efficiency and market penetration. This strategic move is likely to contribute to improved revenue and potentially higher net margins as territory productivity increases over time.

- Reimbursement enhancements, including transitional pass-through payment status for Granite and the potential for new technology add-on payment approval for TNT, could enhance the reimbursement profile of SI-BONE's products, bolstering their revenue contribution and potentially improving net margins due to favorable reimbursement policies.

- The focus on physician engagement and training, with nearly 2,000 U.S. physicians trained and a growing density of procedure types per physician, suggests a strong foundation for increased procedure volumes. This strategy is expected to stimulate demand, which should positively influence revenue growth and sustainability.

- SI-BONE's robust innovation pipeline, underscored by the recent FDA breakthrough device designation for a new novel implant system, reflects the company's potential to introduce disruptive products targeting unmet clinical needs. This continued innovation is likely to support sustained revenue growth and strengthen competitive positioning, with a positive impact on long-term earnings.

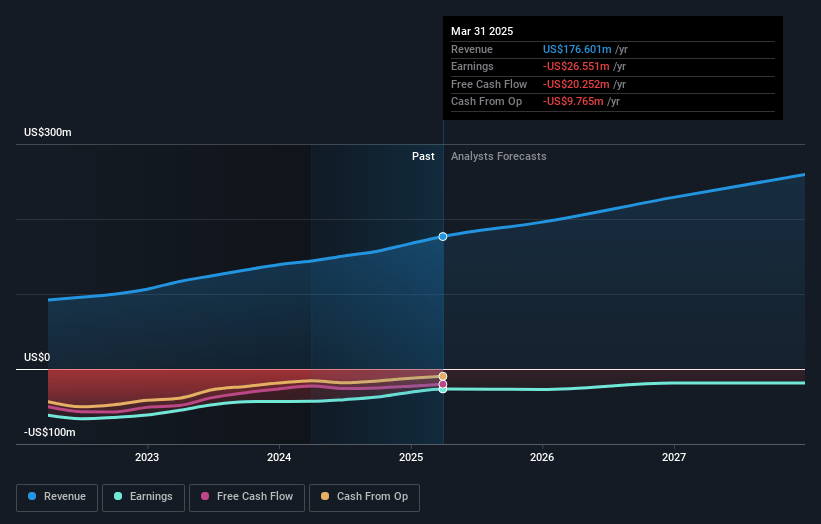

SI-BONE Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SI-BONE's revenue will grow by 15.6% annually over the next 3 years.

- Analysts are not forecasting that SI-BONE will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate SI-BONE's profit margin will increase from -18.5% to the average US Medical Equipment industry of 12.9% in 3 years.

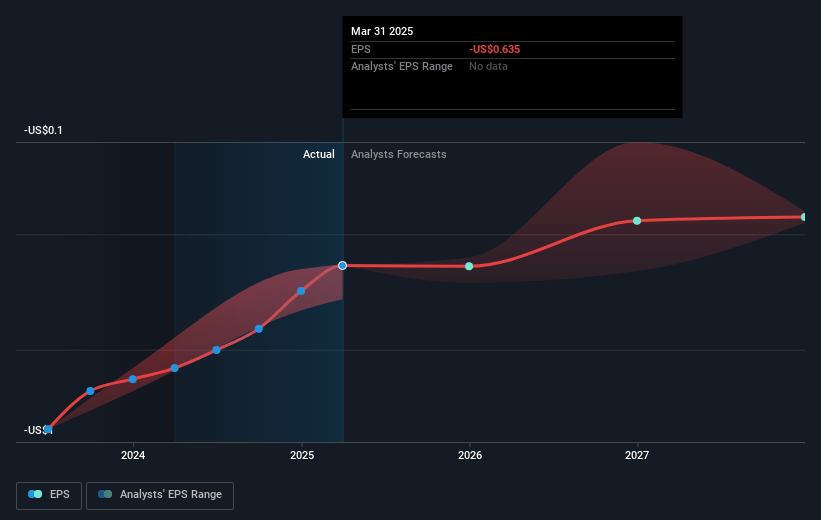

- If SI-BONE's profit margin were to converge on the industry average, you could expect earnings to reach $33.4 million (and earnings per share of $0.73) by about May 2028, up from $-30.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.3x on those 2028 earnings, up from -19.6x today. This future PE is greater than the current PE for the US Medical Equipment industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 3.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.03%, as per the Simply Wall St company report.

SI-BONE Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SI-BONE faces risks associated with the ability to introduce and commercialize new products, which could impact revenue growth if innovations do not meet market or regulatory expectations.

- Changes in payer requirements for authorizing procedures using SI-BONE’s products could affect the company’s ability to maintain favorable reimbursement, potentially impacting revenues and net margins.

- Economic downturns could reduce patients' willingness to undergo elective procedures, thereby constraining SI-BONE’s revenue growth opportunities.

- The investigation by the Department of Justice into SI-BONE’s compliance with regulations introduces legal and financial uncertainties that could impact earnings and corporate reputation.

- The company’s reliance on high growth expectations, such as maintaining its strong revenue and profitability trajectory, poses a risk if market dynamics or internal execution falter, potentially affecting earnings projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.444 for SI-BONE based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $258.4 million, earnings will come to $33.4 million, and it would be trading on a PE ratio of 41.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of $14.28, the analyst price target of $24.44 is 41.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.