Key Takeaways

- Strategic initiatives in operational efficiencies, contracting, and execution aim to significantly boost EBITDA, net margins, and earnings.

- Innovative programs and strategic partnerships enhance service offerings and revenue predictability, supporting long-term profitability and growth.

- Concerns over operational inefficiencies, financial management, and reliance on non-GAAP measures may undermine profitability and investor confidence.

Catalysts

About P3 Health Partners- A patient-centered and physician-led population health management company, provides superior care services in the United States.

- P3 Health Partners is actively pursuing over $130 million in adjusted EBITDA opportunities through ongoing programmatic initiatives such as operational efficiencies, contract rationalization, and operational execution, all expected to bolster net margins and earnings.

- The company is seeing early positive trends in 2025, particularly within benefit design changes and utilization, which are projected to provide an estimated incremental medical margin benefit of $30 to $35 per member per month, potentially improving net margins.

- P3 Health Partners is focused on a deliberate growth strategy aimed at profitable expansion, reaffirming its 2025 guidance with a goal to achieve profitability this year, which could improve earnings.

- Introductions of innovative programs like P3 Restore and effective deployment of new point-of-care tools have improved patient outcome metrics and physician engagement, which could impact revenue positively through enhanced service offerings and patient retention.

- Strategic re-contracting efforts and payer partnership improvements, including a shift away from Part D risk, are poised to provide better revenue stability and predictability, ultimately supporting revenue growth and margin expansion.

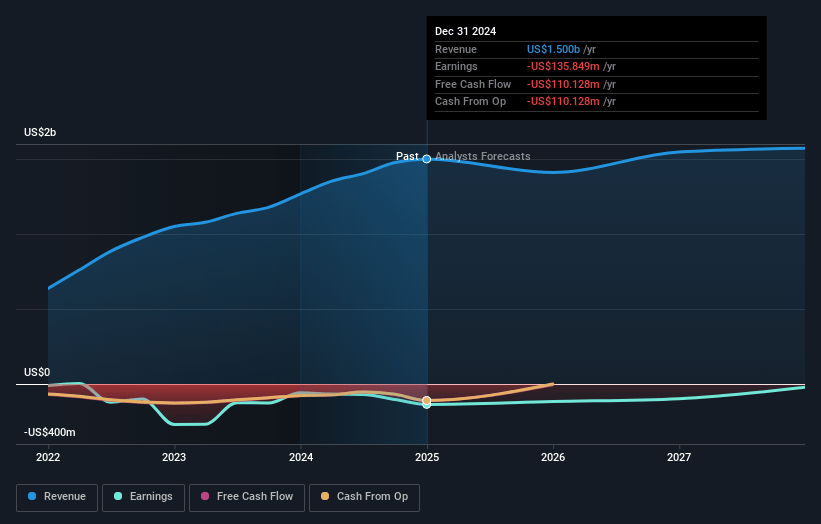

P3 Health Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming P3 Health Partners's revenue will grow by 1.6% annually over the next 3 years.

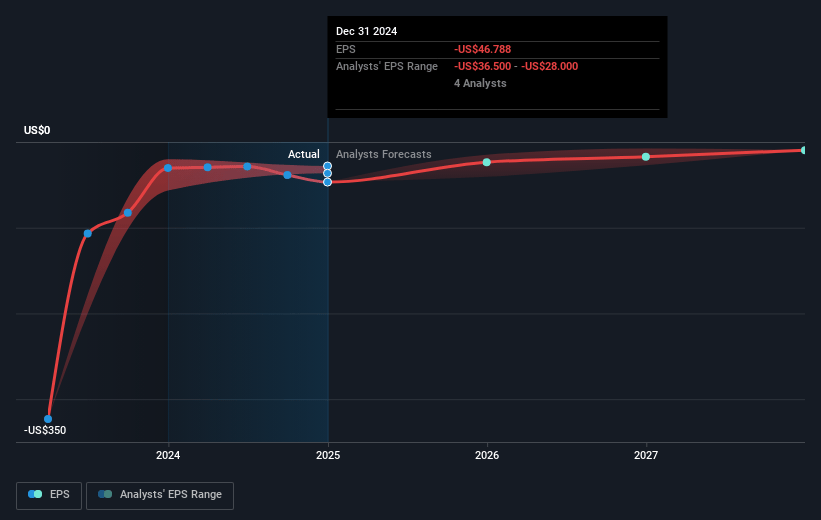

- Analysts are not forecasting that P3 Health Partners will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate P3 Health Partners's profit margin will increase from -9.1% to the average US Healthcare industry of 4.9% in 3 years.

- If P3 Health Partners's profit margin were to converge on the industry average, you could expect earnings to reach $76.9 million (and earnings per share of $9.61) by about May 2028, up from $-135.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 2.2x on those 2028 earnings, up from -0.2x today. This future PE is lower than the current PE for the US Healthcare industry at 23.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.24%, as per the Simply Wall St company report.

P3 Health Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a decrease in medical margin year-over-year due to elevated utilization trends, which could continue to impact net margins negatively if not addressed.

- Adjusted EBITDA for the quarter was a loss of $68 million, exacerbated by unfavorable out-of-period true-ups related to a single payer partner, indicating potential ongoing challenges with financial management and settlement accuracy that could impact earnings.

- Full year adjusted EBITDA loss increased significantly from the prior year, suggesting operational inefficiencies that need to be resolved to improve overall financial health and profitability.

- The company's guidance for adjusted EBITDA in 2025 indicates a potential continued negative EBITDA, underscoring concerns about their ability to achieve sustainable profitability, impacting investor confidence and future earnings potential.

- The reliance on non-GAAP financial measures and the acknowledgment of associated limitations suggests potential variability and lack of standardization in financial reporting, which could impact the transparency and reliability of revenue and profit forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.25 for P3 Health Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $12.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $76.9 million, and it would be trading on a PE ratio of 2.2x, assuming you use a discount rate of 9.2%.

- Given the current share price of $8.75, the analyst price target of $16.25 is 46.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.