Key Takeaways

- Performant Healthcare's commercial market expansion and strategic contracts are driving future revenue growth and boosting its revenue visibility and scalability.

- Project Turing's technological advancements and governmental auditing opportunities are set to improve operational efficiencies, expand margins, and enhance profitability.

- Investments in new contracts and technology initiatives, alongside macroeconomic uncertainties, may depress profitability and pose risks to revenue growth and margins.

Catalysts

About Performant Healthcare- Provides audit, recovery, and analytics services in the United States.

- Performant Healthcare's expansion within the commercial market is expected to drive significant future revenue growth, as contracts with top Managed Care Organizations (MCOs) and midmarket payors continue to increase. Commercial clients now account for nearly 60% of healthcare revenue, indicating a successful pivot and potential for further revenue expansion.

- The implementation of over 100 commercial programs since early 2022, with expectations of generating $46 million in annual revenue at steady state, signifies robust forward revenue visibility, instrumental in achieving scaled EBITDA margins.

- Project Turing, focusing on enhancing workflow through next-generation technologies, including AI and NLP, is expected to improve operational efficiencies and contribute to margin expansion, targeting adjusted EBITDA margins of 20%.

- The anticipated ramp-up of new federal and state contracts, like the New York State RAC, is projected to enhance long-term revenue streams. The contract's timely implementation aims to generate revenue sooner than typical cycles, impacting overall earnings positively.

- Engagement with governmental bodies pursuing fraud, waste, and abuse initiatives could lead to expanded auditing opportunities, featuring in revenue and profitability growth, leveraging Performant's strong reputation and aligning with government objectives.

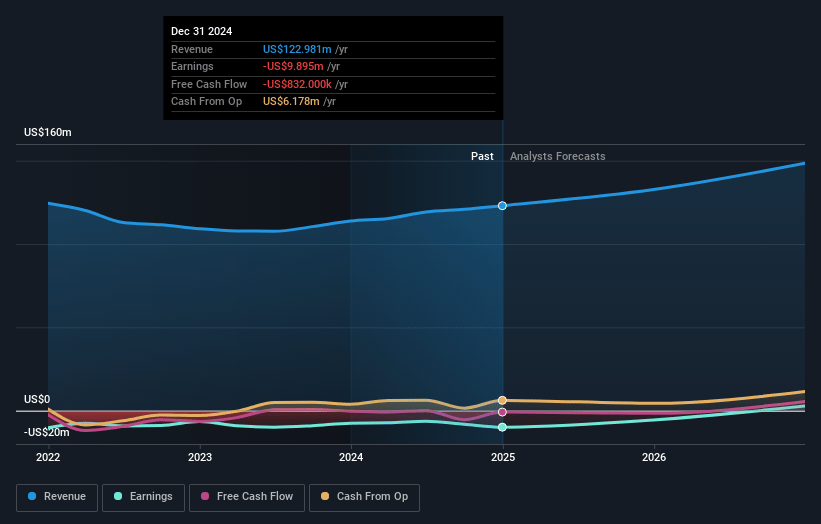

Performant Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Performant Healthcare's revenue will grow by 9.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -8.0% today to 3.5% in 3 years time.

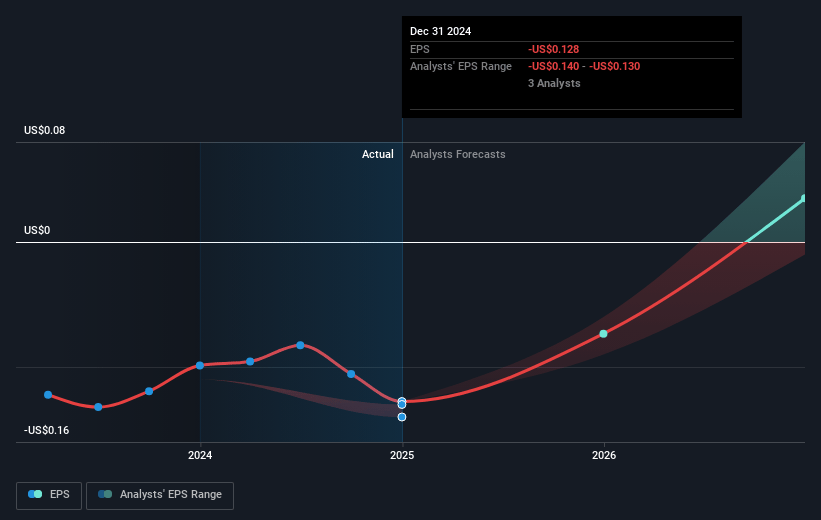

- Analysts expect earnings to reach $5.7 million (and earnings per share of $0.07) by about May 2028, up from $-9.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 120.6x on those 2028 earnings, up from -18.6x today. This future PE is greater than the current PE for the US Healthcare industry at 23.6x.

- Analysts expect the number of shares outstanding to grow by 1.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Performant Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slower-than-anticipated growth in the government sector due to election-related sensitivities and maturation of contracts could hamper overall revenue growth expectations.

- The upfront investment needed for many new commercial contracts could compress margins and delay profitability, impacting net margins.

- There is macroeconomic uncertainty related to the actions of the new administration, posing risks to federal revenue streams and net earnings.

- The reliance on a few large yet subscale contracts, some operating at negative margins, presents significant margin risks that could impact earnings if not successfully ramped.

- Continued significant investment requirements related to technology initiatives, such as Project Turing, may depress short-term profitability and adjusted EBITDA margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.0 for Performant Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $162.2 million, earnings will come to $5.7 million, and it would be trading on a PE ratio of 120.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of $2.35, the analyst price target of $7.0 is 66.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.