Last Update02 Apr 25Fair value Decreased 2.46%

Key Takeaways

- Expected growth from EsoGuard and Lucid Diagnostics' program could significantly boost revenues and cash flow management due to insurance coverage and strong execution.

- Strategic partnerships and advancements with Veris Health, including potential FDA clearance, are likely to enhance commercial potential and market differentiation.

- PAVmed's financial outlook hinges on successful deconsolidation impacts, insurance validation for EsoGuard, FDA approvals, funding stability, and execution at subsidiaries Lucid and Veris.

Catalysts

About PAVmed- Focuses on acquiring, developing, and commercializing novel products that target unmet needs in the United States.

- PAVmed expects future growth driven by the positive commercial insurance coverage policy for EsoGuard in New York and updates to clinical guidelines, which will likely boost EsoGuard revenue significantly.

- The successful launch of Lucid Diagnostics’ concierge medicine cash pay program and strong early execution with contracts are anticipated to contribute to higher revenues and improved cash flow management.

- Positive developments with Veris Health, including a $2.4 million private placement financing and an NIH grant for advancing its implantable physiologic monitor, are expected to enhance Veris' long-term commercial potential and generate future revenue streams.

- PAVmed’s strategic partnership with Ohio State University’s James Cancer Center for the Veris Cancer Care platform is positioned to expand commercially, potentially driving significant revenue growth and encouraging adoption by other institutions.

- Upcoming potential FDA clearance of Veris Health’s implantable device is projected to boost earnings by differentiating PAVmed in the remote cancer monitoring market, which would enhance commercial adoption and market penetration.

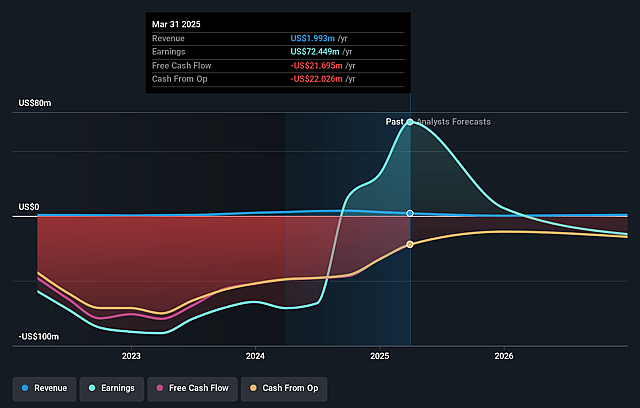

PAVmed Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PAVmed's revenue will grow by 269.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 1067.3% today to 1.5% in 3 years time.

- Analysts expect earnings to reach $2.2 million (and earnings per share of $0.01) by about April 2028, down from $32.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 110.8x on those 2028 earnings, up from 0.4x today. This future PE is greater than the current PE for the US Medical Equipment industry at 27.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

PAVmed Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The deconsolidation of Lucid Diagnostics from PAVmed's balance sheet, while preserving ownership, indicates a need to manage operating losses and maintain NASDAQ listing standards, potentially impacting future net margins due to decreased direct financial integration.

- PAVmed relies on new insurance coverage and guidelines like those from NCCN to drive growth for EsoGuard, but dependence on such external validations introduces risk to projected revenues if broader adoption fails to meet expectations.

- Delays or failures in securing FDA clearance and strategic partnerships for Veris Health's implantable physiologic monitor could hinder commercialization efforts and affect future earnings.

- Significant reliance on future funding for specific projects like PortIO, through either investors or strategic partnerships, highlights potential cash flow challenges, which could negatively impact revenue growth.

- The success of subsidiaries such as Lucid and Veris is crucial for PAVmed, making it vulnerable to execution risks within these entities, which could impact overall earnings and shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.0 for PAVmed based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $151.0 million, earnings will come to $2.2 million, and it would be trading on a PE ratio of 110.8x, assuming you use a discount rate of 11.4%.

- Given the current share price of $0.7, the analyst price target of $9.0 is 92.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.