Narratives are currently in beta

Key Takeaways

- Strategic investments in pharmacies and clinical capabilities are projected to enhance referral opportunities and potentially boost revenue and gross margins.

- Financial strength, with positive cash flow and low leverage, allows capital deployment for acquisitions or share buybacks, supporting earnings growth.

- Supply chain disruptions and drug pricing pressures could hinder revenue growth and compress gross profit margins for Option Care Health.

Catalysts

About Option Care Health- Offers home and alternate site infusion services in the United States.

- Option Care Health's acute therapy market has the potential for growth due to the exit of a large infusion provider from certain acute therapies. They expect improved supply chain dynamics over the medium term, allowing them to capture market share and boost revenues.

- Their extensive investments in compounding pharmacies and clinical capabilities position them to capitalize on referral opportunities, which could lead to increased revenue and potentially higher gross margins as these facilities become more utilized.

- Continued focus on operational efficiencies and cost reductions, particularly in response to potential pricing pressures, is expected to help sustain or improve net margins even in the face of certain headwinds.

- Positive cash flow generation and a strong balance sheet with low leverage enable potential further capital deployment into share repurchases or acquisitions, contributing positively to earnings per share growth.

- Expansion into rare and orphan portfolios that are experiencing strong growth, alongside new therapeutic areas like Alzheimer's and oncology, presents opportunities to diversify and increase revenues over the medium to long term.

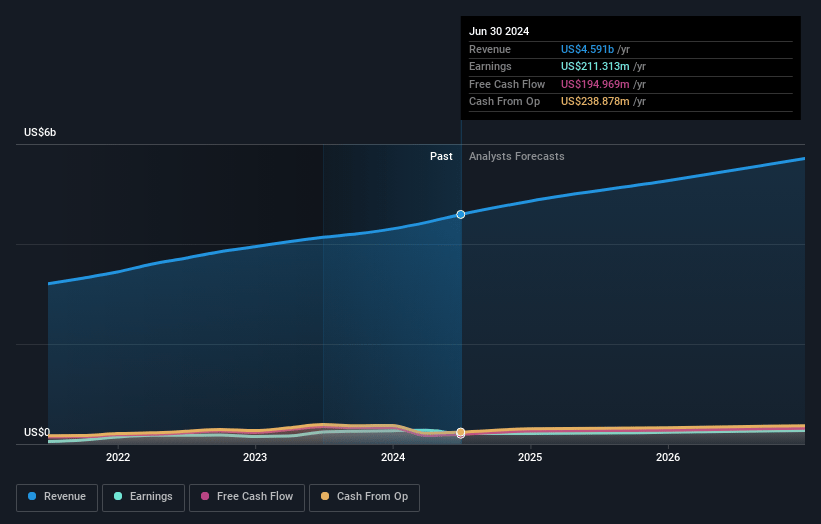

Option Care Health Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Option Care Health's revenue will grow by 9.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 4.8% in 3 years time.

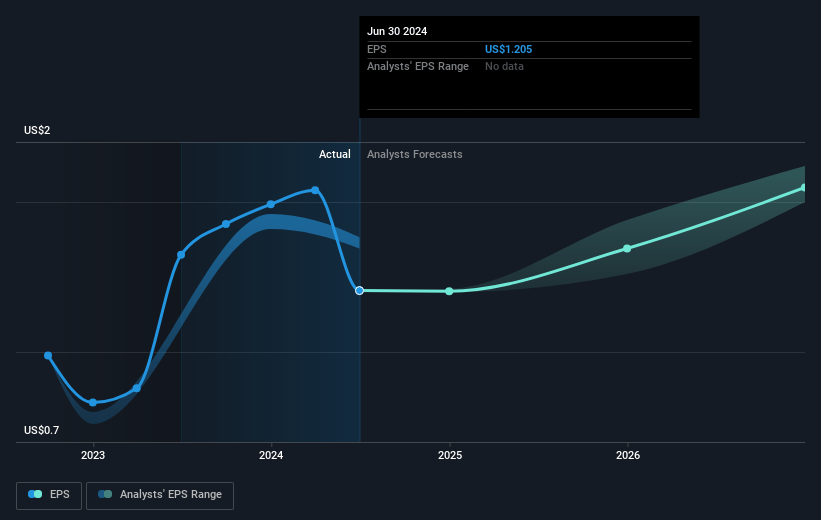

- Analysts expect earnings to reach $285.0 million (and earnings per share of $1.57) by about October 2027, up from $211.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.6x on those 2027 earnings, up from 24.7x today. This future PE is greater than the current PE for the US Healthcare industry at 24.6x.

- Analysts expect the number of shares outstanding to grow by 2.06% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 5.8%, as per the Simply Wall St company report.

Option Care Health Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Supply chain disruptions from Hurricane Helene have resulted in less than optimal levels of IV bags, affecting Option Care Health's ability to onboard new patients, which could impact revenue growth and earnings.

- A large infusion provider's market exit presents an opportunity, but supply chain limitations create uncertainty in Option Care Health's ability to capitalize on new patient intake, impacting potential revenue expansion.

- The 66% cost reduction for STELARA under the Inflation Reduction Act and expected biosimilar competition could materially impact gross profit margins for Option Care Health from 2025, affecting overall earnings.

- The unpredictable timing of supply chain improvement and continued disruptions pose risks to patient service delivery and revenue goals, potentially affecting financial performance.

- There is significant uncertainty around drug pricing actions by a manufacturer that may compress profit margins on STELARA, threatening gross profits and affecting the company’s bottom line in 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $39.38 for Option Care Health based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $6.0 billion, earnings will come to $285.0 million, and it would be trading on a PE ratio of 29.6x, assuming you use a discount rate of 5.8%.

- Given the current share price of $30.5, the analyst's price target of $39.38 is 22.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives