Narratives are currently in beta

Key Takeaways

- Evaluating consumer business separation could enhance the healthcare segment's focus and efficiency, potentially improving net margins and earnings.

- Relocating sensor manufacturing and margin improvement initiatives will likely boost operational efficiencies and profitability.

- The potential consumer business separation and leadership instability introduce revenue and earnings uncertainty, with additional risk from declines in non-healthcare revenues and legal disputes.

Catalysts

About Masimo- Develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide.

- The potential separation of the consumer business is being evaluated, which could result in a more focused and efficient healthcare segment, potentially leading to improvements in net margins and earnings.

- The relocation of sensor manufacturing to Malaysia is expected to continue yielding operational efficiencies and improved gross margins, contributing to higher net earnings in the future.

- The implementation of margin improvement initiatives, including rightsizing corporate overhead and reducing marketing expenses for underperforming products, is expected to provide at least a 200 basis point increase in operating margin, enhancing profitability.

- The focus on reallocating R&D resources to high-return projects and big market opportunities is projected to drive long-term revenue growth.

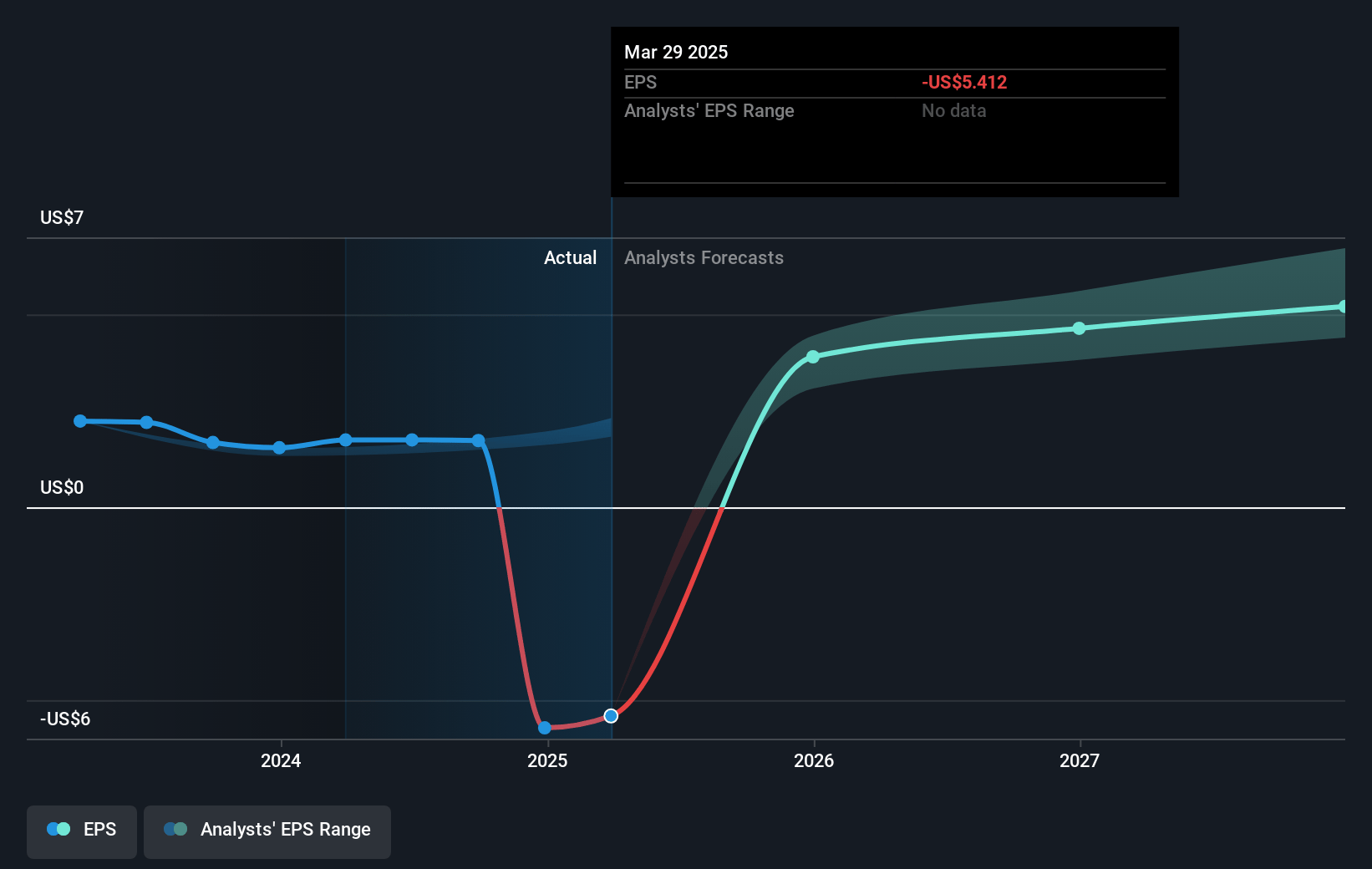

- Strong contracting activity and record contract revenues suggest solid future revenue growth, with the aim of more than doubling earnings per share within five years.

Masimo Future Earnings and Revenue Growth

Assumptions

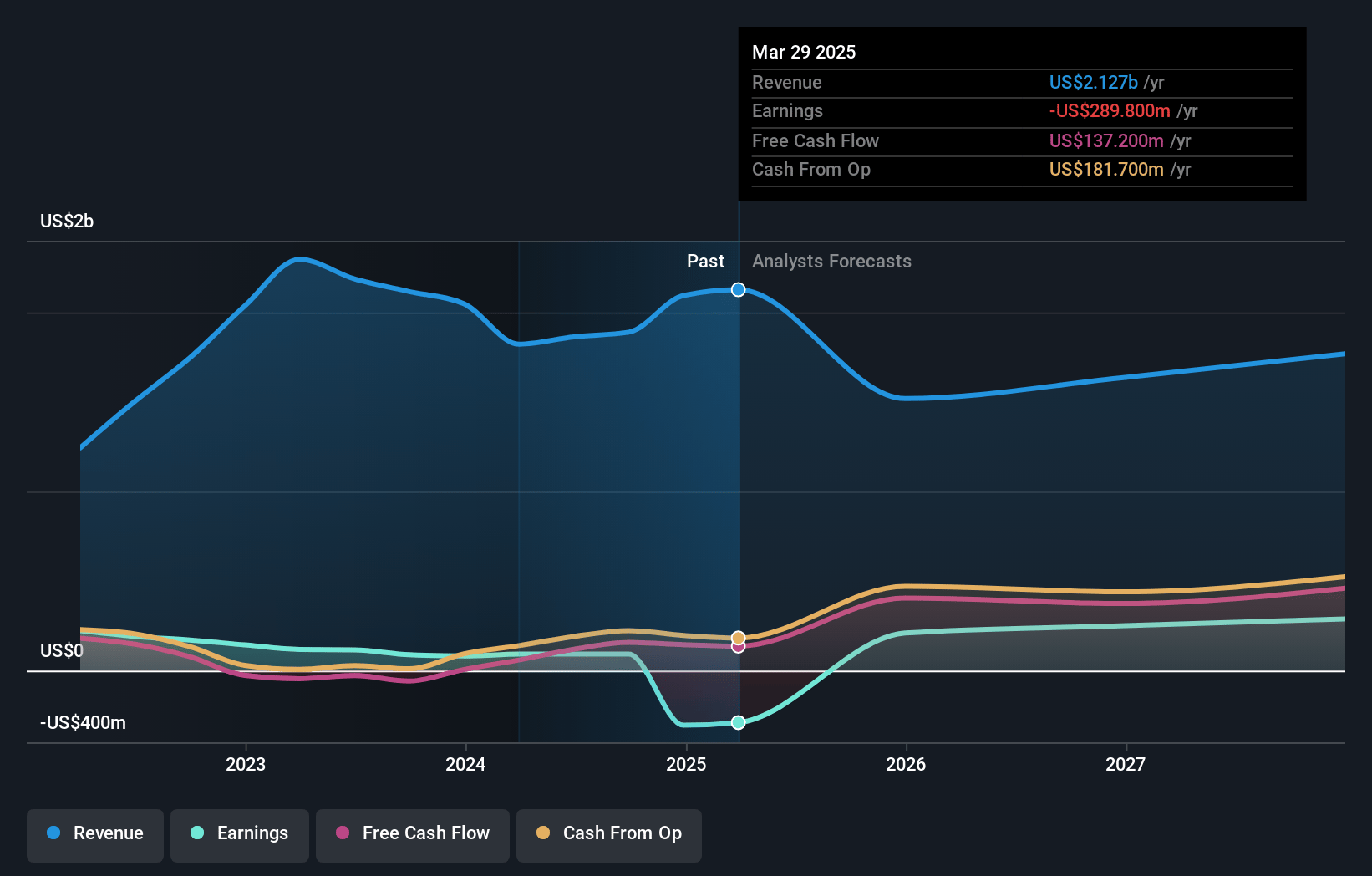

How have these above catalysts been quantified?- Analysts are assuming Masimo's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.8% today to 7.8% in 3 years time.

- Analysts expect earnings to reach $190.1 million (and earnings per share of $3.35) by about November 2027, up from $78.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 59.5x on those 2027 earnings, down from 110.1x today. This future PE is greater than the current PE for the US Medical Equipment industry at 37.2x.

- Analysts expect the number of shares outstanding to grow by 1.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.63%, as per the Simply Wall St company report.

Masimo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential separation of the consumer business introduces uncertainty, which could impact Masimo's revenue stability and earnings predictability if not executed effectively or if the market perceives it negatively.

- Declines in non-healthcare revenues, influenced by the weakening environment for luxury consumer purchases and housing market slowness, could continue to impact overall revenue and net margins.

- Shift in strategy to focus on fewer projects may result in missed opportunities if the high-potential projects do not materialize as expected, affecting long-term revenue growth.

- The ongoing CEO succession process introduces leadership instability, which may impact strategic direction and operational execution, potentially affecting revenue and earnings.

- The legal proceedings with Apple concerning trade secrets create litigation risk and potential financial liabilities, which could impact net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $166.52 for Masimo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $190.0, and the most bearish reporting a price target of just $128.12.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.4 billion, earnings will come to $190.1 million, and it would be trading on a PE ratio of 59.5x, assuming you use a discount rate of 6.6%.

- Given the current share price of $161.68, the analyst's price target of $166.52 is 2.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives