Key Takeaways

- Strategic focus on obstructive sleep apnea and cardiopulmonary advancements is key for revenue growth and market expansion.

- Operational efficiency through talent transformation and R&D investment aims to diversify revenue streams and improve margins.

- LivaNova faces potential revenue risks from flat U.S. epilepsy growth, European declines, SNIA litigation, OSA market costs, and exchange rate fluctuations.

Catalysts

About LivaNova- A medical technology company, designs, develops, manufactures, markets, and sells products and therapies for neurological and cardiac conditions worldwide.

- LivaNova is focusing on a strategic growth opportunity by bringing their obstructive sleep apnea (OSA) technology to market, which is expected to impact revenue growth as the hypoglossal nerve stimulation market could approach $2 billion by the end of the decade.

- The company is enhancing and upgrading their cardiopulmonary segment with new products like the ProtekDuo Plus and NextGen oxygenator, which are anticipated to drive revenue from both device sales and associated consumables.

- Efforts in improving reimbursement coverage for the VNS Therapy in difficult-to-treat depression (DTD) promise to diversify the revenue stream and potentially expand margins due to increased market penetration.

- Transformation and enhancement in talent and culture with the hiring of industry-leading professionals and internal promotions are expected to drive operational efficiency, potentially improving net margins.

- Continued investment in R&D for innovation in both core products and new growth areas like DTD and OSA, while gradually decreasing R&D spend as a percentage of revenue, can lead to improved earnings as these new initiatives begin to pay off in the coming years.

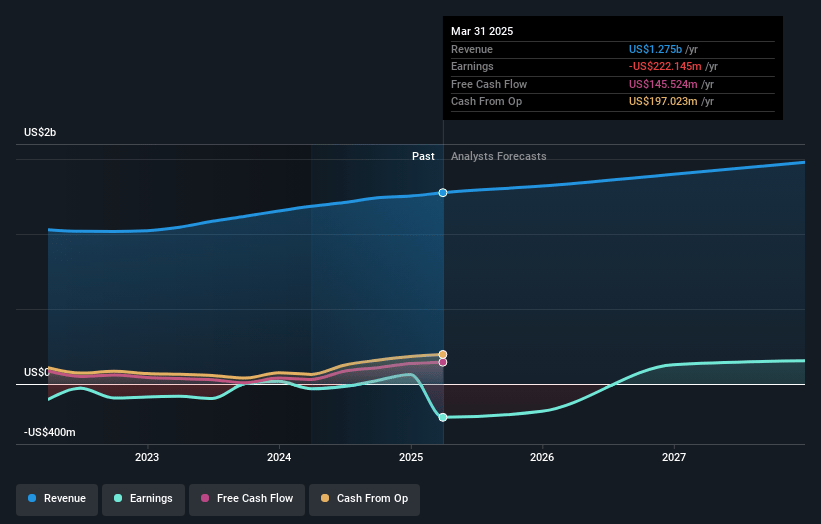

LivaNova Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LivaNova's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 10.3% in 3 years time.

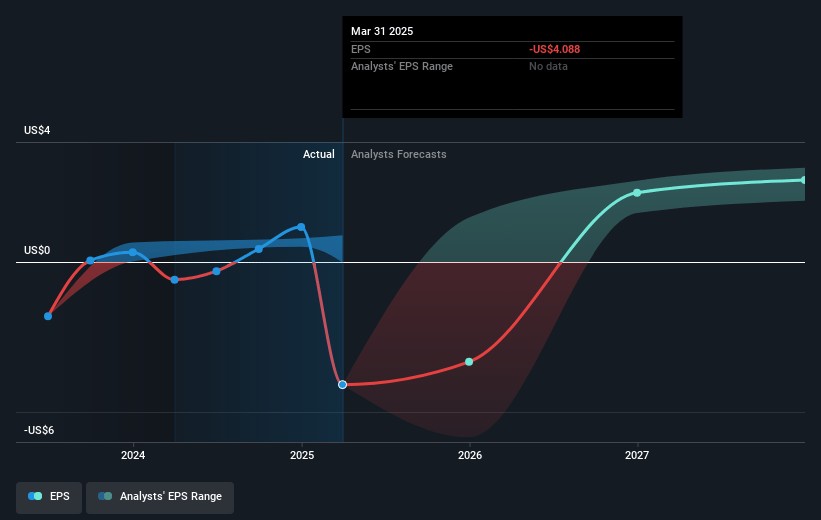

- Analysts expect earnings to reach $149.1 million (and earnings per share of $2.71) by about May 2028, up from $63.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $167 million in earnings, and the most bearish expecting $112 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.7x on those 2028 earnings, down from 32.4x today. This future PE is lower than the current PE for the GB Medical Equipment industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 0.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

LivaNova Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LivaNova's growth in 2025 may be constrained by a flat growth rate in U.S. epilepsy replacement units, due to the decline in total implants that occurred in 2019 and 2020, potentially impacting future revenue sustainability.

- The company is facing challenges in its Epilepsy segment in Europe and the Rest of the World, with a significant revenue decline of 9% in Q4 2024, reflecting potential commercial execution issues that could risk projected revenue growth.

- Uncertainty surrounds the SNIA litigation case, and an unfavorable ruling could result in a significant financial liability, not currently accounted for in 2025 guidance, threatening the company's net earnings and financial stability.

- Increased investment in the obstructive sleep apnea (OSA) market development, even as clinical trials are ongoing and market entry timelines remain uncertain, may pressure net margins and cash flow in the near term.

- The projected foreign exchange headwind of 1.5% to 2% for 2025 due to fluctuating exchange rates presents risks to reported revenue and earnings, potentially affecting financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $59.9 for LivaNova based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $149.1 million, and it would be trading on a PE ratio of 27.7x, assuming you use a discount rate of 8.5%.

- Given the current share price of $37.66, the analyst price target of $59.9 is 37.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.