Key Takeaways

- Expanding global adoption and procedure diversity, coupled with innovative products and digital tools, are fueling recurring revenues, margin stability, and long-term competitive advantage.

- Increasing regulatory and payer support, driven by strong clinical outcomes, is reducing adoption barriers and supporting durable growth across multiple healthcare markets.

- Expansion and revenue growth are challenged by international budget constraints, trade uncertainties, increased competition, regulatory delays, and shifting healthcare reimbursement policies.

Catalysts

About Intuitive Surgical- Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

- Strong global procedure growth (18% total; 17% da Vinci specifically), increasing installed base, and rising system utilization indicate that Intuitive is effectively capturing surging demand for minimally invasive, robotic-assisted surgeries as chronic disease rates rise and populations age globally-directly supporting long-term recurring revenue and margin stability.

- Strategic expansion into emerging markets (notably India, Korea, Brazil, Southeast Asia) and broader adoption beyond core urology into general, thoracic, colorectal, and other complex procedures is increasing the addressable market, supporting sustainable topline growth and diversification of revenue streams.

- Ongoing product innovation (including full launch of da Vinci 5, integrated force feedback, and digital/AI case insights), coupled with R&D to expand into adjacent specialties, enhances clinical outcomes and surgeon efficiency-supporting future procedure growth, higher system ASPs, and increased recurring instrument and accessory revenues.

- Accelerated adoption of digital and telecollaboration tools as healthcare systems modernize, alongside increased training and surgeon acceptance, should further drive utilization rates per installed system and strengthen Intuitive's long-term competitive advantage, positively impacting operating leverage and net margins.

- Compelling clinical data showing superior long-term outcomes for robotic-assisted surgeries (e.g., lower recurrence rates in cancer) is likely to underpin broader regulatory and payer support for robotic approaches-reducing barriers to adoption and increasing utilization, which should drive durable revenue and earnings growth.

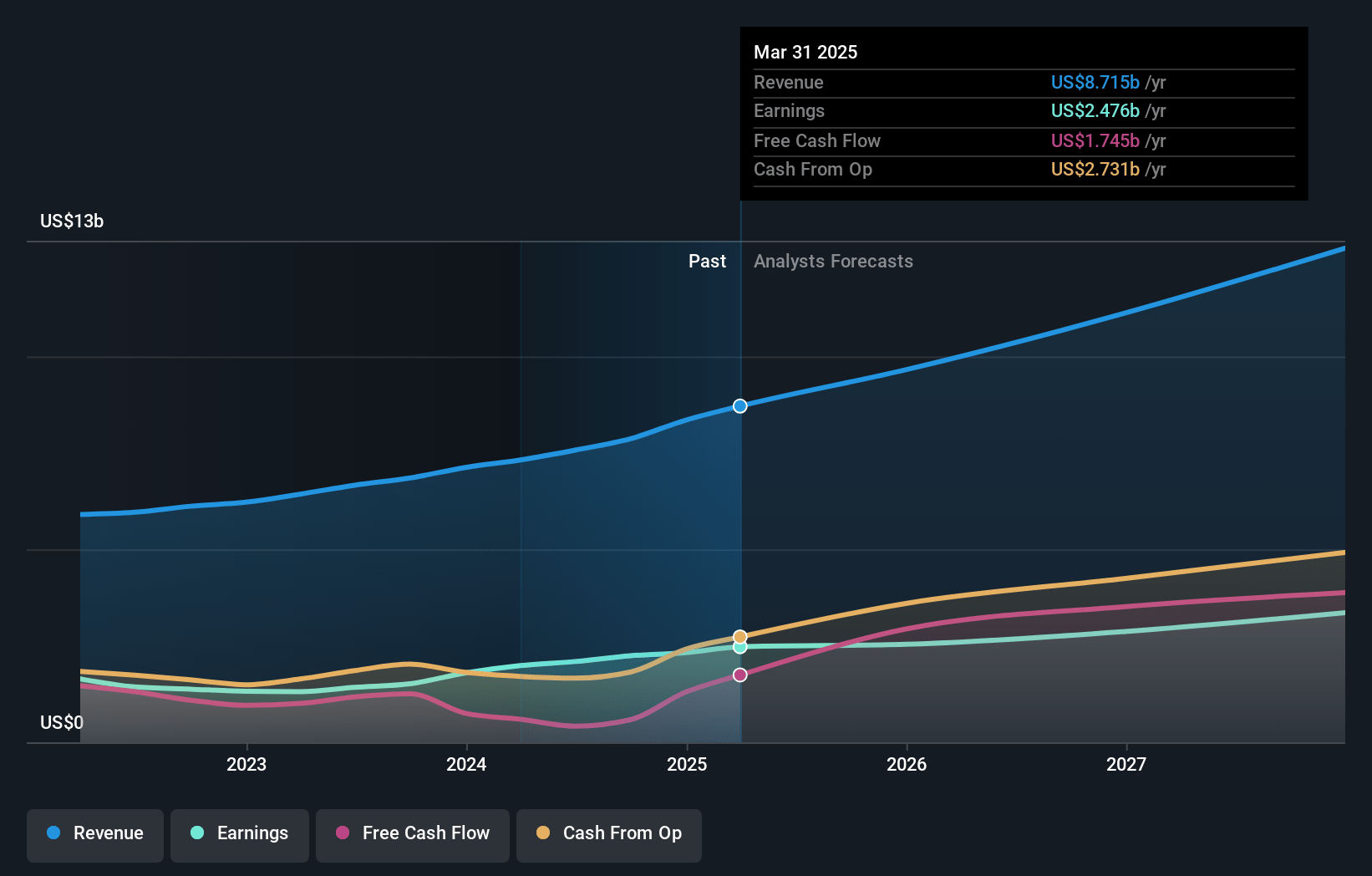

Intuitive Surgical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Intuitive Surgical's revenue will grow by 14.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 28.4% today to 26.5% in 3 years time.

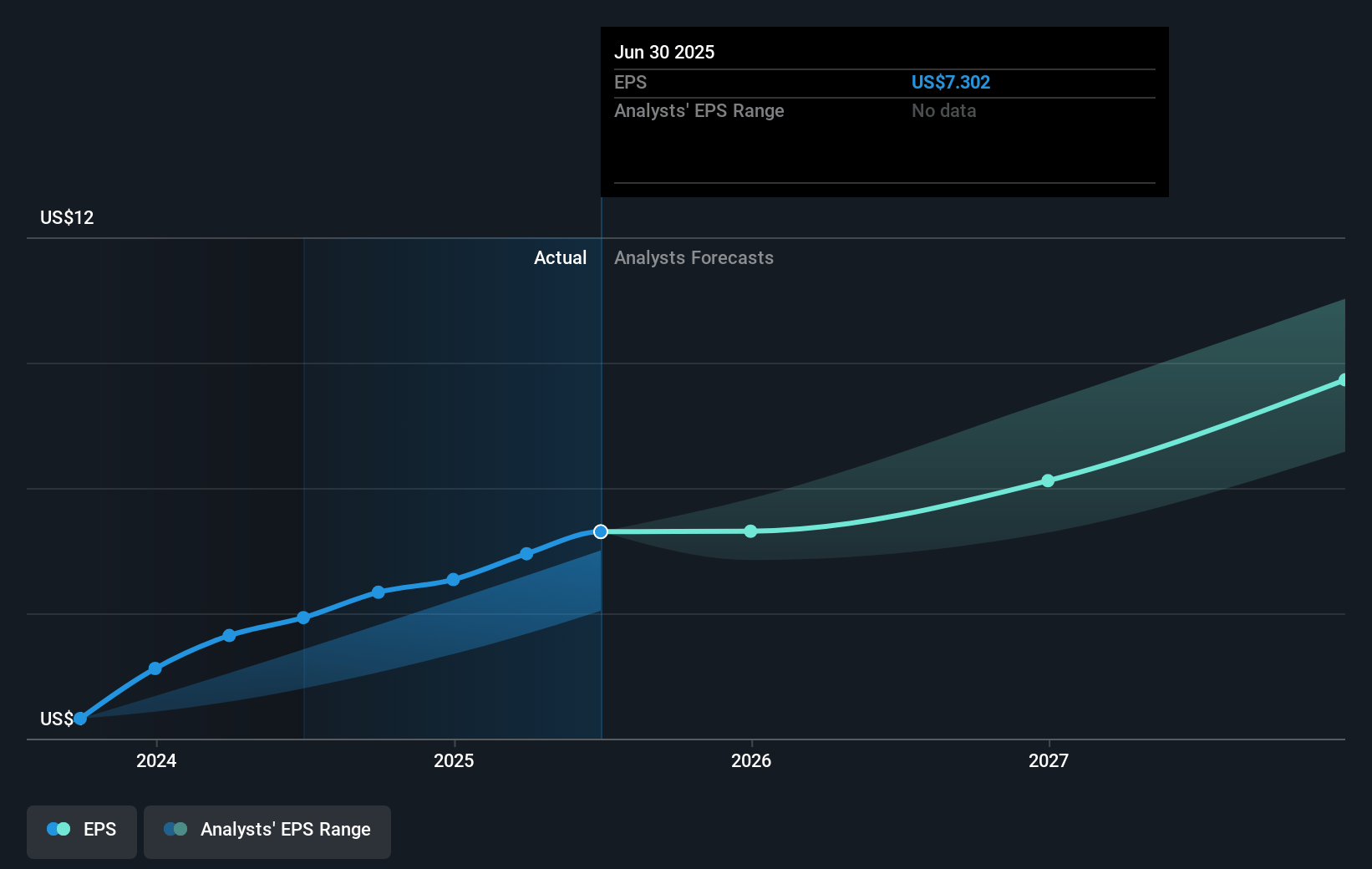

- Analysts expect earnings to reach $3.5 billion (and earnings per share of $9.53) by about July 2028, up from $2.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.8 billion in earnings, and the most bearish expecting $3.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 75.4x on those 2028 earnings, up from 74.0x today. This future PE is greater than the current PE for the US Medical Equipment industry at 31.1x.

- Analysts expect the number of shares outstanding to grow by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

Intuitive Surgical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing financial and budgetary pressures in key international markets like Japan, China, and Europe-driven by government budget deficits, healthcare spending constraints, and capital expenditure limitations-continue to limit Intuitive Surgical's expansion in those regions, potentially slowing system placements and long-term revenue growth.

- Rising tariff and trade uncertainty, especially related to U.S.-China relations and global supply chain challenges, could increase cost of sales and compress gross margins; with tariff impacts expected to rise further, prolonged or worsening trade tensions could significantly impact profitability.

- Increasing competition from third-party suppliers offering remanufactured or extended-use instruments threatens the high-margin recurring revenue from Intuitive's consumables, and if hospitals adopt these alternatives to cut costs, this could erode predictability and volume of recurring revenue, ultimately pressuring net earnings.

- Persistently constrained adoption rates or measured rollouts of new technologies (such as da Vinci 5 in Europe/Japan due to regulatory delays, lack of Force Feedback approval, or higher system pricing) may extend upgrade cycles and reduce the pace of both new and replacement system sales, dampening revenue and margin expansion.

- Uncertainty around evolving U.S. fiscal and reimbursement policy (e.g., potential loss of Medicaid coverage for millions of Americans, value-based care models, and increased focus on procedure cost-effectiveness) could negatively influence hospital budgets, reimbursement rates, and procedural demand, placing downward pressure on both utilization rates and overall company revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $581.454 for Intuitive Surgical based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $675.0, and the most bearish reporting a price target of just $350.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $13.1 billion, earnings will come to $3.5 billion, and it would be trading on a PE ratio of 75.4x, assuming you use a discount rate of 7.0%.

- Given the current share price of $511.0, the analyst price target of $581.45 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.