Narratives are currently in beta

Key Takeaways

- Strategic moves to expand production capacity and modify sales plans aim to stabilize revenue and capitalize on new product demand.

- Robust cash flow from improved working capital management supports future growth initiatives and earnings stability.

- Reliance on FDA approval for the new pump and increased operating expenses could impact projected revenue growth and net margins.

Catalysts

About IRADIMED- Develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally.

- IRadimed is progressing towards FDA clearance for its new pump, expected in Q2 2025, which could drive revenue growth with initial revenue anticipated in Q4 2025. This is likely to increase overall revenue once the new product hits the market.

- The expansion into a new headquarters, which aims to enhance production capacity for the new pump, suggests improved operational efficiency and potential scalability in manufacturing, impacting future earnings positively.

- The company's strategic focus on modifying sales plans to emphasize monitor sales in early 2025, compensating for expected transitional dips in pump sales, could stabilize overall revenue and prevent significant revenue shortfalls before the new pump is launched.

- Anticipated changes in sales territories and potential expansion of the sales force aim to handle expected demand from the new pump, optimizing sales strategies to maximize revenue and maintain net margins.

- Strong cash flow from operations growing to $9.1 million, from $1.4 million the previous year, due to efficiencies in working capital management, indicates robust financial health that can support future growth initiatives and potentially enhance earnings stability.

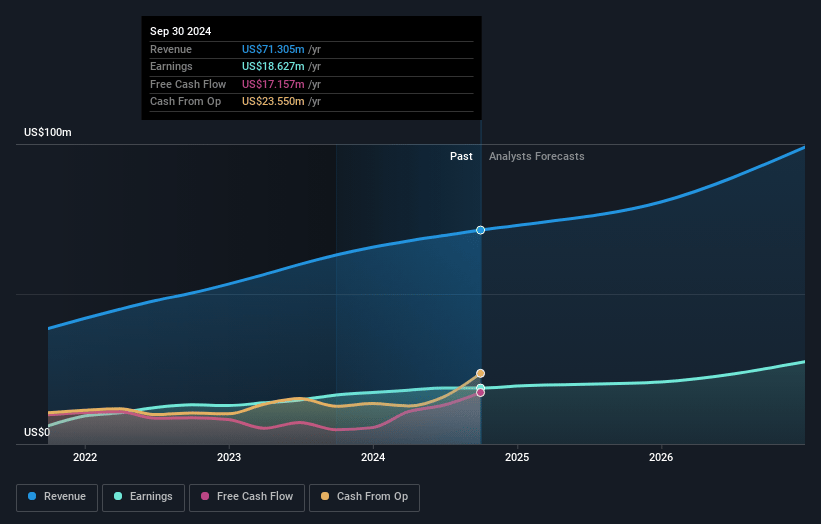

IRADIMED Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IRADIMED's revenue will grow by 14.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.1% today to 27.6% in 3 years time.

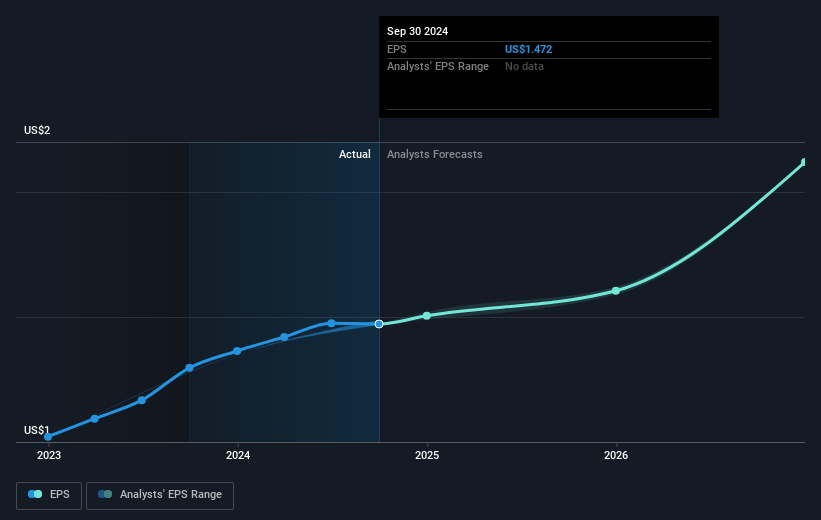

- Analysts expect earnings to reach $29.7 million (and earnings per share of $2.28) by about November 2027, up from $18.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.7x on those 2027 earnings, down from 37.7x today. This future PE is lower than the current PE for the US Medical Equipment industry at 37.2x.

- Analysts expect the number of shares outstanding to grow by 0.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

IRADIMED Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on FDA clearance for the new pump represents a significant risk. Delays or issues could impact projected revenue growth timelines as the anticipated revenue from the new pump is not expected to start significantly until 2026.

- Operating expenses have increased as a percentage of revenue with sales commission expenses rising. This may suggest challenges in maintaining net margins if revenue growth does not outpace these expenses.

- The shift in focus from the current pump to the new monitor could result in a temporary revenue dip during the transition period, impacting revenue consistency in mid-2025.

- The unpredictable nature of FDA processes and potential for delays or additional requirements create uncertainty around earnings timelines, particularly for revenue forecasts linked to new product launches.

- The emphasis on expanding sales territories and increasing the sales team requires careful execution. Missteps could lead to increased costs without a proportional revenue increase, impacting net margins and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $60.0 for IRADIMED based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $107.5 million, earnings will come to $29.7 million, and it would be trading on a PE ratio of 31.7x, assuming you use a discount rate of 6.4%.

- Given the current share price of $55.45, the analyst's price target of $60.0 is 7.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives