Key Takeaways

- GoodRx aims to boost revenue by expanding Pharma Manufacturer Solutions and enhancing the prescription marketplace, aligning with partners' economic needs.

- Strategic initiatives focus on pharmacy profitability, prescriber tools, and e-commerce expansion, promising sustained growth and market share gains.

- Competitive and economic pressures, regulatory changes, and evolving pharmacy models pose risks to GoodRx's transaction revenue and future growth potential.

Catalysts

About GoodRx Holdings- Offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States.

- GoodRx is focusing on expanding its Pharma Manufacturer Solutions, which grew 26% year-over-year. By becoming the starting point for brand medication access and enhancing its prescription marketplace, GoodRx aims to secure better revenue terms and broaden its solution set, potentially boosting revenue and market share significantly.

- The company is committed to enhancing pharmacy profitability through innovative partnerships, leading to a reported 20% increase in partner pharmacies' profitability per script. This approach could bolster revenue by aligning with retailers' economic needs and driving innovation in the prescription experience.

- GoodRx's Integrated Savings Program (ISP) seeks to expand further into non-covered brand drugs, thereby bridging coverage gaps and adding value for both consumers and PBMs. This expansion could contribute to increased revenue by attracting more consumers to GoodRx's higher savings platform.

- Executing on e-commerce capabilities, as demonstrated with offerings like the first over-the-counter birth control pill, GoodRx is entering new addressable markets. This e-commerce infrastructure could drive incremental revenue growth by integrating pharmaceutical brands directly into the GoodRx platform.

- The company's strategic initiatives include building out the prescriber's office as a conduit to market. By optimizing tools for healthcare professionals, GoodRx aims to drive patient adherence and create a seamless prescribing experience, which should, in turn, sustain long-term earnings growth.

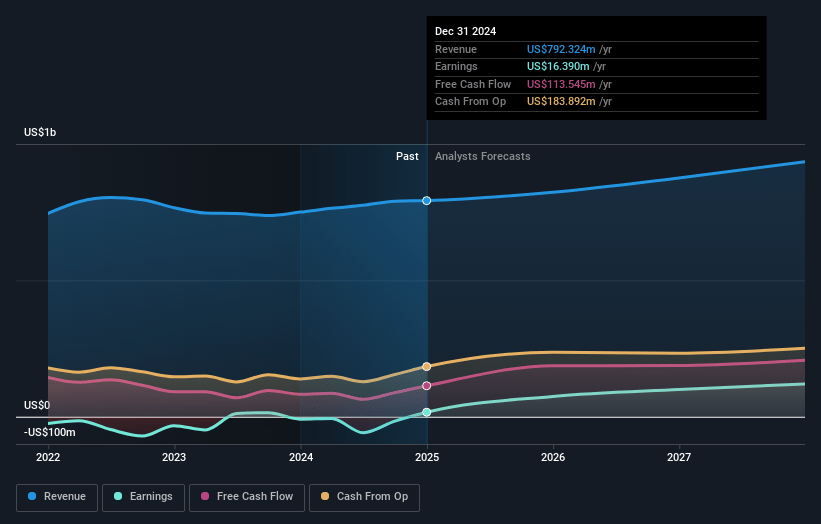

GoodRx Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GoodRx Holdings's revenue will grow by 5.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 12.9% in 3 years time.

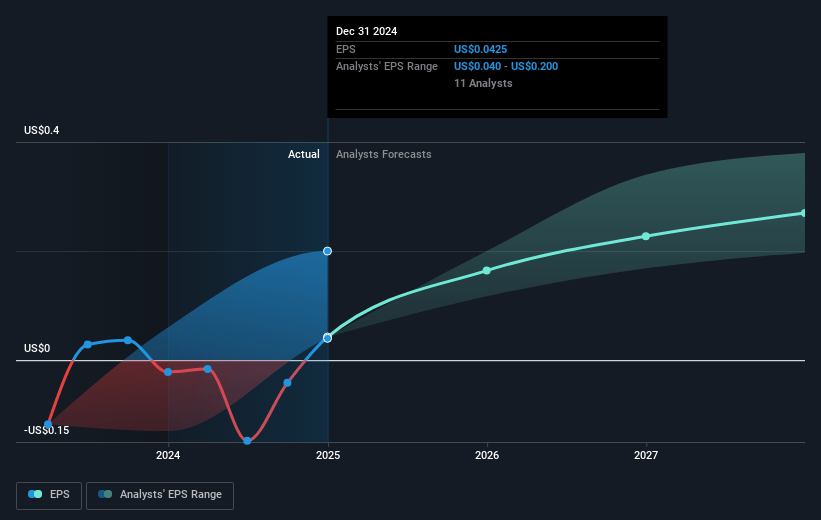

- Analysts expect earnings to reach $120.3 million (and earnings per share of $0.27) by about May 2028, up from $16.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $162.9 million in earnings, and the most bearish expecting $83.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.3x on those 2028 earnings, down from 108.4x today. This future PE is lower than the current PE for the US Healthcare Services industry at 53.2x.

- Analysts expect the number of shares outstanding to grow by 2.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.21%, as per the Simply Wall St company report.

GoodRx Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Competitive pressures from retail pharmacies and pharmacy benefit managers (PBMs) may impact GoodRx’s transaction revenue, as headwinds in retail pharmacy could affect consumer volume and script fills.

- Economic headwinds such as rationalization and potential store closures by pharmacy partners may continue to present risks, potentially leading to short-term disruptions in transaction volume and affecting consumer engagement metrics.

- Changes in pharmacy reimbursement dynamics, including the introduction of alternative models like cost-plus pricing by certain pharmacy partners, could challenge GoodRx's ability to maintain aligned economic models and stable revenue per script.

- Regulatory changes targeting transparency and lower prices in the drug market could introduce uncertainties, potentially impacting margins and revenue related to manufacturer solutions and advertising partnerships.

- The sunset of specific programs, such as retailer-specific prescription savings partnerships, has previously impacted subscription revenues, and the slow rollout of new initiatives like the ISP wrap program may introduce risks to future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.562 for GoodRx Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $4.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $935.0 million, earnings will come to $120.3 million, and it would be trading on a PE ratio of 28.3x, assuming you use a discount rate of 8.2%.

- Given the current share price of $4.63, the analyst price target of $6.56 is 29.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.