Key Takeaways

- Expanded product offerings, like the atopic dermatitis test, alongside increased market penetration could drive future revenue and growth.

- Strong clinician adoption, particularly for TissueCypher, coupled with a growing sales force, supports continued revenue expansion.

- Noncoverage by Medicare for DecisionDx-SCC and declining volumes for IDgenetix could significantly decrease revenue, while cost increases pressure margins.

Catalysts

About Castle Biosciences- Provides testing solutions for the diagnosis and treatment of dermatologic cancers, Barrett’s esophagus, uveal melanoma, and mental health conditions.

- The anticipated launch of the atopic dermatitis gene expression profile test by the end of 2025 could further expand Castle Biosciences' product offerings, potentially driving increased future revenue and market penetration.

- Market penetration growth for DecisionDx-Melanoma and DecisionDx-SCC provides significant room for expansion, with only 28% and 8% market penetration respectively, which could enhance future revenue streams as these tests gain wider adoption.

- Strong growth and clinician adoption of the TissueCypher test, with a 130% increase in reports year-over-year and positive reception from the gastroenterology community, could contribute significantly to revenue growth as market penetration increases.

- Investment in the expansion of the TissueCypher commercial team, with plans to significantly grow the sales force, supports increased test adoption and revenue growth potential.

- Efforts to regain Medicare reimbursement for DecisionDx-SCC, despite the current noncoverage determination by Novitas, could restore a revenue stream if successful, impacting future earnings positively.

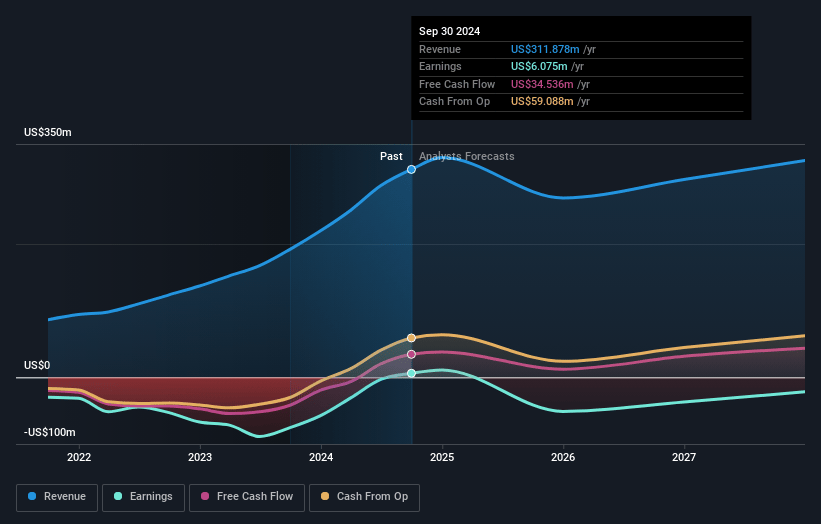

Castle Biosciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Castle Biosciences's revenue will decrease by 1.3% annually over the next 3 years.

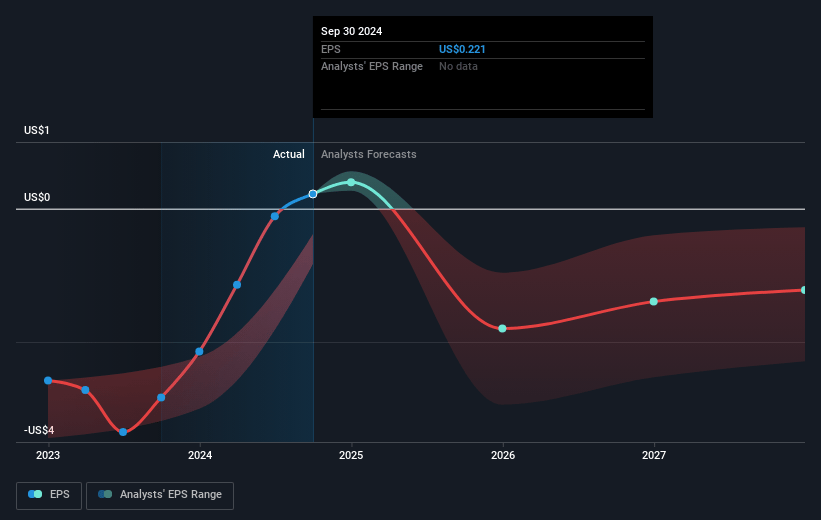

- Analysts are not forecasting that Castle Biosciences will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Castle Biosciences's profit margin will increase from 5.5% to the average US Healthcare industry of 4.9% in 3 years.

- If Castle Biosciences's profit margin were to converge on the industry average, you could expect earnings to reach $15.6 million (and earnings per share of $0.5) by about May 2028, down from $18.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 91.0x on those 2028 earnings, up from 31.4x today. This future PE is greater than the current PE for the US Healthcare industry at 23.6x.

- Analysts expect the number of shares outstanding to grow by 3.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Castle Biosciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential noncoverage by Medicare for the DecisionDx-SCC test after April 24, 2025, could significantly reduce revenues associated with this test if Medicare reimbursement is not reinstated.

- The company's high sensitivity to seasonality and working days might indicate unpredictability in revenue, as seen with fewer reports during holiday periods affecting earnings projections.

- Declining volumes and uncertain long-term performance of the IDgenetix test may continue to decrease revenue and net revenues in this segment.

- Increased operating expenses due to expansions in personnel, sales-related activities, and R&D can put pressure on net margins if revenue growth does not match these cost increases.

- There is a reliance on expanding market penetration in competitive segments like melanoma, where significant untapped market potential must be successfully converted into actionable growth to sustain earnings momentum.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.333 for Castle Biosciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $44.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $319.6 million, earnings will come to $15.6 million, and it would be trading on a PE ratio of 91.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of $19.85, the analyst price target of $38.33 is 48.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.