Key Takeaways

- Strategic partnerships and global expansion aim to boost revenue and earnings through enhanced technology access and new pharma agreements.

- Efficiency-focused hospital products and increased trial capabilities target significant market growth and improved net margins.

- Heavy reliance on cell and gene therapy market growth, rising operational costs, and competitive pressures pose risks to revenue and market share.

Catalysts

About ClearPoint Neuro- Operates as a medical device company primarily in the United States.

- ClearPoint's Fast. Forward. phase aims to extend its lead in cell and gene therapy delivery by leveraging its comprehensive drug delivery ecosystem, which is expected to drive future revenue through increased partnerships and commercialization with over 60 active biopharma partners.

- The company's planned product launches for fast, simple, and predictable workflows in hospital settings are designed to increase efficiency and throughput, which could enhance net margins by streamlining operations and reducing procedure times.

- The expansion of its global installed base and the potential for additional regulatory approvals in 2025 could significantly increase revenue by enabling more patients access to ClearPoint’s technology worldwide.

- ClearPoint's strategy includes executing long-term strategic agreements with pharma partners, incorporating milestone payments and royalty revenue, which should positively impact future earnings as these agreements start to generate income.

- Planned increases in preclinical and clinical trial engagements, supported by expanded GLP capabilities, are expected to capture a larger portion of an estimated $300 million annual market opportunity, contributing to strong revenue growth.

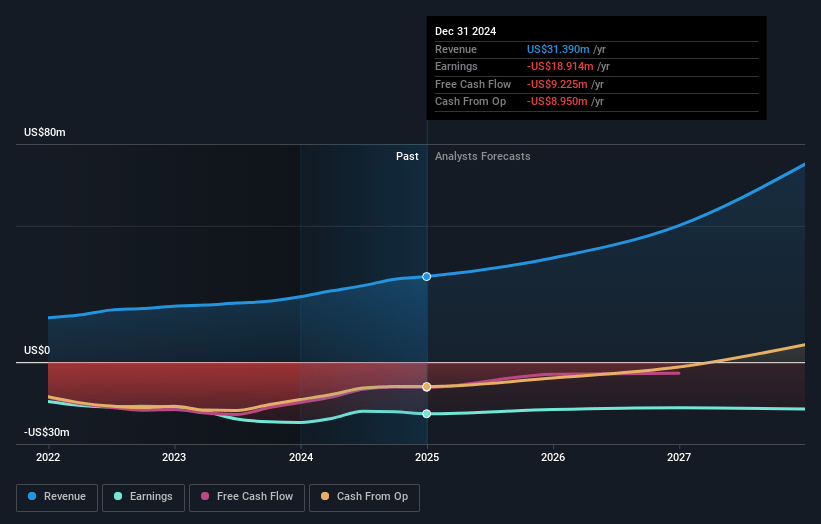

ClearPoint Neuro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ClearPoint Neuro's revenue will grow by 32.2% annually over the next 3 years.

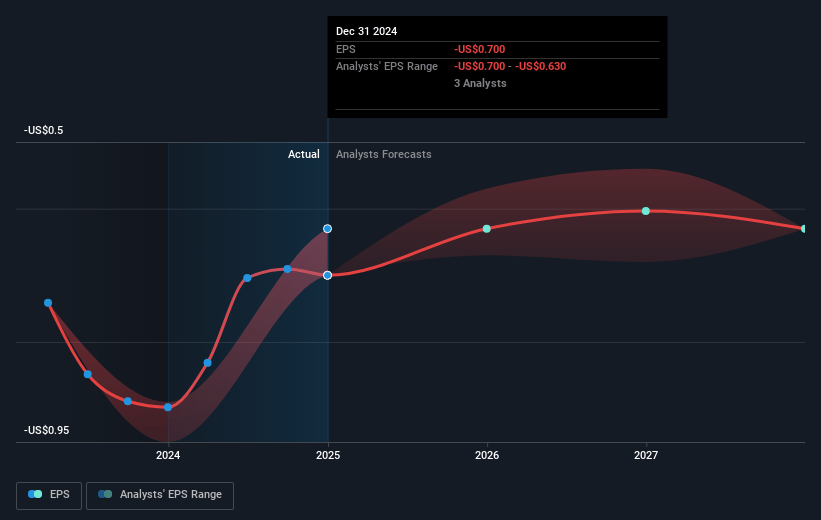

- Analysts are not forecasting that ClearPoint Neuro will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate ClearPoint Neuro's profit margin will increase from -60.3% to the average US Medical Equipment industry of 12.9% in 3 years.

- If ClearPoint Neuro's profit margin were to converge on the industry average, you could expect earnings to reach $9.4 million (and earnings per share of $0.33) by about May 2028, up from $-18.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 101.0x on those 2028 earnings, up from -21.7x today. This future PE is greater than the current PE for the US Medical Equipment industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.91%, as per the Simply Wall St company report.

ClearPoint Neuro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue relies heavily on future growth in the cell and gene therapy market, which could be uncertain, impacting revenue projections if these therapies do not achieve anticipated commercial success.

- Rising operational expenses, notably in research and development, sales, and marketing, could pressure net margins unless offset by significant revenue growth.

- The need for continuous investment in product development and global expansion could strain cash flow, especially if additional facilities and regulatory clearances do not yield expected returns.

- Current cash burn, despite reductions, indicates dependency on managing operational cash effectively; failure to sustain sales growth could impact earnings.

- The competitive landscape, with potential rivals developing similar technologies, could challenge market share and influence future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $27.667 for ClearPoint Neuro based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $72.6 million, earnings will come to $9.4 million, and it would be trading on a PE ratio of 101.0x, assuming you use a discount rate of 6.9%.

- Given the current share price of $14.67, the analyst price target of $27.67 is 47.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.