Key Takeaways

- Strategic acquisitions and technological investments are expected to drive revenue growth and operational efficiencies, enhancing the company's long-term earnings.

- Increasing value-based contracts and efficient cost management are projected to improve net margins and sustain financial performance.

- Strategic growth initiatives and integration costs are impacting profitability, with regulatory uncertainties and value-based contract transitions posing additional risks to revenue and margins.

Catalysts

About Astrana Health- Astrana Health, Inc., Inc., a physician-centric technology-powered healthcare management company, provides medical care services in the United States.

- Astrana Health is focused on sustainably growing its membership and expanding access, which is driving significant revenue growth. This is expected to continue impacting revenue positively as membership increases, especially in their Care Partners segment.

- The company is deepening its alignment with value-based contracts, with approximately 73% of total capitation revenue derived from full risk arrangements by the end of 2024. This strategic shift is anticipated to improve net margins as the company becomes more efficient in managing patient outcomes and healthcare costs over time.

- Astrana Health is investing in its proprietary Care Enablement platform and AI-driven enhancements to improve efficiency and scalability. These technological advancements are expected to yield approximately $10 million in operational efficiencies by early 2026, positively impacting net margins.

- The company is engaging in strategic acquisitions, such as Collaborative Health Systems and Prospect Health, expected to contribute significantly to revenue growth (e.g., $350-400 million from CHS in 2025) and drive operating leverage through integration, improving long-term earnings.

- Astrana Health is maintaining a strategic focus on managing medical cost trends efficiently, which should help mitigate expense increases and improve net margins. Their utilization management showed less impact than industry averages, positioning them well for sustained financial performance improvements.

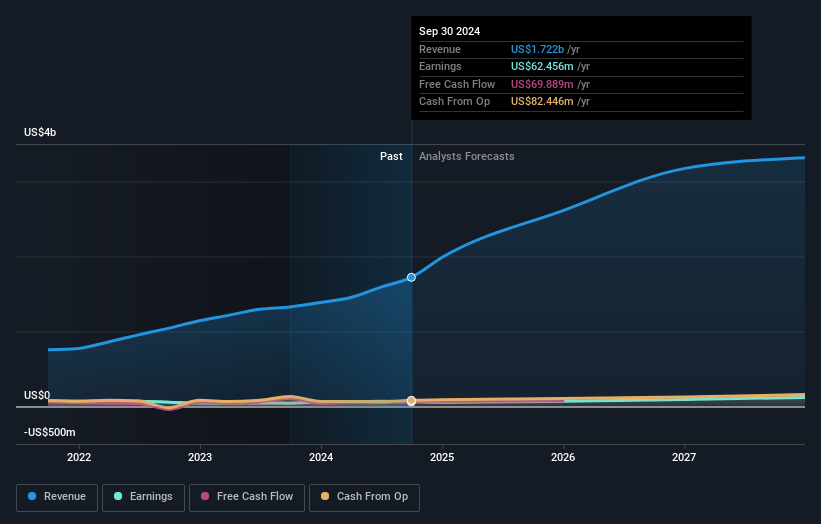

Astrana Health Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Astrana Health's revenue will grow by 19.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 3.8% in 3 years time.

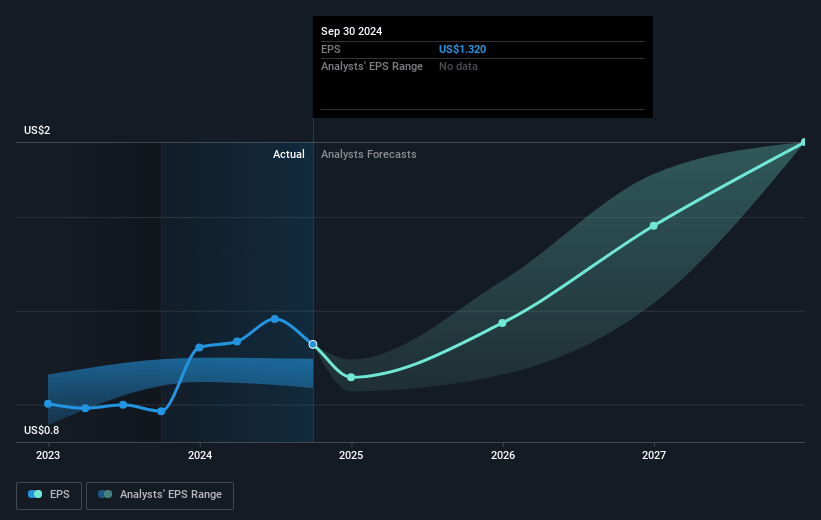

- Analysts expect earnings to reach $132.2 million (and earnings per share of $2.68) by about March 2028, up from $43.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.0x on those 2028 earnings, down from 37.2x today. This future PE is greater than the current PE for the US Healthcare industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 2.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.29%, as per the Simply Wall St company report.

Astrana Health Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Astrana Health's strategic growth initiatives and integrations caused a $13 million drag to earnings in 2024, which suggests future expansion efforts might further impact net margins and earnings before they stabilize.

- The transition to full risk arrangements in value-based contracts, while strategically sound in the long-term, can initially result in lower margins as unit economics take time to improve, affecting short-term profitability.

- Astrana’s 5.3% utilization trend in 2024, although lower than the industry average, was still significant, and maintenance of similar trends in 2025 without corresponding rate increases could pressure net margins.

- Ongoing integration costs, especially relating to new acquisitions like Prospect Health, are expected to impact financial performance, potentially delaying expected contribution to earnings growth.

- Regulatory and reimbursement uncertainties, particularly around Medicaid and any potential changes in Medicare Advantage rates, could pose risks to revenue and margin forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $51.9 for Astrana Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $132.2 million, and it would be trading on a PE ratio of 25.0x, assuming you use a discount rate of 6.3%.

- Given the current share price of $32.03, the analyst price target of $51.9 is 38.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.