Key Takeaways

- The launch of the AYON Body Contouring System may significantly drive revenue growth through market expansion and increased equipment sales.

- Apyx Medical's restructuring and direct-to-consumer strategy are set to optimize costs, enhance brand presence, and boost revenue growth.

- Shifts in discretionary spending, delayed equipment purchases, and workforce cuts suggest potential challenges to Apyx Medical's revenue growth and profitability.

Catalysts

About Apyx Medical- An energy technology company, designs, develops, manufactures, and sells electrosurgical equipment and medical devices in the United States and internationally.

- The anticipated launch of the AYON Body Contouring System in the back half of 2025 is a key catalyst for potential revenue growth. This product's unique integration capabilities may expand Apyx Medical's total addressable market in aesthetic surgery and could drive equipment sales growth.

- The recent restructuring program, which led to a nearly 25% reduction in the U.S. workforce, is expected to generate approximately $4.3 million in annualized cost savings. This initiative is aimed at optimizing operations and is likely to improve net margins by reducing overall operating expenses to below $40 million in 2025.

- Apyx Medical's ongoing direct-to-consumer marketing strategy, launched in 2024, has significantly increased brand awareness and consumer demand, which is expected to continue to positively impact revenue growth as more consumers seek their aesthetic solutions.

- The strong positioning of Apyx Medical's Renuvion system as the only FDA-cleared device for post-liposuction body contouring offers a significant market advantage. As more patients seek surgical solutions to address skin laxity post-GLP-1 weight loss, revenue from these procedures is expected to grow.

- Ongoing efforts to strengthen the financial health of the company, such as the $6.8 million registered direct offering and the amendment of the credit agreement with Perceptive Credit Holdings, are likely to enhance earnings stability and provide greater financial flexibility for growth initiatives.

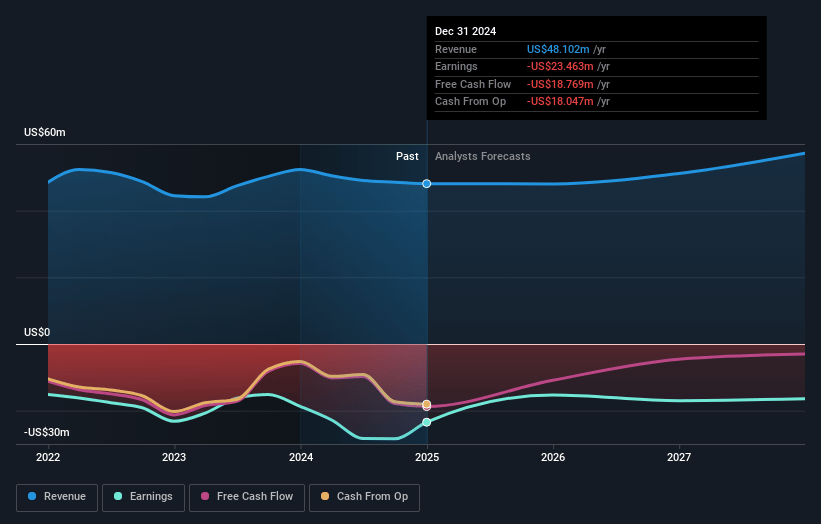

Apyx Medical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Apyx Medical's revenue will grow by 6.0% annually over the next 3 years.

- Analysts are not forecasting that Apyx Medical will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Apyx Medical's profit margin will increase from -48.8% to the average US Medical Equipment industry of 12.9% in 3 years.

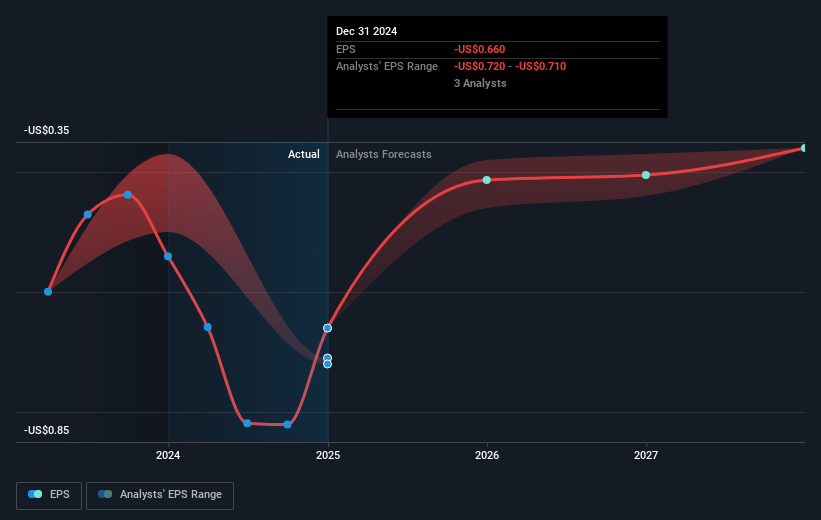

- If Apyx Medical's profit margin were to converge on the industry average, you could expect earnings to reach $7.4 million (and earnings per share of $0.16) by about April 2028, up from $-23.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.3x on those 2028 earnings, up from -1.5x today. This future PE is greater than the current PE for the US Medical Equipment industry at 29.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.1%, as per the Simply Wall St company report.

Apyx Medical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The adoption of GLP-1 drugs for weight loss is causing patients to delay aesthetic treatments, redirecting their discretionary spending towards these drugs and potentially impacting Apyx Medical's future revenue growth in the aesthetic space.

- The delay in purchasing capital equipment by plastic and cosmetic surgeons due to declining revenues in their practices could slow down Apyx's equipment sales and impact earnings.

- The company reported a 3% decrease in total revenue for the fourth quarter compared to the previous year, which could indicate underlying challenges affecting the company’s ability to increase future revenues.

- International sales decreased 8% year-over-year, primarily due to a decrease in sales of new generators, which could impact the company's global revenue growth if not addressed.

- A recent 25% reduction in the U.S. workforce suggests operational and financial challenges that might influence long-term net margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.0 for Apyx Medical based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $57.2 million, earnings will come to $7.4 million, and it would be trading on a PE ratio of 32.3x, assuming you use a discount rate of 9.1%.

- Given the current share price of $0.94, the analyst price target of $4.0 is 76.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.