Key Takeaways

- Expansion into Europe and DSO market focus are poised to drive revenue growth through innovation and strategic collaborations.

- New product launches and pricing strategies aim to enhance revenue and net margins via differentiation and transaction volume increases.

- Stagnant U.S. market growth, unfavorable currency impacts, and potential tariff costs threaten Align's orthodontic revenue, despite potential volume increases.

Catalysts

About Align Technology- Designs, manufactures, and markets Invisalign clear aligners, Vivera retainers, and iTero intraoral scanners and services in the United States, Switzerland, and internationally.

- The commercial launch and expected expansion of the Invisalign Palatal Expander system in Europe, the UK, and EMEA regions in 2025 could drive higher revenue by expanding the market for younger patients and providing new solutions for orthodontic treatments.

- The release of the iTero Lumina intraoral scanner with orthodontic and restorative capabilities in Q1 '25 is anticipated to boost Systems and Services revenues, potentially increasing the company's overall revenue growth for the year.

- The implementation of Invisalign First direct 3D printed retainers and the Mandibular Advancement with Occlusal Blocks in 2025 could enhance product differentiation and adoption, particularly in younger demographics, thereby driving revenue and potentially expanding net margins with innovative technology offerings.

- A strategic focus on the DSO (Dental Support Organizations) market, evidenced by equity investments and collaborations, is expected to contribute to revenue growth in North America, leveraging digital workflows to improve practice efficiencies.

- The removal of processing fees coupled with pricing adjustments seeks to reduce friction in sales transactions, maintain ASPs, and encourage increased volume of aligner transactions, impacting net margins by sustaining customer satisfaction and loyalty.

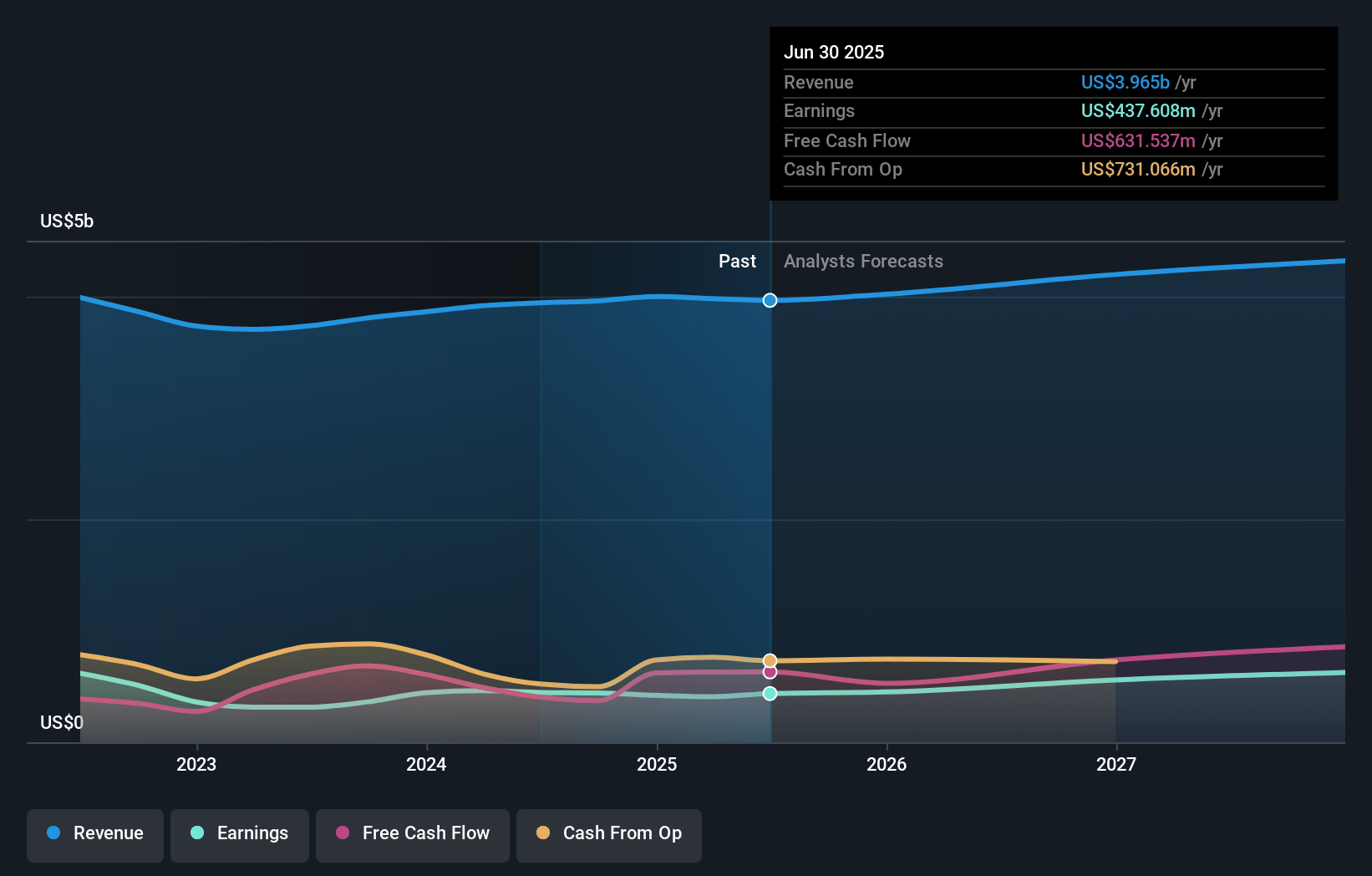

Align Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Align Technology's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.5% today to 15.6% in 3 years time.

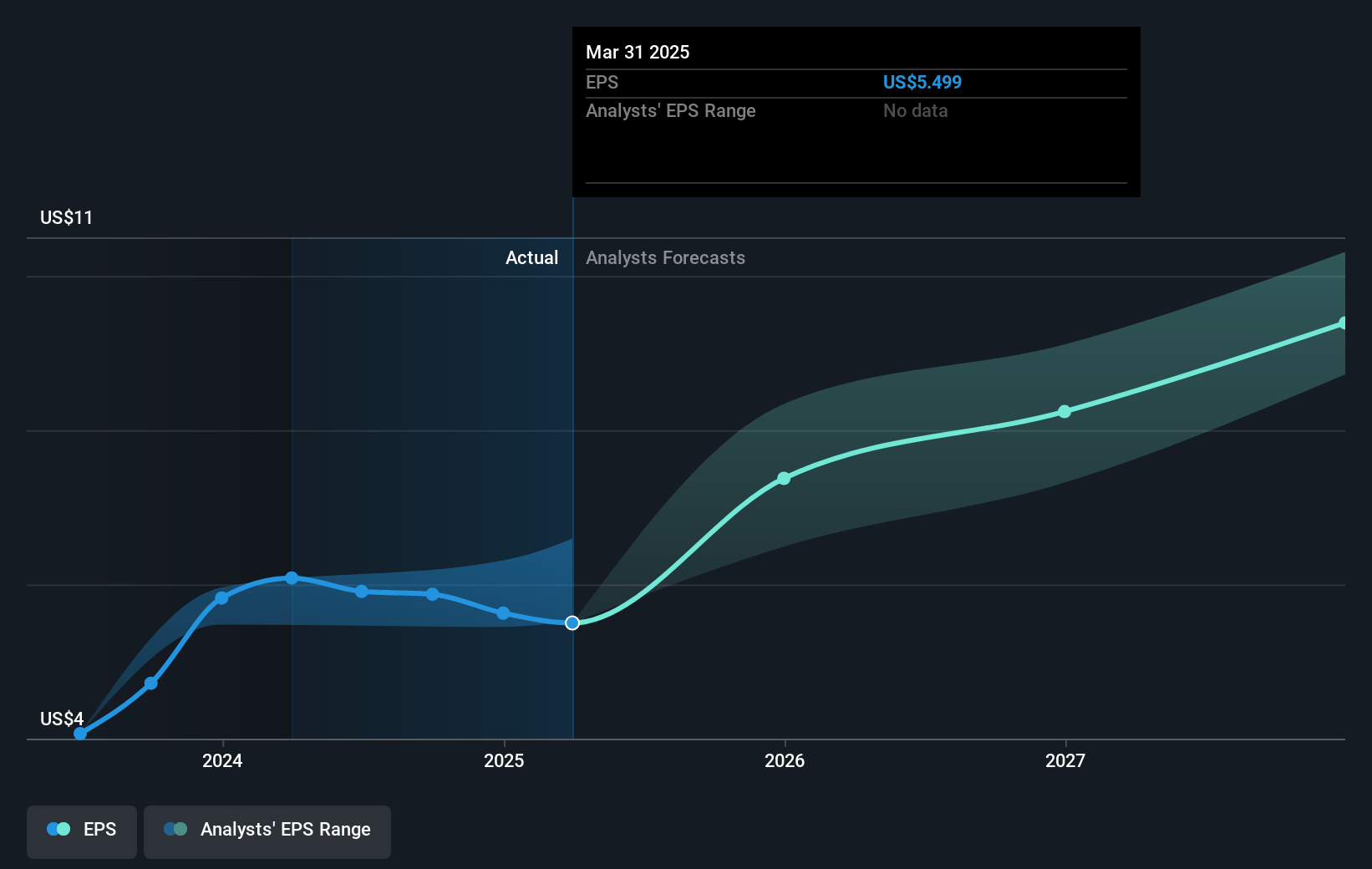

- Analysts expect earnings to reach $719.2 million (and earnings per share of $9.77) by about April 2028, up from $421.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.1x on those 2028 earnings, down from 30.2x today. This future PE is lower than the current PE for the US Medical Equipment industry at 29.5x.

- Analysts expect the number of shares outstanding to decline by 2.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Align Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Unfavorable foreign exchange impacts, particularly from the strengthening U.S. dollar against major currencies, have reduced Clear Aligner ASPs and could continue to impact revenues negatively if currency trends persist.

- The potential implementation of new tariffs on products shipped from Mexico to the U.S. may increase costs significantly, impacting net margins if manufacturing strategies are not adjusted.

- Competition and economic factors have led to a stagnant orthodontic market in the U.S., particularly affecting revenues in the Clear Aligner segment due to a dependency on growth in this crucial region.

- The orthodontic channel, specifically in the North American market, has not shown significant growth in three years, potentially limiting revenue expansion given Align's substantial exposure to this market.

- Continued product mix shifts to non-comprehensive Clear Aligners and higher discounts could exert downward pressure on ASPs, affecting revenue growth despite volume increases.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $234.703 for Align Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $290.0, and the most bearish reporting a price target of just $150.54.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.6 billion, earnings will come to $719.2 million, and it would be trading on a PE ratio of 27.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $173.87, the analyst price target of $234.7 is 25.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives