Key Takeaways

- Strategic acquisitions and synergies are expected to enhance revenue growth, EBITDA contributions, and broaden service offerings for Addus HomeCare.

- Rate increases and operational improvements are poised to drive organic growth, improve margins, and enhance overall earnings.

- Changes to Medicaid funding, integration challenges, and high turnover rates could impact Addus HomeCare's financial stability, operations, and net margins.

Catalysts

About Addus HomeCare- Provides personal care services to elderly, chronically ill, disabled persons, and individuals who are at risk of hospitalization or institutionalization in the United States.

- Addus HomeCare's recent acquisition of Gentiva Personal Care significantly expanded its market coverage and added approximately $280 million in annualized revenues. This positions Addus for enhanced revenue growth and EBITDA contributions as synergies and integration progress.

- The company expects to benefit from a 5.5% rate increase for personal care services in Illinois, effective January 1, 2025, contributing an estimated $23 million in annualized revenue with improved margins, positively impacting overall earnings and net margins.

- Addus HomeCare's strategic approach to acquisitions aims to leverage its strong personal care presence by adding clinical services, enabling the company to offer comprehensive home-based care, which is expected to enhance revenue streams and earnings over time.

- The comprehensive integration of Gentiva's operations, including systems and leadership alignment, is anticipated to generate cost synergies and operational efficiencies, enhancing EBITDA margins in the longer term.

- Addus' focus on improving service percentages and enhancing utilization via technological tools for caregivers is expected to drive organic growth in personal care hours, supporting revenue growth and strengthening earnings.

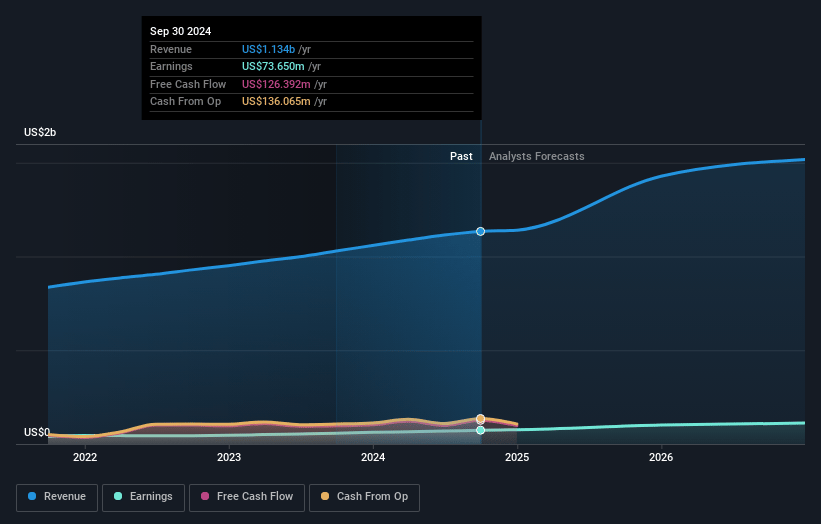

Addus HomeCare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Addus HomeCare's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.4% today to 7.4% in 3 years time.

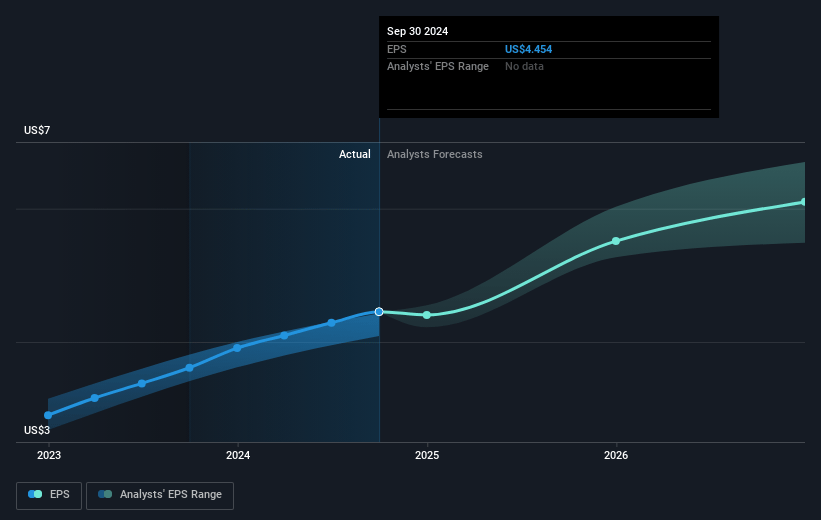

- Analysts expect earnings to reach $122.7 million (and earnings per share of $6.82) by about March 2028, up from $73.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.9x on those 2028 earnings, up from 22.2x today. This future PE is greater than the current PE for the US Healthcare industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Addus HomeCare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential changes to federal Medicaid funding, such as per capita caps and lowering of the FMAP floor, could pressure revenues if states receive less financial support from the federal government, impacting the company's financial stability.

- The ongoing discussions about Medicaid policy changes create uncertainty, which could deter investment and affect the company's ability to plan financially for future earnings.

- The integration challenges and system changes related to the Gentiva acquisition may disrupt operations, possibly affecting net margins if expected efficiencies are not realized promptly.

- Seasonal and weather-related impacts, such as winter storms, can reduce service hours and revenue, which may lower quarterly earnings, especially if extreme weather becomes more frequent.

- High turnover rates in the Personal Care Services segment and difficulties in clinical hiring could lead to increased recruitment and training costs, potentially affecting both net margins and financial performance over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $136.273 for Addus HomeCare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $83.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $122.7 million, and it would be trading on a PE ratio of 27.9x, assuming you use a discount rate of 6.2%.

- Given the current share price of $91.01, the analyst price target of $136.27 is 33.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.