Key Takeaways

- Strategic acquisitions and expanded drilling programs in multiple countries are expected to enhance revenue and improve net margins through diversification and efficiency.

- Focused debt reduction aims to lower interest expenses, supporting stronger future earnings and financial stability.

- Rising operating costs, production risks, integration challenges, geopolitical unpredictability, and exploration investments create potential financial challenges and impact future earnings reliability for Gran Tierra Energy.

Catalysts

About Gran Tierra Energy- Engages in the exploration and production of oil and gas properties in Colombia and Ecuador.

- Gran Tierra Energy projects a significant increase in production for 2025, expecting to achieve 47,000 to 53,000 BOE per day, primarily driven by expanded drilling programs in Colombia, Ecuador, and Canada, which should positively impact revenue.

- The company plans to allocate 25% of its capital program to exploration, particularly in Ecuador, expecting to lead to more discovery and development opportunities by moving towards the development phase after fulfilling exploration commitments, enhancing future revenue potential.

- Gran Tierra completed a strategic acquisition of Canadian assets, integrating these into their portfolio, which diversifies their resource base and is expected to provide synergistic efficiency improvements, positively impacting net margins.

- The company achieved record high reserves in 2024, with significant reserve replacement ratios, setting a foundation for long-term growth and stability in earnings through the development of proven reserves.

- Gran Tierra Energy is focused on paying down debt, targeting $600 million gross debt by the end of 2026, which will reduce interest expenses and improve net margins, supporting stronger earnings in the future.

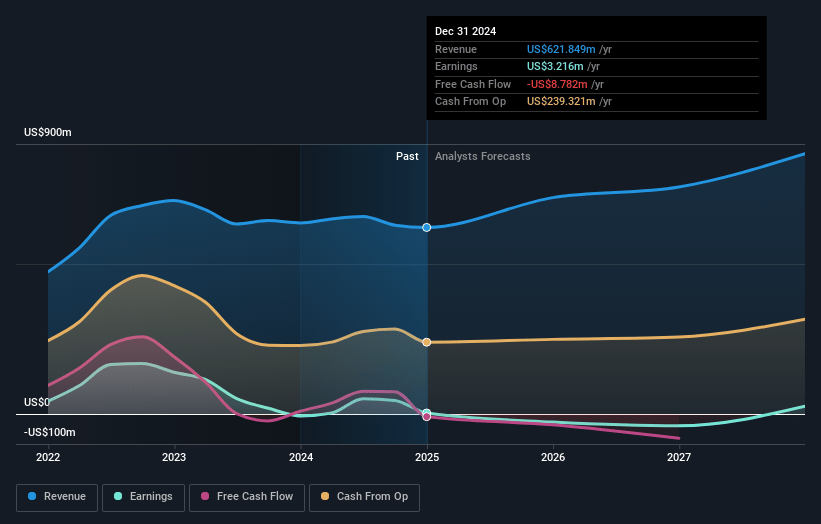

Gran Tierra Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gran Tierra Energy's revenue will grow by 11.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.5% today to 3.0% in 3 years time.

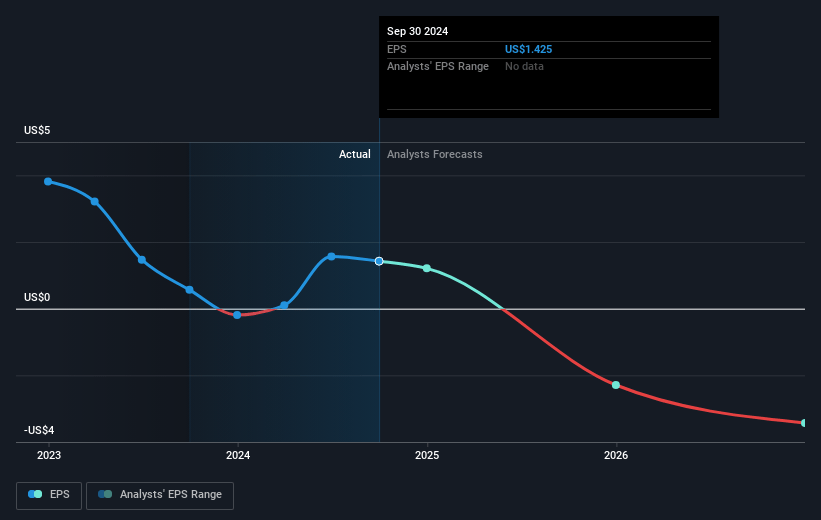

- Analysts expect earnings to reach $26.0 million (and earnings per share of $-0.13) by about March 2028, up from $3.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, down from 57.5x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Gran Tierra Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's operating costs increased by 8% in 2024, owing to factors such as higher workovers, the removal of diesel subsidies in Colombia, and increased natural gas and electricity costs. These elevated costs could impact net margins if not effectively managed.

- Despite achieving growth in reserves and production, there remains potential risk of production challenges in specific regions, such as the downtime from blockades in Suroriente and workovers in Acordionero, which could affect revenue and earnings reliability.

- The integration of newly acquired Canadian assets requires substantial oversight, and any delays or issues in this process could impact expected production efficiencies and profitability, thereby affecting earnings.

- Although Gran Tierra has managed to narrow discounts on Colombian crude (Vasconia and Castilla), unforeseen geopolitical changes or tariff implementations could still negatively affect sales prices and revenue streams reliant on regional markets.

- Gran Tierra's significant commitment to exploration activities, particularly in Ecuador, involves substantial capital investment, and if exploration results do not meet expectations, it could result in lower-than-expected returns on investment, impacting future net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.065 for Gran Tierra Energy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $867.5 million, earnings will come to $26.0 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 11.4%.

- Given the current share price of $5.15, the analyst price target of $8.06 is 36.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.