Narratives are currently in beta

Key Takeaways

- Strategic investments in refining technology and energy value chains are enhancing revenue and net margins, optimizing ExxonMobil's profitability.

- Acquisitions and innovations are boosting production efficiency and capturing emerging market trends, driving growth and future earnings.

- Execution and regulatory risks may delay major projects and integration efforts, impacting projections for revenue, margins, and cash flows.

Catalysts

About Exxon Mobil- Engages in the exploration and production of crude oil and natural gas in the United States and internationally.

- ExxonMobil's enterprise-wide transformation through reduced cost, high-return investments and selected divestments aimed at improving profitability, particularly in challenging market conditions, is expected to enhance future earnings by optimizing revenue and net margins.

- The integration of advanced refining technology, such as the Rotterdam advanced hydrocracker and Beaumont expansion, is increasing the yield of higher-value products, which should boost future revenue and improve net margins.

- The strategic acquisition and integration of Pioneer is leading to synergies and efficiencies that are likely to elevate production efficiency and reduce costs, thereby enhancing earnings from the upstream business.

- ExxonMobil's investment in new energy value chains, such as the world's largest low-carbon hydrogen production facility at Baytown, is poised to create significant growth opportunities, potentially increasing future revenue streams and improving net margins.

- Technological innovations in the Low Carbon Solutions business, including carbon capture and the development of the Proxxima thermoset resin, are expected to capitalize on emerging market trends, potentially driving revenue growth and expanding net margins.

Exxon Mobil Future Earnings and Revenue Growth

Assumptions

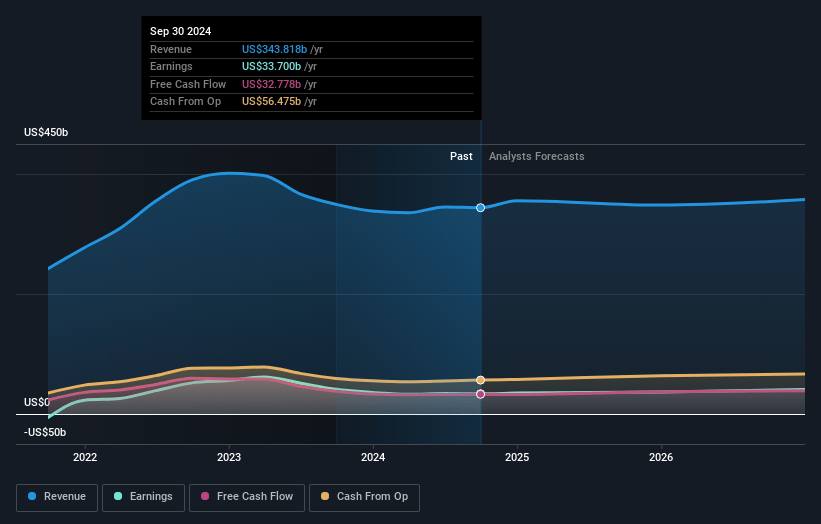

How have these above catalysts been quantified?- Analysts are assuming Exxon Mobil's revenue will decrease by -2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.8% today to 12.4% in 3 years time.

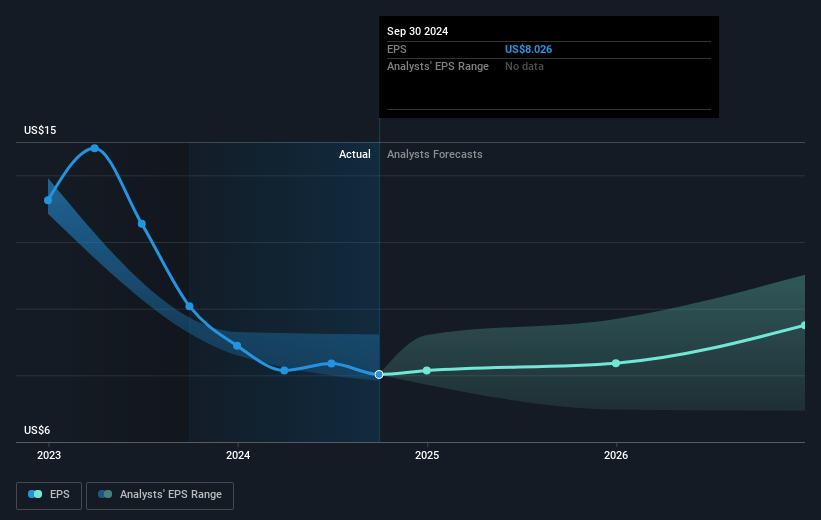

- Analysts expect earnings to reach $39.1 billion (and earnings per share of $9.5) by about November 2027, up from $33.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $45.5 billion in earnings, and the most bearish expecting $28.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2027 earnings, up from 15.8x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 2.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.12%, as per the Simply Wall St company report.

Exxon Mobil Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The long-term plans and integration efforts are still being developed and are subject to risks and uncertainties, which could impact future earnings projections if challenges arise. (Earnings)

- The potential delays or challenges in regulatory approvals, particularly for the world's largest low-carbon hydrogen production facility, could push back timelines and affect projected revenue streams. (Revenue)

- The impact of market trends and crack spread volatility on refining margins suggests that the company’s margins may soften if these market conditions continue or worsen. (Net Margins)

- Despite strong demand signals, project execution risks remain with significant LNG projects like Golden Pass and Northfield expansion, which could delay start-ups and impact projected revenue from these ventures. (Revenue)

- Although enhanced integration and technology synergies are expected from the Pioneer acquisition, execution risks and integration challenges may arise that could reduce the expected accretive impact on cash flows. (Cash Flow)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $131.17 for Exxon Mobil based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $149.0, and the most bearish reporting a price target of just $105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $315.3 billion, earnings will come to $39.1 billion, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 7.1%.

- Given the current share price of $121.47, the analyst's price target of $131.17 is 7.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

RI

Equity Analyst and Writer

ExxonMobil's Focus On Margins Rather Than Growth Will Help It Cash In On Tight Supply

Key Takeaways Oil supply will remain tight leading to a higher and more volatile oil price. Volatility will favor large well capitalized energy companies.

View narrativeUS$126.39

FV

4.8% undervalued intrinsic discount2.94%

Revenue growth p.a.

13users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

about 1 month ago author updated this narrative

ST

Equity Analyst and Writer

Wrong Side Of Energy Transition and Other Headwinds Will Erode Revenues and Earnings

Key Takeaways Exxon is on the wrong side of secular market trends that favor sustainable energy investing. Revenues are reliant on fossil fuels and are vulnerable to industry headwinds and a potential recession.

View narrativeUS$78.00

FV

54.2% overvalued intrinsic discount-1.00%

Revenue growth p.a.

5users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

5 months ago author updated this narrative