Key Takeaways

- Expansion in Offshore Energy Services and new government contracts could drive revenue growth and improve net margins with stable, long-term cash flows.

- Capital allocation strategy and debt reduction efforts are expected to enhance EPS, strengthen the balance sheet, and enable shareholder returns.

- Ongoing issues like accidents, regulatory challenges, and competition could hinder Bristow's revenue growth, contract renewals, and global operational efficiency.

Catalysts

About Bristow Group- Provides vertical flight solutions to integrated, national, and independent offshore energy companies and government agencies.

- The commencement and ongoing projects in the Offshore Energy Services (OES) segment, such as new contracts in Brazil and increased utilization in Africa, are expected to drive revenue growth. This suggests potential for higher revenues in the near future as these projects mature and demand remains consistent.

- The addition and transition of large government contracts, specifically UKSAR2G and Irish Coast Guard services, are expected to provide stable long-term cash flows with high credit-quality customers. This indicates potential improvement in net margins as the contracts fully ramp up and reach peak operational performance.

- The company's capital allocation strategy, including plans for opportunistic share buybacks and initiation of a quarterly dividend in 2026, could enhance earnings per share (EPS) by reducing the number of shares outstanding and returning capital to shareholders.

- Strong performance in Government Services as operations stabilize and penalties reduce, alongside resilient demand in fixed wing markets, is projected to increase operating income margins and boost earnings by 2026.

- A disciplined approach to debt reduction is set to strengthen the balance sheet, potentially lowering interest expenses and improving net earnings, while simultaneously enabling strategic growth opportunities and capital returns through dividends and share buybacks.

Bristow Group Future Earnings and Revenue Growth

Assumptions

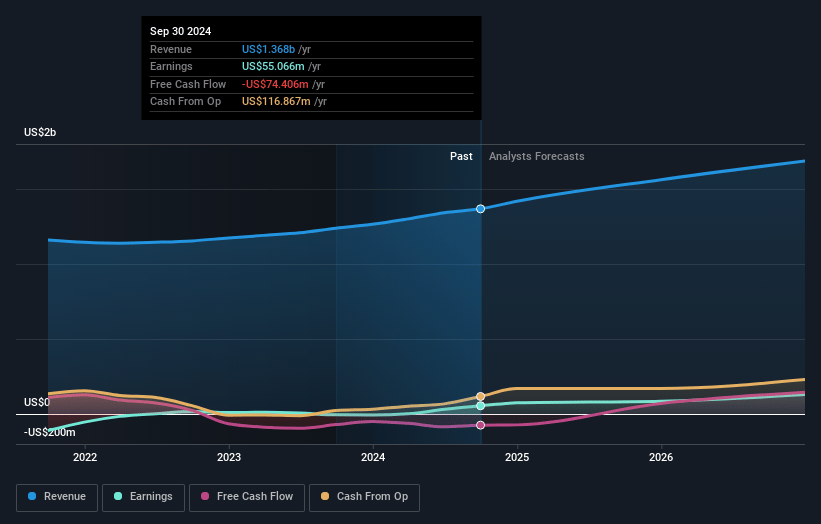

How have these above catalysts been quantified?- Analysts are assuming Bristow Group's revenue will grow by 9.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.7% today to 7.9% in 3 years time.

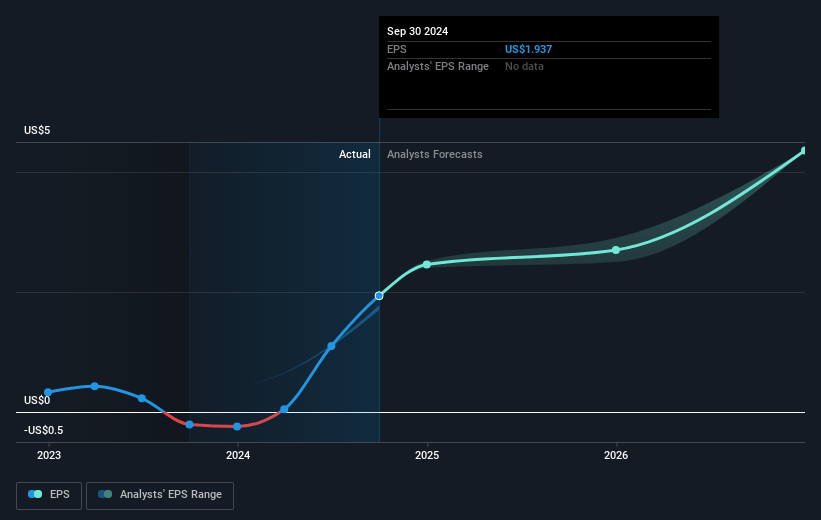

- Analysts expect earnings to reach $147.1 million (and earnings per share of $5.52) by about May 2028, up from $94.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, up from 9.0x today. This future PE is greater than the current PE for the US Energy Services industry at 10.5x.

- Analysts expect the number of shares outstanding to grow by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.49%, as per the Simply Wall St company report.

Bristow Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The tragic air accident in Norway, with ongoing investigations, could tarnish Bristow Group's reputation and affect future revenue and governmental trust in their operations, potentially influencing contract renewals or new opportunities.

- Unexpected regulatory challenges and supply chain delays in significant projects, like the UKSAR2G and Irish Coast Guard contracts, could extend operational timelines and increase costs, impacting net margins and earnings.

- Persistent foreign exchange losses and volatility could continue to negatively affect net income, particularly given the company's global operations and exposure to various currencies.

- Intense competition and market saturation in some regions, coupled with supply chain shortages, could impact aircraft availability, thereby limiting revenue growth opportunities in the Offshore Energy Services segment.

- Potential tariff impacts and international trade uncertainties could increase operational costs or delay equipment procurement, affecting both revenue and net margins, especially with the planned introduction of new helicopter models.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $48.5 for Bristow Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $147.1 million, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 9.5%.

- Given the current share price of $29.72, the analyst price target of $48.5 is 38.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.