Narratives are currently in beta

Key Takeaways

- Strategic debt reduction efforts are expected to strengthen earnings and improve stock valuation by decreasing financial risk.

- Expansion and innovative well designs in key basins are poised to increase production capacity, driving future revenue growth.

- Rapid strategic shifts and acquisitions carry integration and execution risks, affecting margins and potential growth amidst vulnerability to oil price fluctuations.

Catalysts

About Vital Energy- An independent energy company, engages in the acquisition, exploration, and development of oil and natural gas properties in the Permian Basin of West Texas, the United States.

- The Point acquisition is expected to increase production and reduce costs, positively impacting revenue and net margins.

- Cost reduction initiatives and operational efficiencies, such as optimized frac designs and well spacing, are projected to enhance profitability and net margins.

- The strategic focus on debt reduction using free cash flow is anticipated to strengthen earnings and improve stock valuation by decreasing financial risk.

- Expansion in the Barnett and Delaware Basin, coupled with innovative well designs, is poised to increase production capacity and drive future revenue growth.

- Enhanced inventory and a focus on high-return projects, supported by a strong hedge position, are set to improve capital efficiency and earnings sustainably.

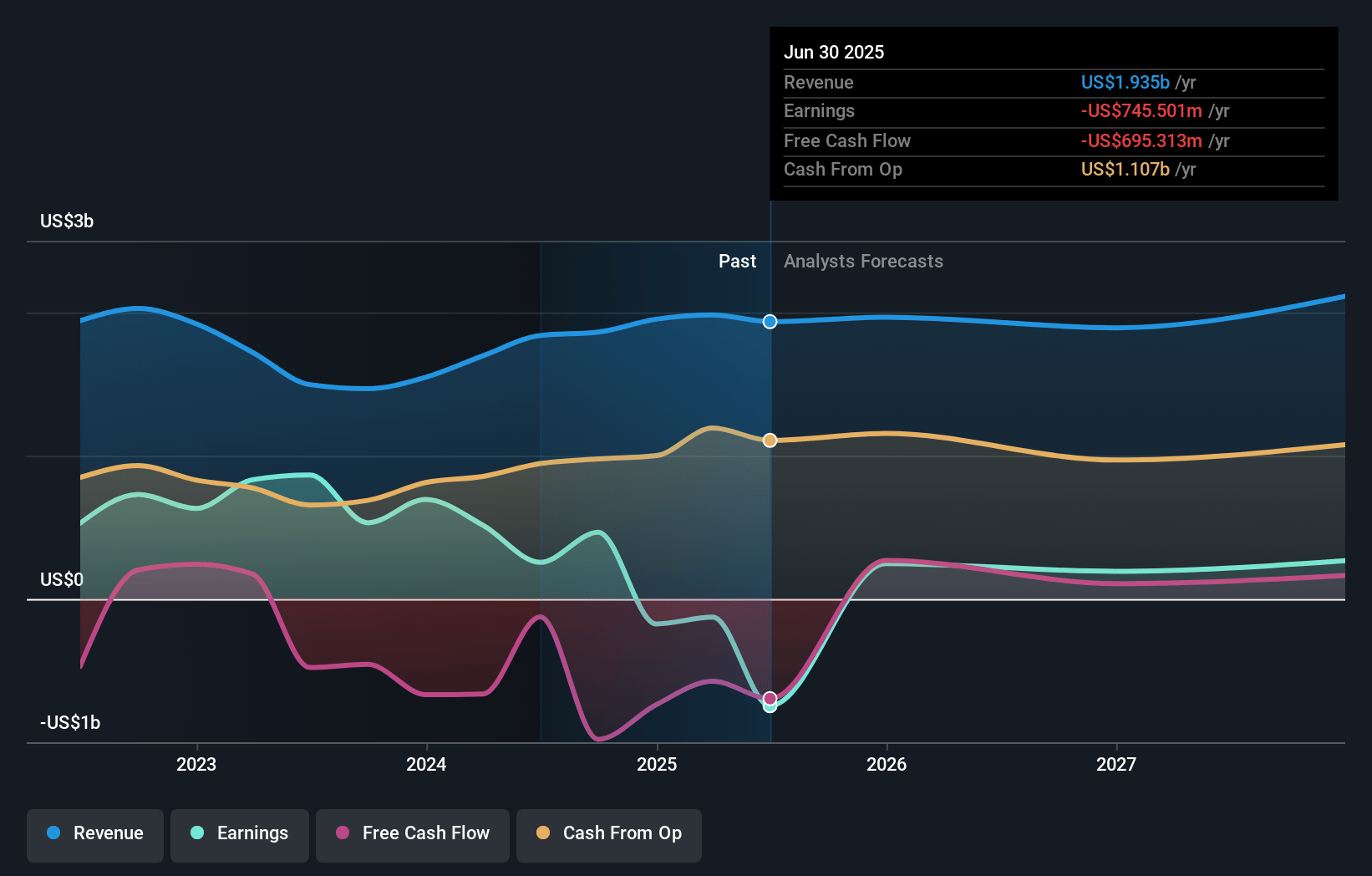

Vital Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vital Energy's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.0% today to 12.1% in 3 years time.

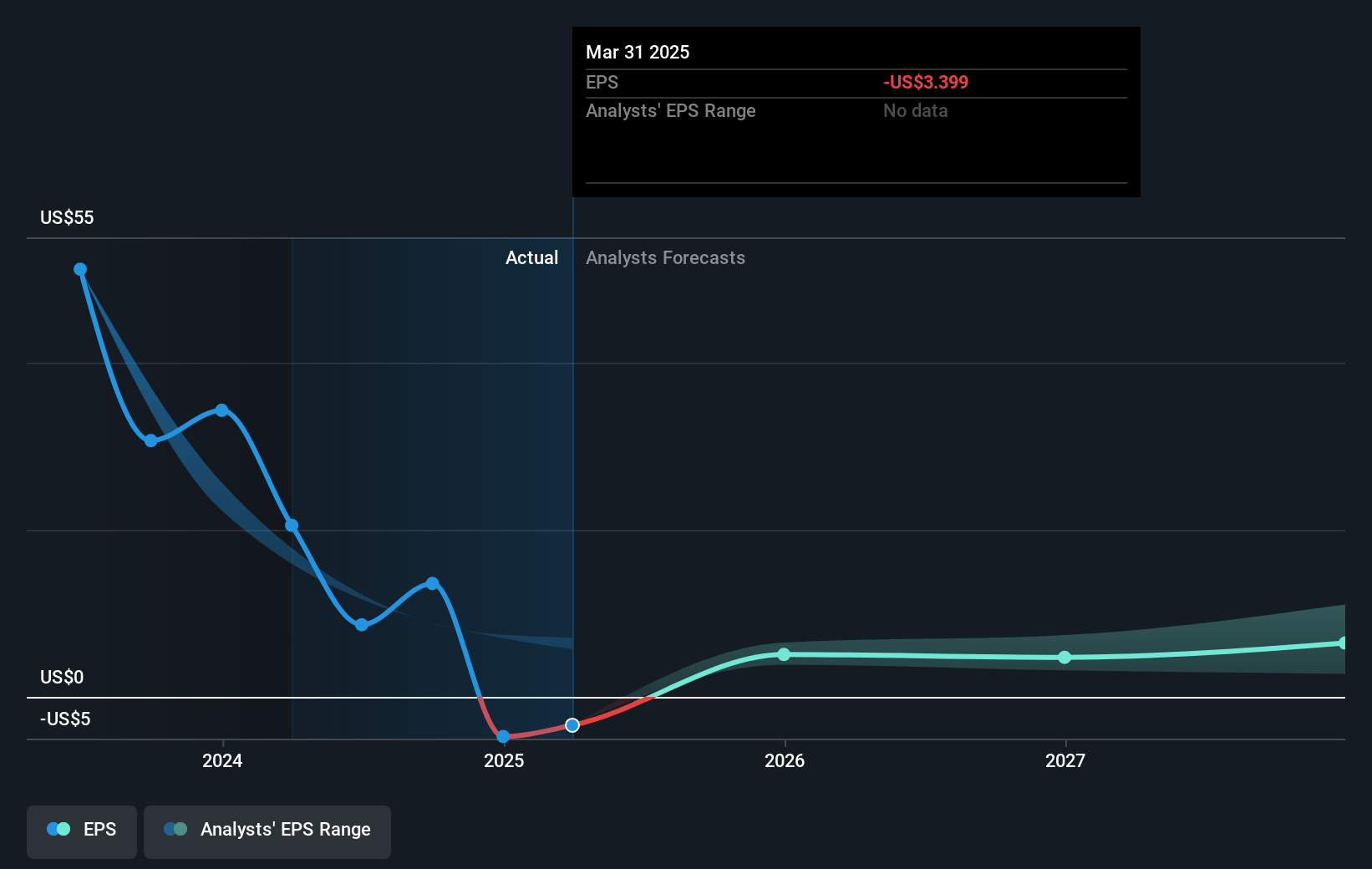

- Analysts expect earnings to reach $266.9 million (and earnings per share of $6.13) by about November 2027, down from $466.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $397 million in earnings, and the most bearish expecting $182 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.8x on those 2027 earnings, up from 2.4x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to grow by 6.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

Vital Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The completed multiple acquisitions, while transformative, may carry significant integration risks and unexpected costs, potentially impacting net margins and earnings negatively.

- The company is undergoing operational changes and strategic shifts rapidly, which may introduce execution risk and affect both productivity and cost efficiency in future quarters, thus impacting net margins.

- Reliance on commodity hedging to manage cash flows indicates vulnerability to fluctuating oil prices; a prolonged period of low oil prices could adversely affect revenue and future earnings.

- While operational efficiencies have been achieved, the potential for significant cost improvements might be limited in future years, which could put pressure on maintaining current profit levels, thereby affecting net margins.

- The focus on reducing leverage and paying down debt with free cash flow may limit the company's ability to reinvest in growth opportunities, potentially impacting future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.0 for Vital Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $29.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.2 billion, earnings will come to $266.9 million, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 10.9%.

- Given the current share price of $30.4, the analyst's price target of $40.0 is 24.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives